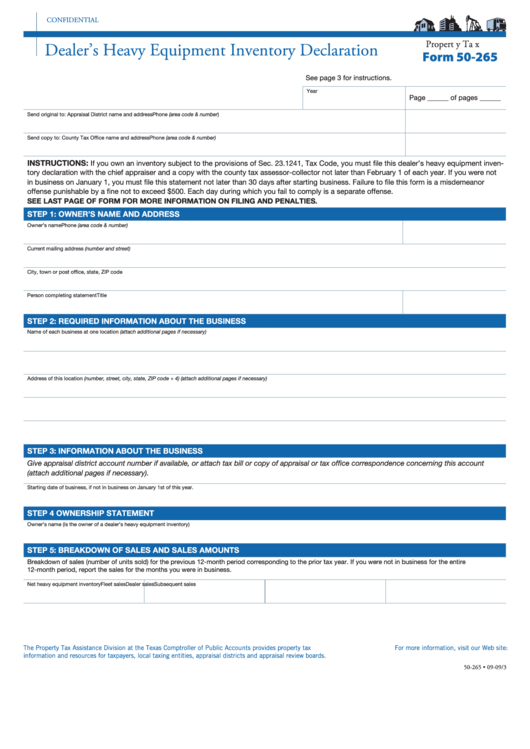

CONFIDENTIAL

P r o p e r t y T a x

Dealer’s Heavy Equipment Inventory Declaration

Form 50-265

See page 3 for instructions.

Year

Page ______ of pages ______

Send original to: Appraisal District name and address

Phone (area code & number)

Send copy to: County Tax Office name and address

Phone (area code & number)

INSTRUCTIONS:

If you own an inventory subject to the provisions of Sec. 23.1241, Tax Code, you must file this dealer’s heavy equipment inven-

tory declaration with the chief appraiser and a copy with the county tax assessor-collector not later than February 1 of each year. If you were not

in business on January 1, you must file this statement not later than 30 days after starting business. Failure to file this form is a misdemeanor

offense punishable by a fine not to exceed $500. Each day during which you fail to comply is a separate offense.

SEE LAST PAGE OF FORM FOR MORE INFORMATION ON FILING AND PENALTIES.

STEP 1: OWNER’S NAME AND ADDRESS

Owner’s name

Phone (area code & number)

Current mailing address (number and street)

City, town or post office, state, ZIP code

Person completing statement

Title

STEP 2: REQUIRED INFORMATION ABOUT THE BUSINESS

Name of each business at one location (attach additional pages if necessary)

Address of this location (number, street, city, state, ZIP code + 4) (attach additional pages if necessary)

STEP 3: INFORMATION ABOUT THE BUSINESS

Give appraisal district account number if available, or attach tax bill or copy of appraisal or tax office correspondence concerning this account

(attach additional pages if necessary).

Starting date of business, if not in business on January 1st of this year.

STEP 4 OWNERSHIP STATEMENT

Owner’s name (is the owner of a dealer’s heavy equipment inventory)

STEP 5: BREAKDOWN OF SALES AND SALES AMOUNTS

Breakdown of sales (number of units sold) for the previous 12-month period corresponding to the prior tax year. If you were not in business for the entire

12-month period, report the sales for the months you were in business.

Net heavy equipment inventory

Fleet sales

Dealer sales

Subsequent sales

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

For more information, visit our Web site:

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

50-265 • 09-09/3

1

1 2

2 3

3