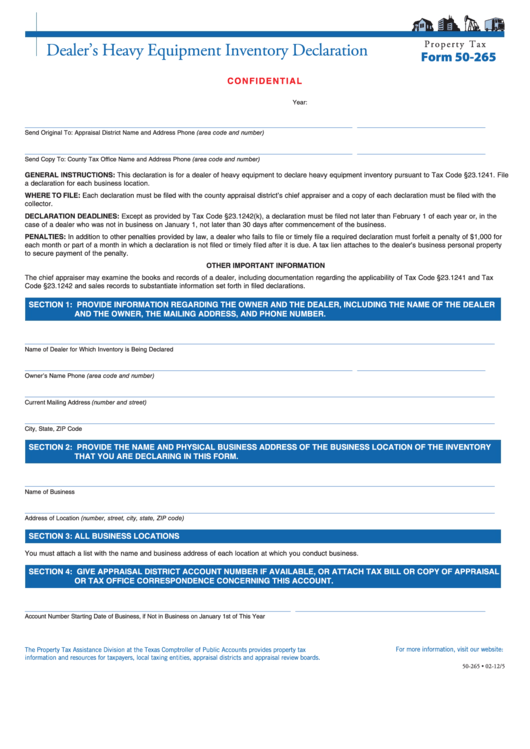

P r o p e r t y T a x

Dealer’s Heavy Equipment Inventory Declaration

Form 50-265

C O N F I D E N T I A L

__________

_________

_________

Year:

Page

of Pages

_____________________________________________________________________

___________________________

Send Original To: Appraisal District Name and Address

Phone (area code and number)

_____________________________________________________________________

___________________________

Send Copy To: County Tax Office Name and Address

Phone (area code and number)

GENERAL INSTRUCTIONS: This declaration is for a dealer of heavy equipment to declare heavy equipment inventory pursuant to Tax Code §23.1241. File

a declaration for each business location.

WHERE TO FILE: Each declaration must be filed with the county appraisal district’s chief appraiser and a copy of each declaration must be filed with the

collector.

DECLARATION DEADLINES: Except as provided by Tax Code §23.1242(k), a declaration must be filed not later than February 1 of each year or, in the

case of a dealer who was not in business on January 1, not later than 30 days after commencement of the business.

PENALTIES: In addition to other penalties provided by law, a dealer who fails to file or timely file a required declaration must forfeit a penalty of $1,000 for

each month or part of a month in which a declaration is not filed or timely filed after it is due. A tax lien attaches to the dealer’s business personal property

to secure payment of the penalty.

OTHER IMPORTANT INFORMATION

The chief appraiser may examine the books and records of a dealer, including documentation regarding the applicability of Tax Code §23.1241 and Tax

Code §23.1242 and sales records to substantiate information set forth in filed declarations.

SECTION 1: PROVIDE INFORMATION REGARDING THE OWNER AND THE DEALER, INCLUDING THE NAME OF THE DEALER

AND THE OWNER, THE MAILING ADDRESS, AND PHONE NUMBER.

___________________________________________________________________________________________________

Name of Dealer for Which Inventory is Being Declared

_____________________________________________________________________

___________________________

Owner’s Name

Phone (area code and number)

___________________________________________________________________________________________________

Current Mailing Address (number and street)

___________________________________________________________________________________________________

City, State, ZIP Code

SECTION 2: PROVIDE THE NAME AND PHYSICAL BUSINESS ADDRESS OF THE BUSINESS LOCATION OF THE INVENTORY

THAT YOU ARE DECLARING IN THIS FORM.

___________________________________________________________________________________________________

Name of Business

___________________________________________________________________________________________________

Address of Location (number, street, city, state, ZIP code)

SECTION 3: ALL BUSINESS LOCATIONS

You must attach a list with the name and business address of each location at which you conduct business.

SECTION 4: GIVE APPRAISAL DISTRICT ACCOUNT NUMBER IF AVAILABLE, OR ATTACH TAX BILL OR COPY OF APPRAISAL

OR TAX OFFICE CORRESPONDENCE CONCERNING THIS ACCOUNT.

________________________________________________________

________________________________________

Account Number

Starting Date of Business, if Not in Business on January 1st of This Year

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

For more information, visit our website:

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

50-265 • 02-12/5

1

1 2

2 3

3