Instructions For Water'S Edge Schedule Page 2

ADVERTISEMENT

Line 6 – Section 78 gross-up received by 80/20

Column 2 – Country of Incorporation. Enter the country

companies. Enter the amount that you reported on your

of incorporation for each company listed in column 1.

federal Schedule C for Section 78 gross-up that your 80/20

companies received during the tax period.

Column 3 – Income/Loss. Enter the income or loss that

you reported on your federal Form 5471 for each company

Line 7 – After-tax net income of 80/20 companies.

listed.

Subtract line 5 and line 6 from line 1; enter the result on line

7.

You will have to send us a copy of the federal Form 5471 of

each company that is incorporated in a tax haven country

Line 8 – After-tax net income of unconsolidated 80/20

during this filing period.

companies. Calculate the after-tax net income for your

United States corporations that quality as an 80/20

For each tax period beginning after December 31, 2003,

company, that are owned greater that 50% and that are not

you will have to include in your water’s edge combined

included in your consolidated federal return. After-tax net

return each corporation that is in a unitary relationship with

income is calculated by subtracting the tax liability from the

you and that is incorporated in a tax haven country . As set

taxable income on the corporations’s federal Form 1120.

forth in §15-31-322 of the Montana Code Annotated, tax

Enter this amount on line 8.

haven countries currently include Andorra, Anguilla, Antigua

and Barbuda, Aruba, the Bahamas, Bahrain, Barbados,

Line 9 – After-tax net income of United States

Belize, Bermuda, British Virgin Islands, Cayman Islands,

possession companies. Calculate the after-tax net

Cook Islands, Turks and Caicos Islands, Dominica,

income for your United States possession corporations

Gibraltar, Grenada, Guernsey-Sark-Alderney, Isle of Man,

described in sections 931 through 934 and 936 of the

Jersey, Liberia, Liechtenstein, Luxembourg, Maldives,

Internal Revenue Code. After-tax net income is calculated

Marshall Islands, Monaco, Montserrat, Nauru, Netherlands

by subtracting the tax liability from the taxable income on

Antilles, Niue, Panama, Samoa, Seychelles, St. Kitts and

the corporation’s federal Form 1120. Enter this amount on

Nevis, St. Lucia, St. Vincent and the Grenadines, Tonga,

line 9.

United States Virgin Islands, and Vanuatu.

Line 10 – Total after-tax net income. Add lines 7, 8 and 9;

enter the total on line 10.

Line 11 – 20% deemed dividend from 80/20 companies.

Multiply line 10 by 20%; enter the result on line 8, and line

2h of Form CLT-4, page 3.

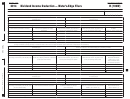

Part III. List of 80/20 Companies

Column 1 – Name. Enter the name of each company

qualified as an 80/20 company for the filing period.

Column 2 – FEIN. Enter the federal identification number

of each company qualified as an 80/20 company for the

filing period.

Column 3 – Income/Loss. Enter the income or loss that

you reported on your federal consolidated return, line 30 for

each company that qualified as an 80/20 company for this

filing period.

Column 4 – Dividends Received. Enter the total

dividends that were received by each company that

qualified as an 80/20 company for this filing period.

Part IV. List of Controlled Foreign

Corporations

Column 1 – Name. Enter the name of each company

incorporated outside the United States that is directly or

indirectly owned greater than 50% by corporations within the

Please mail this form to: Montana Department of

water’s edge group.

Revenue, PO Box 8021, Helena, MT 59604-8021

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2