Instructions For Form Mn-706 - Minnesota Estate Tax

ADVERTISEMENT

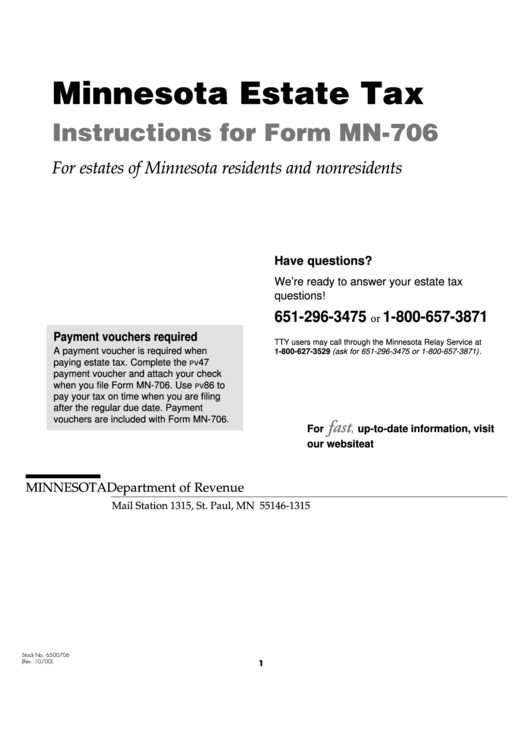

Minnesota Estate Tax

Instructions for Form MN-706

For estates of Minnesota residents and nonresidents

Have questions?

We’re ready to answer your estate tax

questions!

651-296-3475

1-800-657-3871

or

Payment vouchers required

TTY users may call through the Minnesota Relay Service at

A payment voucher is required when

1-800-627-3529 (ask for 651-296-3475 or 1-800-657-3871) .

paying estate tax. Complete the

47

PV

payment voucher and attach your check

when you file Form MN-706. Use

86 to

PV

pay your tax on time when you are filing

after the regular due date. Payment

vouchers are included with Form MN-706.

fast

For

,

up-to-date information, visit

our website at

MINNESOTA Department of Revenue

Mail Station 1315, St. Paul, MN 55146-1315

Stock No. 6500706

(Rev. 10/00)

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6