Kansas Liquor License Application Instructions - Kansas Alcoholic Beverage Control Page 7

ADVERTISEMENT

Kansas Alcoholic Beverage Control

Licensing Unit

915 SW Harrison Street, Room 214

Topeka, KS 66625-3512

Telephone 785-296-7015

FAX 785-296-7185

FEIN_______________________

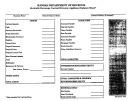

SECTION 7 – TAX CLEARANCE

Has the applicant obtained their Tax Clearance certificate?

Yes*

No**

*If yes, enter your Tax Clearance confirmation number:_______________________________________

**If no, you must request your Tax Clearance certificate.

To obtain your tax clearance, go to:

SECTION 8 – PREMISE(S) INFORMATION

Does the applicant own the proposed location?

Yes*

No

*If yes, attach a copy of the deed to the application. (New applicants only).

Does the applicant have a purchase agreement for the proposed location?

Yes*

No

*If yes, attach a copy of the purchase agreement to the application. (New applicants only).

Does the applicant lease the proposed location?

Yes*

No

*If yes, attach a copy of the lease to the application. (New applicants or renewal applicants with lease

changes).

Is the lease in the correct business entity name?

Yes

No

Does the lease have the correct business entity type?

Yes

No

Is the lease valid for at least 3/4 of the license year?

Yes

No

SECTION 9 – MANAGEMENT SERVICES DISCLOSURE

Are you applying for a retailer’s license?

*If yes, please answer the question below.

Yes*

No**

**If no, proceed to the next section.

Will any person/entity other than the owner(s) or partners be engaged or contracted to perform

management or operational services to the retail liquor store?

Yes*

No

*If yes, you must complete and attach the Management Services Information (ABC-807)

SECTION 10 – STATEMENT OF GROSS RECEIPTS

1

Is your business also a licensed food

service establishment as defined by K.S.A. 36-501?

Yes*

No**

*If yes, please answer the question below.

**If no, proceed to the next section.

1

Food – means any raw, cooked or processed edible substance or ingredient, other than alcoholic liquor or

cereal malt beverage used or intended to use or for sale, in whole or in part, for human consumption.

Is there a 30% requirement for food sales in your county?

Yes*

No**

*If yes, please answer the question below.

**If no, proceed to the next section.

CHECK ONE:

I am applying for a new license. I understand that I must meet the 30% food sales requirement during the next

Yes

No

year.

Yes

No

I am renewing my license. Enter the following information:

License Year: ____________ to ____________

Month/Year

Month/Year

1

Gross Receipts

: $____________________

2

Food Income

:

$____________________

Percentage of Food Income: ____________%

1

Gross Receipts for Drinking Establishments, Caterers or Hotels – includes all sales of food and beverages

sold on the premises

1

Gross Receipts for Private Clubs – includes sales of any type made on the licensed premises including food,

alcohol, membership fees, cover charges, vending machine concessions, video games and other sales.

2

Food Income – means the gross receipts from the sale of food on the licensed premises only and does not

include income derived from the sale of items mixed with alcoholic liquor or cereal malt beverage.

I have attached a true copy of the menu with current prices to my application.

Yes

No

ABC-800 (Rev. 8.5.09)

Page 7 of 8

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8