Occupational Tax Form - Revenue Department - Bessemer - Alaska

ADVERTISEMENT

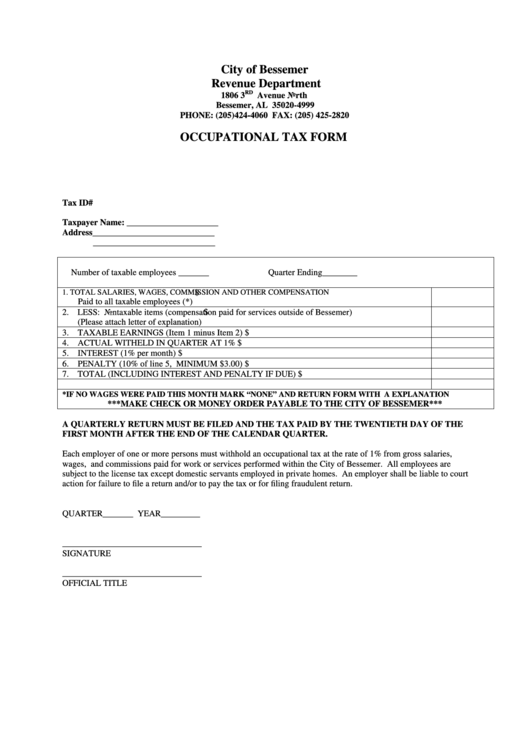

City of Bessemer

Revenue Department

RD

1806 3

Avenue North

Bessemer, AL 35020-4999

PHONE: (205)424-4060 FAX: (205) 425-2820

OCCUPATIONAL TAX FORM

Tax ID#

Taxpayer Name: _____________________

Address____________________________

____________________________

Number of taxable employees _______

Quarter Ending________

1. TOTAL SALARIES, WAGES, COMMISSION AND OTHER COMPENSATION

$

Paid to all taxable employees (*)

2. LESS: Nontaxable items (compensation paid for services outside of Bessemer)

$

(Please attach letter of explanation)

3. TAXABLE EARNINGS (Item 1 minus Item 2)

$

4. ACTUAL WITHELD IN QUARTER AT 1%

$

5. INTEREST (1% per month)

$

6. PENALTY (10% of line 5, MINIMUM $3.00)

$

7. TOTAL (INCLUDING INTEREST AND PENALTY IF DUE)

$

*IF NO WAGES WERE PAID THIS MONTH MARK “NONE” AND RETURN FORM WITH A EXPLANATION

***MAKE CHECK OR MONEY ORDER PAYABLE TO THE CITY OF BESSEMER***

A QUARTERLY RETURN MUST BE FILED AND THE TAX PAID BY THE TWENTIETH DAY OF THE

FIRST MONTH AFTER THE END OF THE CALENDAR QUARTER.

Each employer of one or more persons must withhold an occupational tax at the rate of 1% from gross salaries,

wages, and commissions paid for work or services performed within the City of Bessemer. All employees are

subject to the license tax except domestic servants employed in private homes. An employer shall be liable to court

action for failure to file a return and/or to pay the tax or for filing fraudulent return.

QUARTER_______ YEAR_________

________________________________

SIGNATURE

________________________________

OFFICIAL TITLE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1