Form Ps-19 - State Of Kansas Employment Tax Clearance Application

ADVERTISEMENT

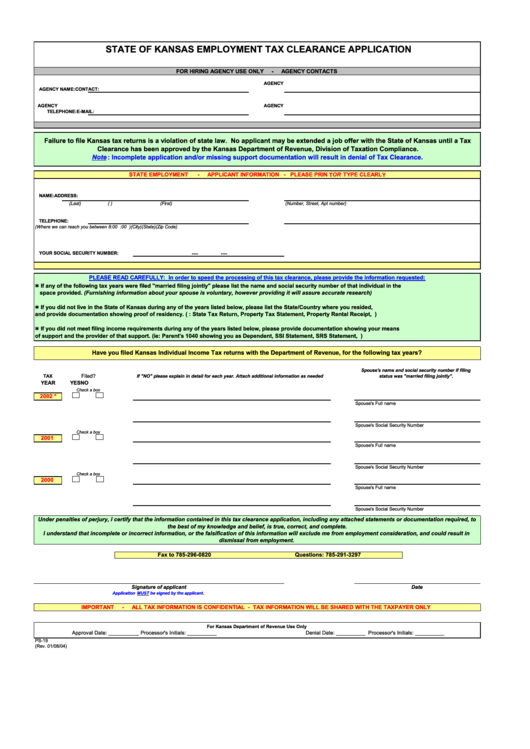

STATE OF KANSAS EMPLOYMENT TAX CLEARANCE APPLICATION

Tax_Clearance@kdor.state.ks.us

FOR HIRING AGENCY USE ONLY

-

AGENCY CONTACTS

AGENCY

AGENCY NAME:

CONTACT:

AGENCY

AGENCY

TELEPHONE:

E-MAIL:

Failure to file Kansas tax returns is a violation of state law. No applicant may be extended a job offer with the State of Kansas until a Tax

Clearance has been approved by the Kansas Department of Revenue, Division of Taxation Compliance.

Note : Incomplete application and/or missing support documentation will result in denial of Tax Clearance.

STATE EMPLOYMENT

-

APPLICANT INFORMATION - PLEASE PRINTOR TYPE CLEARLY

NAME:

ADDRESS:

(Last)

(First)

(M.I.)

(Number, Street, Apt number)

TELEPHONE:

(Where we can reach you between 8:00 a.m. and 5:00 p.m.)

(City)

(State)

(Zip Code)

YOUR SOCIAL SECURITY NUMBER:

----

----

PLEASE READ CAREFULLY: In order to speed the processing of this tax clearance, please provide the information requested:

If any of the following tax years were filed "married filing jointly" please list the name and social security number of that individual in the

space provided. (Furnishing information about your spouse is voluntary, however providing it will assure accurate research)

If you did not live in the State of Kansas during any of the years listed below, please list the State/Country where you resided,

and provide documentation showing proof of residency. (i.e.: State Tax Return, Property Tax Statement, Property Rental Receipt, etc...)

If you did not meet filing income requirements during any of the years listed below, please provide documentation showing your means

of support and the provider of that support. (ie: Parent's 1040 showing you as Dependent, SSI Statement, SRS Statement, etc...)

Have you filed Kansas Individual Income Tax returns with the Department of Revenue, for the following tax years?

Spouse's name and social security number if filing

Filed?

TAX

If "NO" please explain in detail for each year. Attach additional information as needed

status was "married filing jointly".

YEAR

YES

NO

Check a box

2002 *

Spouse's Full name

Spouse's Social Security Number

Check a box

2001

Spouse's Full name

Spouse's Social Security Number

Check a box

2000

Spouse's Full name

Spouse's Social Security Number

Under penalties of perjury, I certify that the information contained in this tax clearance application, including any attached statements or documentation required, to

the best of my knowledge and belief, is true, correct, and complete.

I understand that incomplete or incorrect information, or the falsification of this information will exclude me from employment consideration, and could result in

dismissal from employment.

Fax to 785-296-0820

Questions: 785-291-3297

Signature of applicant

Date

Application MUST be signed by the applicant.

IMPORTANT

-

ALL TAX INFORMATION IS CONFIDENTIAL - TAX INFORMATION WILL BE SHARED WITH THE TAXPAYER ONLY

For Kansas Department of Revenue Use Only

Approval Date: __________ Processor's Initials: __________

Denial Date: __________ Processor's Initials: __________

PS-19

(Rev. 01/08/04)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1