Instructions For Completing The Certificate Of Cancellation (Form Llc-4/7)

ADVERTISEMENT

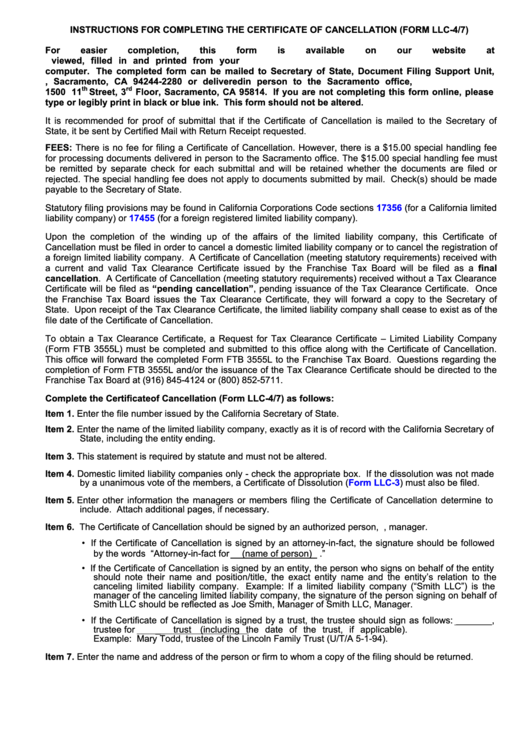

INSTRUCTIONS FOR COMPLETING THE CERTIFICATE OF CANCELLATION (FORM LLC-4/7)

For

easier

completion,

this

form

is

available

on

our

website

at

and can be viewed, filled in and printed from your

computer. The completed form can be mailed to Secretary of State, Document Filing Support Unit,

P.O. Box 944228, Sacramento, CA 94244-2280 or delivered in person to the Sacramento office,

th

rd

1500 11

Street, 3

Floor, Sacramento, CA 95814. If you are not completing this form online, please

type or legibly print in black or blue ink. This form should not be altered.

It is recommended for proof of submittal that if the Certificate of Cancellation is mailed to the Secretary of

State, it be sent by Certified Mail with Return Receipt requested.

FEES: There is no fee for filing a Certificate of Cancellation. However, there is a $15.00 special handling fee

for processing documents delivered in person to the Sacramento office. The $15.00 special handling fee must

be remitted by separate check for each submittal and will be retained whether the documents are filed or

rejected. The special handling fee does not apply to documents submitted by mail. Check(s) should be made

payable to the Secretary of State.

Statutory filing provisions may be found in California Corporations Code sections

17356

(for a California limited

liability company) or

17455

(for a foreign registered limited liability company).

Upon the completion of the winding up of the affairs of the limited liability company, this Certificate of

Cancellation must be filed in order to cancel a domestic limited liability company or to cancel the registration of

a foreign limited liability company. A Certificate of Cancellation (meeting statutory requirements) received with

a current and valid Tax Clearance Certificate issued by the Franchise Tax Board will be filed as a final

cancellation. A Certificate of Cancellation (meeting statutory requirements) received without a Tax Clearance

Certificate will be filed as “pending cancellation”, pending issuance of the Tax Clearance Certificate. Once

the Franchise Tax Board issues the Tax Clearance Certificate, they will forward a copy to the Secretary of

State. Upon receipt of the Tax Clearance Certificate, the limited liability company shall cease to exist as of the

file date of the Certificate of Cancellation.

To obtain a Tax Clearance Certificate, a Request for Tax Clearance Certificate – Limited Liability Company

(Form FTB 3555L) must be completed and submitted to this office along with the Certificate of Cancellation.

This office will forward the completed Form FTB 3555L to the Franchise Tax Board. Questions regarding the

completion of Form FTB 3555L and/or the issuance of the Tax Clearance Certificate should be directed to the

Franchise Tax Board at (916) 845-4124 or (800) 852-5711.

Complete the Certificate of Cancellation (Form LLC-4/7) as follows:

Item 1. Enter the file number issued by the California Secretary of State.

Item 2. Enter the name of the limited liability company, exactly as it is of record with the California Secretary of

State, including the entity ending.

Item 3. This statement is required by statute and must not be altered.

Item 4. Domestic limited liability companies only - check the appropriate box. If the dissolution was not made

by a unanimous vote of the members, a Certificate of Dissolution

(Form

LLC-3) must also be filed.

Item 5. Enter other information the managers or members filing the Certificate of Cancellation determine to

include. Attach additional pages, if necessary.

Item 6. The Certificate of Cancellation should be signed by an authorized person, i.e., manager.

• If the Certificate of Cancellation is signed by an attorney-in-fact, the signature should be followed

by the words “Attorney-in-fact for

(name of person) .”

• If the Certificate of Cancellation is signed by an entity, the person who signs on behalf of the entity

should note their name and position/title, the exact entity name and the entity’s relation to the

canceling limited liability company. Example: If a limited liability company (“Smith LLC”) is the

manager of the canceling limited liability company, the signature of the person signing on behalf of

Smith LLC should be reflected as Joe Smith, Manager of Smith LLC, Manager.

• If the Certificate of Cancellation is signed by a trust, the trustee should sign as follows: _______,

trustee for

_

trust

(including the date of the trust, if applicable).

Example: Mary Todd, trustee of the Lincoln Family Trust (U/T/A 5-1-94).

Item 7.

Enter the name and address of the person or firm to whom a copy of the filing should be returned.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1