Instructions For Completing The Certificate Of Cancellation Form Llc-4/7

ADVERTISEMENT

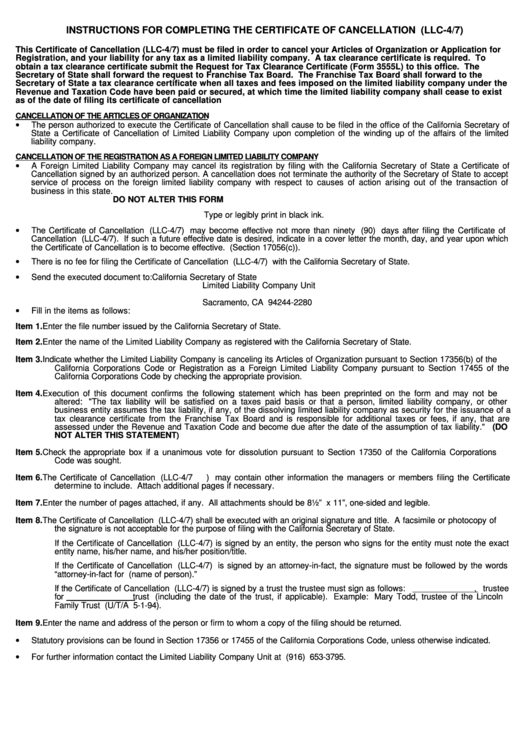

INSTRUCTIONS FOR COMPLETING THE CERTIFICATE OF CANCELLATION (LLC-4/7)

This Certificate of Cancellation (LLC-4/7) must be filed in order to cancel your Articles of Organization or Application for

Registration, and your liability for any tax as a limited liability company. A tax clearance certificate is required. To

obtain a tax clearance certificate submit the Request for Tax Clearance Certificate (Form 3555L) to this office. The

Secretary of State shall forward the request to Franchise Tax Board. The Franchise Tax Board shall forward to the

Secretary of State a tax clearance certificate when all taxes and fees imposed on the limited liability company under the

Revenue and Taxation Code have been paid or secured, at which time the limited liability company shall cease to exist

as of the date of filing its certificate of cancellation

CANCELLATION OF THE ARTICLES OF ORGANIZATION

•

The person authorized to execute the Certificate of Cancellation shall cause to be filed in the office of the California Secretary of

State a Certificate of Cancellation of Limited Liability Company upon completion of the winding up of the affairs of the limited

liability company.

CANCELLATION OF THE REGISTRATION AS A FOREIGN LIMITED LIABILITY COMPANY

•

A Foreign Limited Liability Company may cancel its registration by filing with the California Secretary of State a Certificate of

Cancellation signed by an authorized person. A cancellation does not terminate the authority of the Secretary of State to accept

service of process on the foreign limited liability company with respect to causes of action arising out of the transaction of

business in this state.

DO NOT ALTER THIS FORM

Type or legibly print in black ink.

•

The Certificate of Cancellation (LLC-4/7) may become effective not more than ninety (90) days after filing the Certificate of

Cancellation (LLC-4/7). If such a future effective date is desired, indicate in a cover letter the month, day, and year upon which

the Certificate of Cancellation is to become effective. (Section 17056(c)).

•

There is no fee for filing the Certificate of Cancellation (LLC-4/7) with the California Secretary of State.

•

Send the executed document to:

California Secretary of State

Limited Liability Company Unit

P.O. Box 944228

Sacramento, CA 94244-2280

•

Fill in the items as follows:

Item 1.

Enter the file number issued by the California Secretary of State.

Item 2.

Enter the name of the Limited Liability Company as registered with the California Secretary of State.

Item 3.

Indicate whether the Limited Liability Company is canceling its Articles of Organization pursuant to Section 17356(b) of the

California Corporations Code or Registration as a Foreign Limited Liability Company pursuant to Section 17455 of the

California Corporations Code by checking the appropriate provision.

Item 4.

Execution of this document confirms the following statement which has been preprinted on the form and may not be

altered: "The tax liability will be satisfied on a taxes paid basis or that a person, limited liability company, or other

business entity assumes the tax liability, if any, of the dissolving limited liability company as security for the issuance of a

tax clearance certificate from the Franchise Tax Board and is responsible for additional taxes or fees, if any, that are

assessed under the Revenue and Taxation Code and become due after the date of the assumption of tax liability."

(DO

NOT ALTER THIS STATEMENT

)

Item 5.

Check the appropriate box if a unanimous vote for dissolution pursuant to Section 17350 of the California Corporations

Code was sought.

Item 6.

The Certificate of Cancellation (LLC-4/7) may contain other information the managers or members filing the Certificate

determine to include. Attach additional pages if necessary.

Item 7.

Enter the number of pages attached, if any. All attachments should be 8½” x 11”, one-sided and legible.

Item 8.

The Certificate of Cancellation (LLC-4/7) shall be executed with an original signature and title. A facsimile or photocopy of

the signature is not acceptable for the purpose of filing with the California Secretary of State.

If the Certificate of Cancellation (LLC-4/7) is signed by an entity, the person who signs for the entity must note the exact

entity name, his/her name, and his/her position/title.

If the Certificate of Cancellation (LLC-4/7) is signed by an attorney-in-fact, the signature must be followed by the words

“attorney-in-fact for (name of person).”

If the Certificate of Cancellation (LLC-4/7) is signed by a trust the trustee must sign as follows:

, trustee

for _____________ trust (including the date of the trust, if applicable). Example: Mary Todd, trustee of the Lincoln

Family Trust (U/T/A 5-1-94).

Item 9.

Enter the name and address of the person or firm to whom a copy of the filing should be returned.

•

Statutory provisions can be found in Section 17356 or 17455 of the California Corporations Code, unless otherwise indicated.

•

For further information contact the Limited Liability Company Unit at (916) 653-3795.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1