Annual Premium Tax And Fees Instructions - State Of Arizona

ADVERTISEMENT

Department of Insurance

State of Arizona

ANNUAL PREMIUM TAX AND FEES

Financial Affairs Division – Tax Unit

INSTRUCTIONS

2910 North 44th Street, Suite 210

Phoenix, AZ 85018-7269

Telephone: (602) 364-3998

Facsimile: (602) 364-3989

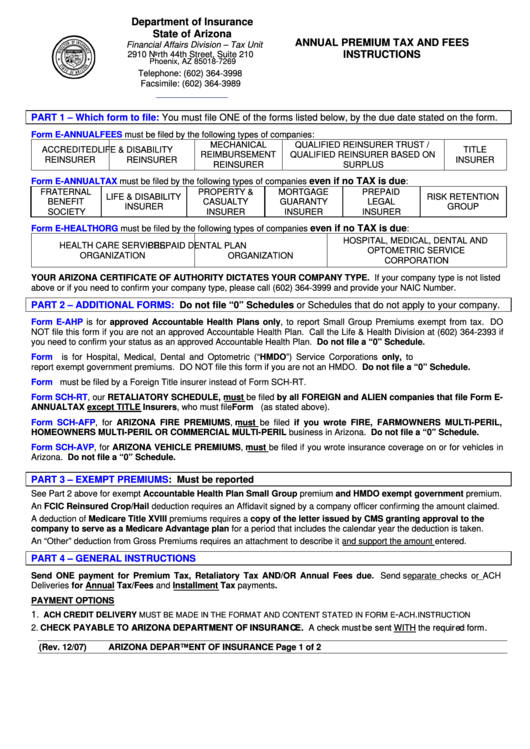

PART 1 – Which form to file:

You must file ONE of the forms listed below, by the due date stated on the form.

Form E-ANNUALFEES

must be filed by the following types of companies:

MECHANICAL

QUALIFIED REINSURER TRUST /

ACCREDITED

LIFE & DISABILITY

TITLE

REIMBURSEMENT

QUALIFIED REINSURER BASED ON

REINSURER

REINSURER

INSURER

REINSURER

SURPLUS

even if no TAX is due

Form E-ANNUALTAX

must be filed by the following types of companies

:

FRATERNAL

PROPERTY &

MORTGAGE

PREPAID

LIFE & DISABILITY

RISK RETENTION

BENEFIT

CASUALTY

GUARANTY

LEGAL

INSURER

GROUP

SOCIETY

INSURER

INSURER

INSURER

even if no TAX is due

Form E-HEALTHORG

must be filed by the following types of companies

:

HOSPITAL, MEDICAL, DENTAL AND

HEALTH CARE SERVICES

PREPAID DENTAL PLAN

OPTOMETRIC SERVICE

ORGANIZATION

ORGANIZATION

CORPORATION

YOUR ARIZONA CERTIFICATE OF AUTHORITY DICTATES YOUR COMPANY TYPE. If your company type is not listed

above or if you need to confirm your company type, please call (602) 364-3999 and provide your NAIC Number.

PART 2 – ADDITIONAL FORMS:

Do not file “0” Schedules or Schedules that do not apply to your company.

Form E-AHP

is for approved Accountable Health Plans only, to report Small Group Premiums exempt from tax. DO

NOT file this form if you are not an approved Accountable Health Plan. Call the Life & Health Division at (602) 364-2393 if

you need to confirm your status as an approved Accountable Health Plan. Do not file a “0” Schedule.

Form E-HEALTHORG.HMDO

is for Hospital, Medical, Dental and Optometric (“HMDO”) Service Corporations only, to

report exempt government premiums. DO NOT file this form if you are not an HMDO. Do not file a “0” Schedule.

Form E-TITLE.RETALIATORY

must be filed by a Foreign Title insurer instead of Form SCH-RT.

Form

SCH-RT, our RETALIATORY SCHEDULE, must be filed by all FOREIGN and ALIEN companies that file Form E-

ANNUALTAX except TITLE Insurers, who must file Form E-TITLE.RETALIATORY (as stated above).

Form

SCH-AFP, for ARIZONA FIRE PREMIUMS, must be filed if you wrote FIRE, FARMOWNERS MULTI-PERIL,

HOMEOWNERS MULTI-PERIL OR COMMERCIAL MULTI-PERIL business in Arizona. Do not file a “0” Schedule.

Form

SCH-AVP, for ARIZONA VEHICLE PREMIUMS, must be filed if you wrote insurance coverage on or for vehicles in

Arizona. Do not file a “0” Schedule.

PART 3 – EXEMPT

PREMIUMS: Must be reported

See Part 2 above for exempt Accountable Health Plan Small Group premium and HMDO exempt government premium.

An FCIC Reinsured Crop/Hail deduction requires an Affidavit signed by a company officer confirming the amount claimed.

A deduction of Medicare Title XVIII premiums requires a copy of the letter issued by CMS granting approval to the

company to serve as a Medicare Advantage plan for a period that includes the calendar year the deduction is taken.

An “Other” deduction from Gross Premiums requires an attachment to describe it and support the amount entered.

PART 4 – GENERAL INSTRUCTIONS

Send ONE payment for Premium Tax, Retaliatory Tax AND/OR Annual Fees due. Send separate checks or ACH

Deliveries for Annual Tax/Fees and Installment Tax payments.

PAYMENT OPTIONS

1.

-

.

ACH CREDIT DELIVERY

MUST BE MADE IN THE FORMAT AND CONTENT STATED IN FORM E

ACH

INSTRUCTION

2. CHECK PAYABLE TO

A

R

I

Z

O

N

A

D

E

P

A

R

T

M

E

N

T

O

F

I

N

S

U

R

A

N

C

E

.

A

c

h

e

c

k

m

u

s

t

b

e

s

e

n

t

WITH

t

h

e

r

e

q

u

i

r

e

d

f

o

r

m

.

A

R

I

Z

O

N

A

D

E

P

A

R

T

M

E

N

T

O

F

I

N

S

U

R

A

N

C

E

.

A

c

h

e

c

k

m

u

s

t

b

e

s

e

n

t

WITH

t

h

e

r

e

q

u

i

r

e

d

f

o

r

m

.

E-ANNUALTAX.INSTRUCTION (Rev. 12/07)

ARIZONA DEPARTMENT OF INSURANCE

Page 1 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2