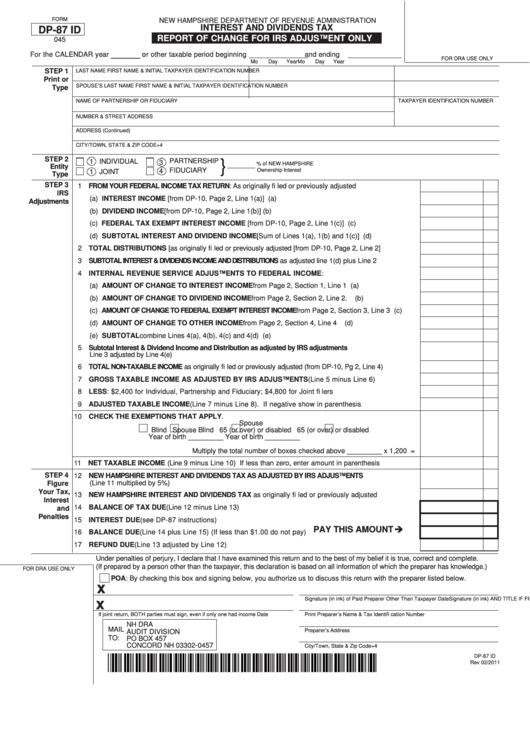

FORM

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

INTEREST AND DIVIDENDS TAX

DP-87 ID

REPORT OF CHANGE FOR IRS ADJUSTMENT ONLY

045

_____

For the CALENDAR year

or other taxable period beginning

and ending

FOR DRA USE ONLY

Mo

Day

Year

Mo

Day

Year

STEP 1

LAST NAME

FIRST NAME & INITIAL

TAXPAYER IDENTIFICATION NUMBER

Print or

SPOUSE’S LAST NAME

FIRST NAME & INITIAL

TAXPAYER IDENTIFICATION NUMBER

Type

NAME OF PARTNERSHIP OR FIDUCIARY

TAXPAYER IDENTIFICATION NUMBER

NUMBER & STREET ADDRESS

ADDRESS (Continued)

CITY/TOWN, STATE & ZIP CODE+4

STEP 2

INDIVIDUAL

PARTNERSHIP

1

}

3

% of NEW HAMPSHIRE

Entity

FIDUCIARY

Ownership Interest

4

1

JOINT

Type

STEP 3

1 FROM YOUR FEDERAL INCOME TAX RETURN: As originally fi led or previously adjusted

IRS

(a) INTEREST INCOME [from DP-10, Page 2, Line 1(a)] .........................................................................1(a)

Adjustments

(b) DIVIDEND INCOME [from DP-10, Page 2, Line 1(b)]..........................................................................1(b)

(c) FEDERAL TAX EXEMPT INTEREST INCOME [from DP-10, Page 2, Line 1(c)] ................................1(c)

(d) SUBTOTAL INTEREST AND DIVIDEND INCOME [Sum of Lines 1(a), 1(b) and 1(c)] .......................1(d)

2 TOTAL DISTRIBUTIONS [as originally fi led or previously adjusted [from DP-10, Page 2, Line 2] .................. 2

3 SUBTOTAL INTEREST & DIVIDENDS INCOME AND DISTRIBUTIONS as adjusted line 1(d) plus Line 2 ................. 3

4 INTERNAL REVENUE SERVICE ADJUSTMENTS TO FEDERAL INCOME:........................................... 4

(a) AMOUNT OF CHANGE TO INTEREST INCOME from Page 2, Section 1, Line 1 .............................4(a)

(b) AMOUNT OF CHANGE TO DIVIDEND INCOME from Page 2, Section 2, Line 2. ...........................4(b)

(c) AMOUNT OF CHANGE TO FEDERAL EXEMPT INTEREST INCOME from Page 2, Section 3, Line 3 ..... 4(c)

(d) AMOUNT OF CHANGE TO OTHER INCOME from Page 2, Section 4, Line 4 ................................4(d)

(e) SUBTOTAL combine Lines 4(a), 4(b), 4(c) and 4(d) ...........................................................................4(e)

5 Subtotal Interest & Dividend Income and Distribution as adjusted by IRS adjustments

Line 3 adjusted by Line 4(e) ......................................................................................................................... 5

6 TOTAL NON-TAXABLE INCOME as originally fi led or previously adjusted (from DP-10, Pg 2, Line 4) ................ 6

7 GROSS TAXABLE INCOME AS ADJUSTED BY IRS ADJUSTMENTS (Line 5 minus Line 6) ............... 7

8 LESS: $2,400 for Individual, Partnership and Fiduciary; $4,800 for Joint fi lers ......................................... 8

9 ADJUSTED TAXABLE INCOME (Line 7 minus Line 8). If negative show in parenthesis ....................... 9

10 CHECK THE EXEMPTIONS THAT APPLY.

Spouse

Blind

Spouse Blind

65 (or over) or disabled

65 (or over) or disabled

Year of birth _________

Year of birth _________

Multiply the total number of boxes checked above _________ x 1,200 =

11 NET TAXABLE INCOME (Line 9 minus Line 10) If less than zero, enter amount in parenthesis ............. 11

STEP 4

12 NEW HAMPSHIRE INTEREST AND DIVIDENDS TAX AS ADJUSTED BY IRS ADJUSTMENTS

(Line 11 multiplied by 5%) ............................................................................................................................ 12

Figure

Your Tax,

13 NEW HAMPSHIRE INTEREST AND DIVIDENDS TAX as originally fi led or previously adjusted ................ 13

Interest

14 BALANCE OF TAX DUE (Line 12 minus Line 13) ....................................................................................... 14

and

Penalties

15 INTEREST DUE (see DP-87 instructions) ............................................................................................... 15

PAY THIS AMOUNT

16 BALANCE DUE (Line 14 plus Line 15) (If less than $1.00 do not pay) .................................................. 16

17 REFUND DUE (Line 13 adjusted by Line 12) .......................................................................................... 17

Under penalties of perjury, I declare that I have examined this return and to the best of my belief it is true, correct and complete.

(If prepared by a person other than the taxpayer, this declaration is based on all information of which the preparer has knowledge.)

FOR DRA USE ONLY

POA: By checking this box and signing below, you authorize us to discuss this return with the preparer listed below.

x

Signature (in ink) AND TITLE IF FIDUCIARY

Date

Signature (in ink) of Paid Preparer Other Than Taxpayer

Date

x

If joint return, BOTH parties must sign, even if only one had income

Date

Print Preparer’s Name & Tax Identifi cation Number

NH DRA

MAIL

Preparer’s Address

AUDIT DIVISION

TO:

PO BOX 457

CONCORD NH 03302-0457

City/Town, State & Zip Code+4

DP-87 ID

Rev 02/2011

1

1 2

2