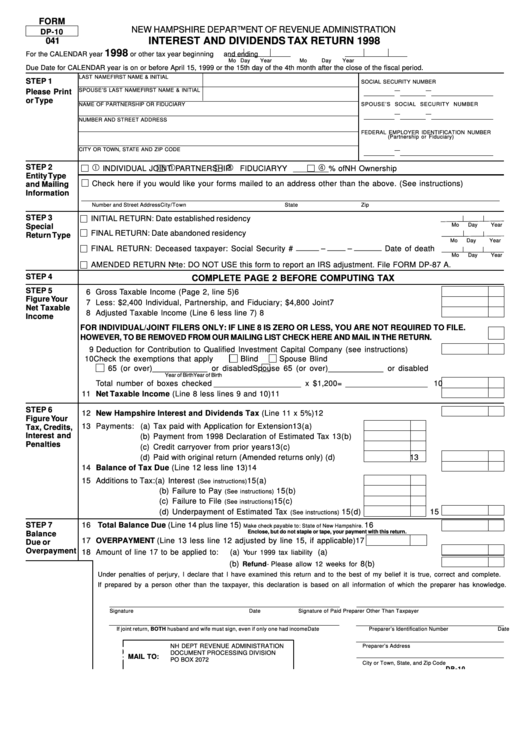

FORM

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

DP-10

INTEREST AND DIVIDENDS TAX RETURN 1998

041

1998

For the CALENDAR year

or other tax year beginning

and ending

Mo

Day

Year

Mo

Day

Year

Due Date for CALENDAR year is on or before April 15, 1999 or the 15th day of the 4th month after the close of the fiscal period.

LAST NAME

FIRST NAME & INITIAL

STEP 1

SOCIAL SECURITY NUMBER

SPOUSE’S LAST NAME

FIRST NAME & INITIAL

Please Print

or Type

SPOUSE’S SOCIAL SECURITY NUMBER

NAME OF PARTNERSHIP OR FIDUCIARY

NUMBER AND STREET ADDRESS

FEDERAL EMPLOYER IDENTIFICATION NUMBER

(Partnership or Fiduciary)

CITY OR TOWN, STATE AND ZIP CODE

STEP 2

INDIVIDUAL

JOINT

PARTNERSHIP

FIDUCIARY Y

% of NH Ownership

_________

Entity Type

Check here if you would like your forms mailed to an address other than the above. (See instructions)

and Mailing

Information

Number and Street Address

City/Town

State

Zip

STEP 3

INITIAL RETURN: Date established residency.......................................................................................

Mo

Day

Year

Special

FINAL RETURN: Date abandoned residency.........................................................................................

Return Type

Mo

Day

Year

FINAL RETURN: Deceased taxpayer: Social Security # _____ – ____ – ______ Date of death

Mo

Day

Year

AMENDED RETURN Note: DO NOT USE this form to report an IRS adjustment. File FORM DP-87 A.

STEP 4

COMPLETE PAGE 2 BEFORE COMPUTING TAX

STEP 5

6 Gross Taxable Income (Page 2, line 5) ............................................................................................... 6

Figure Your

7 Less: $2,400 Individual, Partnership, and Fiduciary; $4,800 Joint ................................................. 7

Net Taxable

8 Adjusted Taxable Income (Line 6 less line 7) .................................................................................... 8

Income

FOR INDIVIDUAL/JOINT FILERS ONLY: IF LINE 8 IS ZERO OR LESS, YOU ARE NOT REQUIRED TO FILE.

HOWEVER, TO BE REMOVED FROM OUR MAILING LIST CHECK HERE AND MAIL IN THE RETURN. ........................

9 Deduction for Contribution to Qualified Investment Capital Company (see instructions).......... 9

10 Check the exemptions that apply

Blind

Spouse Blind

65 (or over) ____________ or disabled

Spouse 65 (or over) ____________ or disabled

Year of Birth

Year of Birth

Total number of boxes checked ___________________ x $1,200= __________________ 10

11 Net Taxable Income (Line 8 less lines 9 and 10) ........................................................................... 11

STEP 6

12 New Hampshire Interest and Dividends Tax (Line 11 x 5%) ...................................................... 12

Figure Your

13 Payments: (a) Tax paid with Application for Extension ...................... 13(a)

Tax, Credits,

Interest and

(b) Payment from 1998 Declaration of Estimated Tax .... 13(b)

Penalties

(c) Credit carryover from prior years ................................. 13(c)

(d) Paid with original return (Amended returns only)....... 13(d)

13

14 Balance of Tax Due (Line 12 less line 13) ...................................................................................... 14

15 Additions to Tax: (a) Interest

15(a)

(See instructions) ....................................................

(b) Failure to Pay

15(b)

(See instructions) ......................................

(c) Failure to File

15(c)

(See instructions) ........................................

(d) Underpayment of Estimated Tax

15(d)

15

(See instructions)

STEP 7

16 Total Balance Due (Line 14 plus line 15)

............................... 16

Make check payable to: State of New Hampshire.

Enclose, but do not staple or tape, your payment with this return.

Balance

17 OVERPAYMENT (Line 13 less line 12 adjusted by line 15, if applicable)17

Due or

Overpayment

18 Amount of line 17 to be applied to:

(a)

..........18(a)

Your 1999 tax liability ...........................................

(b)

8(b)

Refund - Please allow 12 weeks for processing............1

Under penalties of perjury, I declare that I have examined this return and to the best of my belief it is true, correct and complete.

If prepared by a person other than the taxpayer, this declaration is based on all information of which the preparer has knowledge.

Signature

Date

Signature of Paid Preparer Other Than Taxpayer

If joint return, BOTH husband and wife must sign, even if only one had income.

Date

Preparer’s Identification Number

Date

ç

NH DEPT REVENUE ADMINISTRATION

Preparer’s Address

DOCUMENT PROCESSING DIVISION

MAIL TO:

PO BOX 2072

City or Town, State, and Zip Code

D P - 1 0

1

1 2

2 3

3