Form Rpd-41192 - Tobacco Products Tax Return Page 2

ADVERTISEMENT

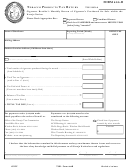

STATE OF NEW MEXICO - TAXATION AND REVENUE DEPARTMENT

RPD-41192

Rev. 07/2009

TOBACCO PRODUCTS TAX RETURN

INSTRUCTIONS FOR COMPLETING THIS FORM: Complete all information requested on the form. Verify your company’s fed-

eral employer identification number (FEIN) and your CRS identification number, the name of the business and mailing address.

Verify the report period in which the tobacco products were manufactured, purchased, or received if the products are acquired for

consignment sale, from any person outside of New Mexico. A report period is from the first day of the month to the last day of the

calendar month. See the line instructions to complete lines 1 through 9. Check the amended box at the bottom of the form if you are

amending a previously filed return. Sign and date the return. Note: Tobacco products subject to the tobacco products tax include

tobacco products acquired or manufactured and given for consumption. For example, tobacco products acquired to be given out

as part of a promotion are included in Column 1 of Form RPD-41192.

LINE INSTRUCTIONS:

Rows A and B. Using the line instructions for columns 1 through 4, enter the information for cigars in Row A. Enter information for

all other tobacco products in Row B.

Col. 1. Acquired. Enter the product value of all tobacco products acquired for distribution during the report period. Manufacturers

of tobacco products located in New Mexico must enter the product value of the tobacco products that have completed

the production process and are available for distribution. Other businesses located in New Mexico must enter the product

value of all tobacco products that were acquired on consignment from a source outside New Mexico or purchased from a

source outside New Mexico. See the definition of product value below.

Col. 2. O/S Sales. Enter the product value of the tobacco products included in Column 1 that are sold and shipped or given and

shipped to a person in another state. The Department may require proof of out-of-state sales. Include only those products

that are shipped during the reporting month or set aside for shipment to the out-of-state purchaser. If the product is sold

or given to an out-of-state purchaser after the reporting month in which the tobacco product was acquired, submit an

amended Tobacco Products Tax Return for the month in which the tobacco product was acquired and Form RPD-41318,

Application for Refund of Tobacco Products Tax, to claim the refund. Proof is required.

Col. 3. Exempt. Enter the product value of the tobacco products included in Column 1 that are sold to the United States or any

agency or instrumentality thereof or the State of New Mexico or any political subdivision thereof. “Agency or instrumentality”

does not include agents or instrumentalities of the United States either for a particular purpose or when acting in a particular

capacity. The terms also do not include corporate agencies or instrumentalities. Also exempted from the tobacco products

tax are sales to the governing body or to any enrolled tribal member licensed by the governing body of any Indian nation,

tribe or pueblo for use or sale on that reservation or pueblo grant. If an exempt sale occurs after the reporting month in

which the tobacco product was acquired, submit an amended Tobacco Products Tax Return for the month in which the

tobacco product was acquired and Form RPD-41318, Application for Refund of Tobacco Products Tax, to claim the refund.

Proof is required.

Col. 4. Taxable value. Subtract the sum of Columns 2 and 3 from Column 1.

Line 5. Total taxable value. Enter the sum of Column 4, Rows A and B.

Line 6. Tax. Compute the tax due by multiplying line 5 by 25% (0.25).

Line 7. Penalty. Add penalty if the entity fails to file timely or to pay the amount on line 6 when due. Calculate the penalty by

multiplying the amount on line 6 by 2%, then by the number of months or partial months for which the return or payment

is late, not to exceed 20% of the tax due. Penalty for failure to file or pay on time may not be less than $5.00.

Line 8. Interest. Interest accrues daily on the unpaid principal of tax due and can change on a quarterly basis. The effective

annual and daily interest rates are posted on the Department's web page at

or can be obtained by

contacting the Department.

Line 9. Total. Enter the sum of lines 6, 7 and 8. Pay this amount.

DEFINITIONS:

Tobacco product means any product, other than cigarettes, made from or containing tobacco.

Product value means the amount paid for the tobacco product, net of any discounts taken and allowed, or in the case of tobacco

products received on consignment or to be given as gifts for consumption, the value of the tobacco products received. In the case

of tobacco products manufactured and sold in New Mexico, product value is the proceeds from the sale by the manufacturer.

OTHER REQUIREMENTS:

Retention of records. Businesses selling tobacco products must maintain file copies of invoices of sale and purchase for three

years from the end of the year the sale or purchase was made. The invoices shall indicate the date of sale or purchase of the tobacco

products, quantity of tobacco products sold or purchased, the price received or paid and the name and address of the purchaser or

seller. All invoices may be inspected by the Department along with any stock of tobacco products in the possession of the purchaser

or seller. Failure to retain the invoices may result in penalties not less than $50 or more than $500 upon conviction.

Registration. Businesses selling tobacco products must obtain a New Mexico CRS identification number. To obtain a CRS identi-

fication number submit Form ACD-31015, Application for Business Tax Identification Number, to the Department. The form can be

downloaded from the web site , obtained by calling (505) 827-0951 or visiting a local district office.

Obtaining a refund of tobacco product tax. To obtain a refund of tobacco products tax paid on tobacco products destroyed or

returned to the seller as spoiled or otherwise unfit for sale or consumption, submit Form RPD-41318, Application for Refund of

Tobacco Products Tax. Proof is required.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2