Form Dr 1093 - Transmittal Of State W-2s And 1099s - 2004

ADVERTISEMENT

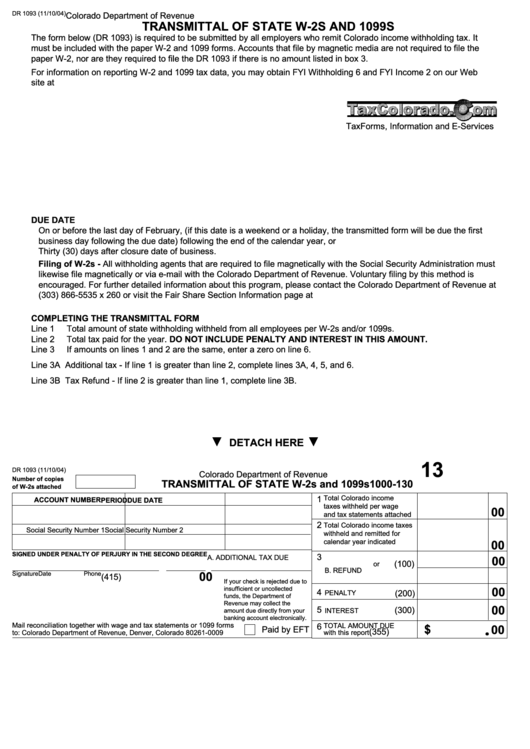

DR 1093 (11/10/04)

Colorado Department of Revenue

TRANSMITTAL OF STATE W-2S AND 1099S

The form below (DR 1093) is required to be submitted by all employers who remit Colorado income withholding tax. It

must be included with the paper W-2 and 1099 forms. Accounts that file by magnetic media are not required to file the

paper W-2, nor are they required to file the DR 1093 if there is no amount listed in box 3.

For information on reporting W-2 and 1099 tax data, you may obtain FYI Withholding 6 and FYI Income 2 on our Web

site at

TaxForms, Information and E-Services

DUE DATE

On or before the last day of February, (if this date is a weekend or a holiday, the transmitted form will be due the first

business day following the due date) following the end of the calendar year, or

Thirty (30) days after closure date of business.

Filing of W-2s - All withholding agents that are required to file magnetically with the Social Security Administration must

likewise file magnetically or via e-mail with the Colorado Department of Revenue. Voluntary filing by this method is

encouraged. For further detailed information about this program, please contact the Colorado Department of Revenue at

(303) 866-5535 x 260 or visit the Fair Share Section Information page at

COMPLETING THE TRANSMITTAL FORM

Line 1

Total amount of state withholding withheld from all employees per W-2s and/or 1099s.

Total tax paid for the year. DO NOT INCLUDE PENALTY AND INTEREST IN THIS AMOUNT.

Line 2

Line 3

If amounts on lines 1 and 2 are the same, enter a zero on line 6.

Line 3A Additional tax - If line 1 is greater than line 2, complete lines 3A, 4, 5, and 6.

Line 3B Tax Refund - If line 2 is greater than line 1, complete line 3B.

F

DETACH HERE

F

13

DR 1093 (11/10/04)

Colorado Department of Revenue

Number of copies

TRANSMITTAL OF STATE W-2s and 1099s

1000-130

of W-2s attached

Total Colorado income

1

ACCOUNT NUMBER

PERIOD

DUE DATE

taxes withheld per wage

00

and tax statements attached

2

Total Colorado income taxes

F.E.I.N.

Social Security Number 1

Social Security Number 2

withheld and remitted for

calendar year indicated

00

SIGNED UNDER PENALTY OF PERJURY IN THE SECOND DEGREE

3

A. ADDITIONAL TAX DUE

00

(100)

or

B. REFUND

Signature

Date

Phone

00

(415)

If your check is rejected due to

insufficient or uncollected

00

4

PENALTY

(200)

funds, the Department of

Revenue may collect the

00

5

(300)

amount due directly from your

INTEREST

banking account electronically.

Mail reconciliation together with wage and tax statements or 1099 forms

TOTAL AMOUNT DUE

6

$

00

Paid by EFT

(355)

to: Colorado Department of Revenue, Denver, Colorado 80261-0009

with this report

?

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1