DR 1093 (12/06/12)

Web

COLORADO DEPARTMENT OF REVENUE

Annual Transmittal of State W-2 Forms (DR 1093)

1375 Sherman Street

Denver, CO 80261-0009

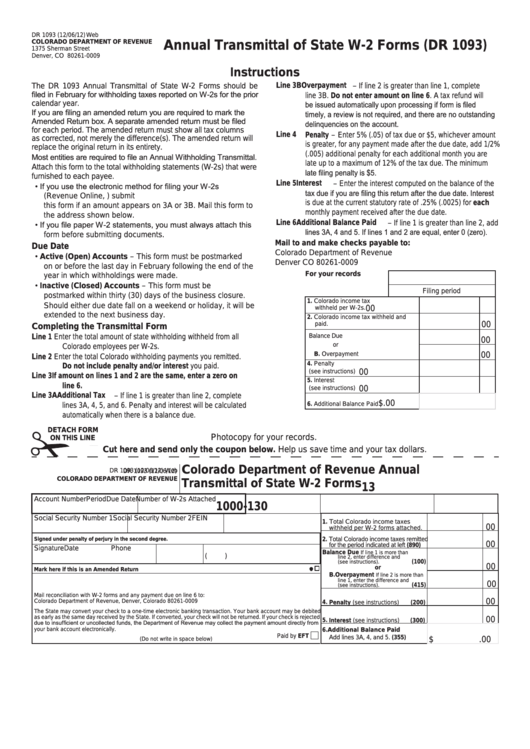

Instructions

The DR 1093 Annual Transmittal of State W-2 Forms should be

Line 3B Overpayment – If line 2 is greater than line 1, complete

filed in February for withholding taxes reported on W-2s for the prior

line 3B. Do not enter amount on line 6. A tax refund will

be issued automatically upon processing if form is filed

calendar year.

If you are filing an amended return you are required to mark the

timely, a review is not required, and there are no outstanding

Amended Return box. A separate amended return must be filed

delinquencies on the account.

for each period. The amended return must show all tax columns

Line 4

Penalty – Enter 5% (.05) of tax due or $5, whichever amount

as corrected, not merely the difference(s). The amended return will

is greater, for any payment made after the due date, add 1/2%

replace the original return in its entirety.

(.005) additional penalty for each additional month you are

Most entities are required to file an Annual Withholding Transmittal.

late up to a maximum of 12% of the tax due. The minimum

Attach this form to the total withholding statements (W-2s) that were

late filing penalty is $5.

furnished to each payee.

Line 5

Interest – Enter the interest computed on the balance of the

• If you use the electronic method for filing your W-2s

tax due if you are filing this return after the due date. Interest

(Revenue Online, ) submit

is due at the current statutory rate of .25% (.0025) for each

this form if an amount appears on 3A or 3B. Mail this form to

monthly payment received after the due date.

the address shown below.

• If you file paper W-2 statements, you must always attach this

Line 6

Additional Balance Paid – If line 1 is greater than line 2, add

lines 3A, 4 and 5. If lines 1 and 2 are equal, enter 0 (zero).

form before submitting documents.

Mail to and make checks payable to:

Due Date

Colorado Department of Revenue

• Active (Open) Accounts – This form must be postmarked

Denver CO 80261-0009

on or before the last day in February following the end of the

For your records

year in which withholdings were made.

• Inactive (Closed) Accounts – This form must be

Filing period

postmarked within thirty (30) days of the business closure.

1. Colorado income tax

Should either due date fall on a weekend or holiday, it will be

00

withheld per W-2s.

extended to the next business day.

2. Colorado income tax withheld and

00

paid.

Completing the Transmittal Form

3. A. Balance Due

Line 1

Enter the total amount of state withholding withheld from all

00

or

Colorado employees per W-2s.

B. Overpayment

00

Line 2

Enter the total Colorado withholding payments you remitted.

4. Penalty

Do not include penalty and/or interest you paid.

00

(see instructions)

Line 3

If amount on lines 1 and 2 are the same, enter a zero on

5. Interest

line 6.

(see instructions)

00

Line 3A Additional Tax – If line 1 is greater than line 2, complete

$

.00

6. Additional Balance Paid

lines 3A, 4, 5, and 6. Penalty and interest will be calculated

automatically when there is a balance due.

DETACH FORM

Photocopy for your records.

ON THIS LINE

Cut here and send only the coupon below. Help us save time and your tax dollars.

Colorado Department of Revenue Annual

DR 1093 (12/06/12) Web

DR 1093 (12/06/12)

COLORADO DEPARTMENT OF REVENUE

Transmittal of State W-2 Forms

13

Account Number

Period

Due Date

Number of W-2s Attached

1000-130

Social Security Number 1

Social Security Number 2

FEIN

1. Total Colorado income taxes

00

withheld per W-2 forms attached.

Signed under penalty of perjury in the second degree.

2. Total Colorado income taxes remitted

00

for the period indicated at left

(890)

Signature

Date

Phone

3. A. Balance Due

If line 1 is more than

(

)

line 2, enter difference and

(100)

(see instructions).

00

or

Mark here if this is an Amended Return .............................................................................................................

B. Overpayment

If line 2 is more than

line 1, enter the difference and

00

(415)

(see instructions).

Mail reconciliation with W-2 forms and any payment due on line 6 to:

00

Colorado Department of Revenue, Denver, Colorado 80261-0009

4. Penalty (see instructions)

(200)

The State may convert your check to a one-time electronic banking transaction. Your bank account may be debited

as early as the same day received by the State. If converted, your check will not be returned. If your check is rejected

00

5. Interest (see instructions)

(300)

due to insufficient or uncollected funds, the Department of Revenue may collect the payment amount directly from

your bank account electronically.

6. Additional Balance Paid

Paid by EFT

Add lines 3A, 4, and 5.

(355)

$

.00

(Do not write in space below)

1

1