Form 2220AL – 2016

1600132C

Page 2

ADOR

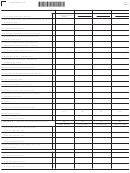

PART IV – Late Payment Penalty-Estimate

(a)

(b)

(c)

(d)

17

17 Required Installments (from line 8, page 1) . . . . . . . . . . . . . . . . . . . . .

18

18 Estimated Tax Paid (from line 9, page 1) . . . . . . . . . . . . . . . . . . . . . . .

Complete lines 19 through 22 of one column before going to the next column.

19 Underpayment/(Overpayment) of Estimated Tax (subtract

19

line 18 from line 17). Enter the result.. . . . . . . . . . . . . . . . . . . . . . . . . .

//////////////////////////

20 Enter any Overpayment (as a positive value) from the preceding

20

//////////////////////////

column of line 19 (or line 21) in columns (b)–(d) . . . . . . . . . . . . . . . . .

21 Underpayment/(Overpayment) by period (subtract line 20 from

21

line 19). Enter the result. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22 Penalty [Multiply the underpayment on line 21 by 10% (.10)].

22

If line 21 reflects an overpayment, leave blank.. . . . . . . . . . . . . . . . . .

23

23 PENALTY. Add columns (a) through (d) of line 22. Enter the total here and on page 1, line 4a.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

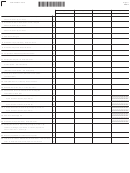

(a)

(b)

(c)

(d)

PART V – Computing the Addition to Tax-Interest

Enter the date of payment or the 15th day of the 4th month after

the close of the tax year, whichever is earlier (see instructions) . . . . . . . .

24 Number of days from due date of installment on line 7

24

to the date shown above . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

25

25 Number of days on line 24 after 4/15/2016 and before 7/1/2016. . . .

26 Underpayment on line 15 x number of days on line 25 x 4%

$

$

$

$

26

365

. . . . . . .

27

27 Number of days on line 24 after 6/30/2016 and before 10/1/2016 . . .

28 Underpayment on line 15 x number of days on line 27 x 4%

$

$

$

$

28

365

. . . . . . .

29

29 Number of days on line 24 after 9/30/2016 and before 1/1/2017 . . . .

30 Underpayment on line 15 x number of days on line 29 x *%

$

$

$

$

30

365

. . . . . . .

31

31 Number of days on line 24 after 12/31/2016 and before 4/1/2017 . . .

32 Underpayment on line 15 x number of days on line 31 x *%

$

$

$

$

32

365

. . . . . . .

33

33 Number of days on line 24 after 3/31/2017 and before 7/1/2017 . . . .

34 Underpayment on line 15 x number of days on line 33 x *%

$

$

$

$

34

365

. . . . . . .

35

35 Number of days on line 24 after 6/30/2017 and before 10/1/2017 . . .

36 Underpayment on line 15 x number of days on line 35 x *%

$

$

$

$

36

365

. . . . . . .

37

37 Number of days on line 24 after 9/30/2017 and before 1/1/2018 . . . .

38 Underpayment on line 15 x number of days on line 37 x *%

$

$

$

$

38

365

. . . . . . .

39

39 Number of days on line 24 after 12/31/2017 and before 2/16/2018. .

40 Underpayment on line 15 x number of days on line 39 x *%

$

$

$

$

40

365

. . . . . . .

$

$

$

$

41

41 Add lines 26, 28, 30, 32, 34, 36, 38 and 40 . . . . . . . . . . . . . . . . . . . . .

$

42 Addition to tax (interest). Add columns (a) through (d) of line 41. Enter the total here and page 1, line 4b. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

42

1

1 2

2 3

3 4

4 5

5