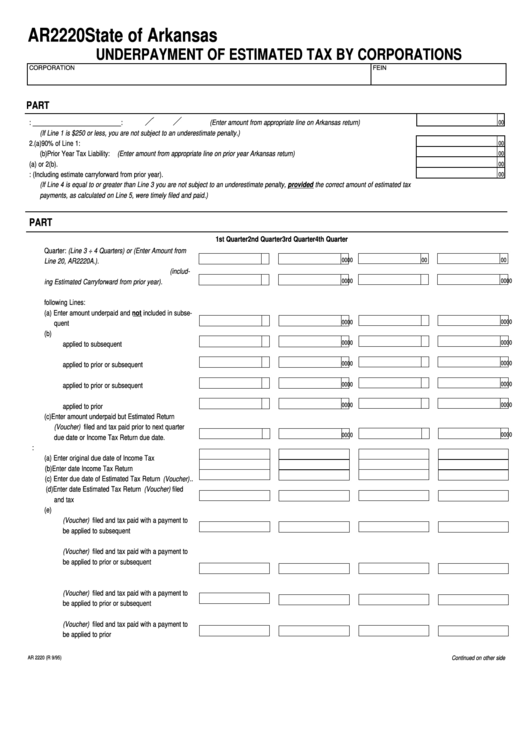

AR2220

State of Arkansas

UNDERPAYMENT OF ESTIMATED TAX BY CORPORATIONS

CORPORATION

FEIN

PART 1.

DETERMINING TAX AMOUNT REQUIRED TO BE ESTIMATED

1. Tax Liability for Year Ending: __________________________: (Enter amount from appropriate line on Arkansas return) .............................

00

(If Line 1 is $250 or less, you are not subject to an underestimate penalty.)

2. (a) 90% of Line 1: .............................................................................................................................................................................................

00

(b) Prior Year Tax Liability: (Enter amount from appropriate line on prior year Arkansas return) ....................................................................

00

3. Enter Lesser of 2(a) or 2(b). ...............................................................................................................................................................................

00

4. Total Estimated Tax Paid: (Including estimate carryforward from prior year). ...................................................................................................

00

(If Line 4 is equal to or greater than Line 3 you are not subject to an underestimate penalty, provided the correct amount of estimated tax

payments, as calculated on Line 5, were timely filed and paid.)

PART 2.

COMPUTATION OF UNDERESTIMATED PENALTY

1st Quarter

2nd Quarter

3rd Quarter

4th Quarter

5. Enter Required Estimated Income Tax Due per

Quarter: (Line 3 ÷ 4 Quarters) or (Enter Amount from

00

00

00

00

Line 20, AR2220A.). ........................................................

6. Enter Estimated Income Tax Paid per Quarter (includ-

00

00

ing Estimated Carryforward from prior year). .................

00

00

7. Enter Applicable Dollar amount subject to penalty on

following Lines:

(a) Enter amount underpaid and not included in subse-

00

00

00

00

quent quarter. ............................................................

(b) 1. Enter amount overpaid in 1st quarter to be

00

00

00

00

applied to subsequent quarter. ............................

2. Enter amount overpaid in 2nd quarter to be

00

00

00

00

applied to prior or subsequent quarter.................

3. Enter amount overpaid in 3rd quarter to be

00

00

00

00

applied to prior or subsequent quarter. ................

4. Enter amount overpaid in 4th quarter to be

00

00

00

00

applied to prior quarter. ........................................

(c) Enter amount underpaid but Estimated Return

(Voucher) filed and tax paid prior to next quarter

00

00

00

00

due date or Income Tax Return due date. ...............

8.

Date Returns Due/Filed:

(a) Enter original due date of Income Tax Return. .........

(b) Enter date Income Tax Return filed. .........................

(c) Enter due date of Estimated Tax Return (Voucher) ..

(d)Enter date Estimated Tax Return (Voucher) filed

and tax paid...............................................................

(e) 1. Enter date 1st quarter Estimated Tax Return

(Voucher) filed and tax paid with a payment to

be applied to subsequent quarter. .......................

2. Enter date 2nd quarter Estimated Tax Return

(Voucher) filed and tax paid with a payment to

be applied to prior or subsequent

quarter..................................................................

3. Enter date 3rd quarter Estimated Tax Return

(Voucher) filed and tax paid with a payment to

be applied to prior or subsequent quarter. ..........

4. Enter date 4th quarter Estimated Tax Return

(Voucher) filed and tax paid with a payment to

be applied to prior quarter. ..................................

AR 2220 (R 9/95)

Continued on other side

1

1 2

2