Form Fut-6 - Excise And Motor Fuel Tax

ADVERTISEMENT

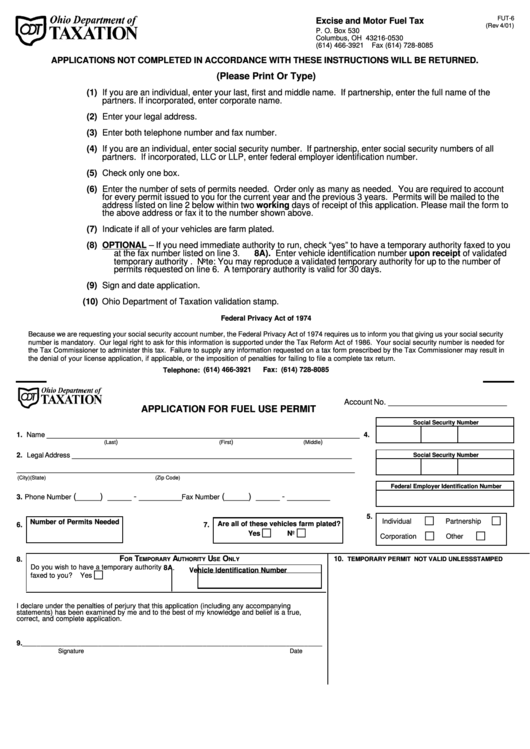

FUT-6

Excise and Motor Fuel Tax

(Rev 4/01)

P. O. Box 530

Columbus, OH 43216-0530

(614) 466-3921

Fax (614) 728-8085

APPLICATIONS NOT COMPLETED IN ACCORDANCE WITH THESE INSTRUCTIONS WILL BE RETURNED.

(Please Print Or Type)

(1) If you are an individual, enter your last, first and middle name. If partnership, enter the full name of the

partners. If incorporated, enter corporate name.

(2) Enter your legal address.

(3) Enter both telephone number and fax number.

(4) If you are an individual, enter social security number. If partnership, enter social security numbers of all

partners. If incorporated, LLC or LLP, enter federal employer identification number.

(5) Check only one box.

(6) Enter the number of sets of permits needed. Order only as many as needed. You are required to account

for every permit issued to you for the current year and the previous 3 years. Permits will be mailed to the

address listed on line 2 below within two working days of receipt of this application. Please mail the form to

the above address or fax it to the number shown above.

(7) Indicate if all of your vehicles are farm plated.

(8) OPTIONAL – If you need immediate authority to run, check “yes” to have a temporary authority faxed to you

at the fax number listed on line 3.

8A). Enter vehicle identification number upon receipt of validated

temporary authority . Note: You may reproduce a validated temporary authority for up to the number of

permits requested on line 6. A temporary authority is valid for 30 days.

(9) Sign and date application.

(10) Ohio Department of Taxation validation stamp.

Federal Privacy Act of 1974

Because we are requesting your social security account number, the Federal Privacy Act of 1974 requires us to inform you that giving us your social security

number is mandatory. Our legal right to ask for this information is supported under the Tax Reform Act of 1986. Your social security number is needed for

the Tax Commissioner to administer this tax. Failure to supply any information requested on a tax form prescribed by the Tax Commissioner may result in

the denial of your license application, if applicable, or the imposition of penalties for failing to file a complete tax return.

(614) 466-3921

Fax: (614) 728-8085

Telephone:

_________________________

Account No.

APPLICATION FOR FUEL USE PERMIT

Social Security Number

__________________________________________________________________

1. Name

4.

)

)

)

(Last

(First

(Middle

___________________________________________________________

2. Legal Address

Social Security Number

________________________________________________________________________

(City)

(State)

(Zip Code)

Federal Employer Identification Number

(_____) _____ - _________

(_____) _____ - _________

3. Phone Number

Fax Number

5.

c

c

Individual

Partnership

Number of Permits Needed

Are all of these vehicles farm plated?

6.

7.

c

c

c

c

Yes

No

Corporation

Other

F

T

A

U

O

10.

8.

TEMPORARY PERMIT NOT VALID UNLESS STAMPED

OR

EMPORARY

UTHORITY

SE

NLY

Do you wish to have a temporary authority

8A.

Vehicle Identification Number

c

faxed to you?

Yes

I declare under the penalties of perjury that this application (including any accompanying

statements) has been examined by me and to the best of my knowledge and belief is a true,

correct, and complete application.

9.___________________________________________________________________________________

Signature

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1