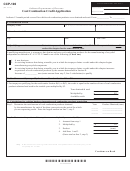

Effective Jan. 1, 2005, Indiana Code 6-3.1-25.2 was enacted

Section E - Use of Credit

providing a Coal Combustion Product Credit to manufacturers with

a facility located in Indiana who obtain and use “coal combustion

Please indicate how you anticipate using the credit by checking the

products” for the manufacturing of recycled components. The

appropriate box(es).

maximum amount of credit available per state fiscal year is $2

million.

Note: If the credit is being claimed by a shareholder, partner, or

Condition for Obtaining a Credit

member of a pass-through entity, you must attach a list providing

the name, SSN/FID, and percentage of the pass-through entity’s

A taxpayer that obtains a deduction under IC 6-1.1-44 may not obtain

distributive income to which the shareholder, partner, or member

a credit under this chapter for the same taxable year.

is entitled.

Section F - Signature

Who May Apply for This Credit?

The credit application must be signed by the taxpayer or an

A taxpayer with an Indiana location that obtains and uses coal

authorized agent. If necessary, a properly executed Power of

combustion products for the manufacturing of recycled components

Attorney form must accompany the application.

and is one of the following:

A. A new business;

How Soon Will I Receive My Credit Approval?

B. An existing business that begins manufacturing recycled

components; or

Applications will be reviewed in the order in which they are

C. An existing business that increases its acquisitions of coal

received. Processing time will vary depending on the number of

combustion products by one-tenth for the manufacturing

applications received. Incomplete applications will be delayed until

of recycled components.

the Department is able to obtain the required information.

Where Do I Send My Coal

How Often Can I File an Application for Credit?

Combustion Credit Application?

A claim for credit may be filed on an annual basis. Credits will be

Applications can be faxed to (317) 615-2697 or mailed to:

approved by the Department until the maximum amount of credit

for each category is reached.

Indiana Department of Revenue

Tax Administration

A manufacturer with a location in Indiana may claim this credit

P.O. Box 6197

in each of 10 consecutive years beginning with the taxable year in

Indianapolis, IN 46204

which the manufacturer first claims the credit under this chapter.

Section A - Information

Where Can I Claim This Credit?

1. Type or print the applicant’s name and location address.

The Coal Combustion Credit can be applied against state income

2. Enter the applicant’s Indiana taxpayer ID number (TID).

tax liability. A copy of the approved CCP-100 must be attached to

3. Enter the applicant’s federal ID number (FID).

the tax return; otherwise, the credit will be disallowed. Please see

the instructions for your tax returns to determine where the credit

Section B - Qualifying Manufacturer

should be entered on the various tax forms.

Indicate if you qualify as a new business, an existing business that

What If I Do Not Use All of My Credit?

begins manufacturing recycled components, or an existing business

that increases acquisitions of coal combustion products.

If the amount of credit determined for a taxable year exceeds

the manufacturer’s state tax liability for the taxable year, the

Section C - Credit Amount

manufacturer may not carry over the excess to following years.

A taxpayer is not entitled to a carryback or refund of any unused

For taxpayers qualifying under Section B (1) or B (2), multiply the

credit.

number of tons obtained and used in the taxable year by $2.

Contact Us

Section D - Calculation

If you have questions, please call the Department at (317) 232-2339.

Complete the Section D calculation ONLY if you qualify for

this credit as an existing business B(3) that increases your coal

combustion product acquisitions in the taxable year by one-tenth.

*24100000000*

24100000000

1

1 2

2 3

3