Form 200 - Request For Innocent Spouse Relief And Separation Of Liability And Equitable Relief

ADVERTISEMENT

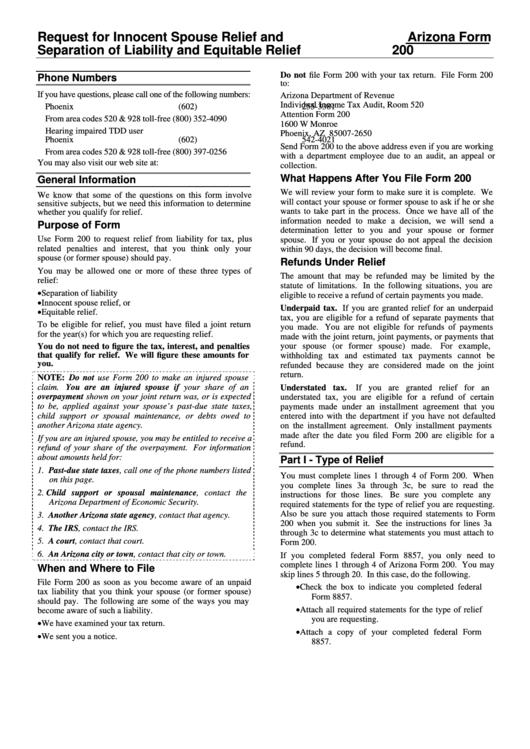

Request for Innocent Spouse Relief and

Arizona Form

Separation of Liability and Equitable Relief

200

Do not file Form 200 with your tax return. File Form 200

Phone Numbers

to:

If you have questions, please call one of the following numbers:

Arizona Department of Revenue

Individual Income Tax Audit, Room 520

Phoenix

(602) 255-3381

Attention Form 200

From area codes 520 & 928 toll-free

(800) 352-4090

1600 W Monroe

Hearing impaired TDD user

Phoenix, AZ 85007-2650

Phoenix

(602) 542-4021

Send Form 200 to the above address even if you are working

From area codes 520 & 928 toll-free

(800) 397-0256

with a department employee due to an audit, an appeal or

You may also visit our web site at:

collection.

What Happens After You File Form 200

General Information

We will review your form to make sure it is complete. We

We know that some of the questions on this form involve

will contact your spouse or former spouse to ask if he or she

sensitive subjects, but we need this information to determine

wants to take part in the process. Once we have all of the

whether you qualify for relief.

information needed to make a decision, we will send a

Purpose of Form

determination letter to you and your spouse or former

Use Form 200 to request relief from liability for tax, plus

spouse. If you or your spouse do not appeal the decision

related penalties and interest, that you think only your

within 90 days, the decision will become final.

spouse (or former spouse) should pay.

Refunds Under Relief

You may be allowed one or more of these three types of

The amount that may be refunded may be limited by the

relief:

statute of limitations. In the following situations, you are

Separation of liability

eligible to receive a refund of certain payments you made.

Innocent spouse relief, or

Underpaid tax. If you are granted relief for an underpaid

Equitable relief.

tax, you are eligible for a refund of separate payments that

To be eligible for relief, you must have filed a joint return

you made. You are not eligible for refunds of payments

for the year(s) for which you are requesting relief.

made with the joint return, joint payments, or payments that

You do not need to figure the tax, interest, and penalties

your spouse (or former spouse) made.

For example,

that qualify for relief. We will figure these amounts for

withholding tax and estimated tax payments cannot be

you.

refunded because they are considered made on the joint

return.

NOTE: Do not use Form 200 to make an injured spouse

claim. You are an injured spouse if your share of an

Understated tax.

If you are granted relief for an

overpayment shown on your joint return was, or is expected

understated tax, you are eligible for a refund of certain

to be, applied against your spouse’s past-due state taxes,

payments made under an installment agreement that you

child support or spousal maintenance, or debts owed to

entered into with the department if you have not defaulted

another Arizona state agency.

on the installment agreement. Only installment payments

made after the date you filed Form 200 are eligible for a

If you are an injured spouse, you may be entitled to receive a

refund.

refund of your share of the overpayment. For information

about amounts held for:

Part I - Type of Relief

1. Past-due state taxes, call one of the phone numbers listed

You must complete lines 1 through 4 of Form 200. When

on this page.

you complete lines 3a through 3c, be sure to read the

2. Child support or spousal maintenance, contact the

instructions for those lines.

Be sure you complete any

Arizona Department of Economic Security.

required statements for the type of relief you are requesting.

Also be sure you attach those required statements to Form

3. Another Arizona state agency, contact that agency.

200 when you submit it. See the instructions for lines 3a

4. The IRS, contact the IRS.

through 3c to determine what statements you must attach to

5. A court, contact that court.

Form 200.

6. An Arizona city or town, contact that city or town.

If you completed federal Form 8857, you only need to

complete lines 1 through 4 of Arizona Form 200. You may

When and Where to File

skip lines 5 through 20. In this case, do the following.

File Form 200 as soon as you become aware of an unpaid

Check the box to indicate you completed federal

tax liability that you think your spouse (or former spouse)

Form 8857.

should pay. The following are some of the ways you may

Attach all required statements for the type of relief

become aware of such a liability.

you are requesting.

We have examined your tax return.

Attach a copy of your completed federal Form

We sent you a notice.

8857.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4