Instructions For Form Ft-1006

ADVERTISEMENT

FT-1006 (4/96) (back)

Instructions

Note: The excise tax on diesel motor fuel decreased from ten cents

Claims for refund cover a complete calendar month. No refund will be

per gallon to eight cents per gallon on January 1, 1996.

made by the department for purchases made more than two years

before the date of filing the claim.

Use this form to claim a refund of diesel motor fuel tax paid on purchases

of diesel motor fuel made on or after September 1, 1988.

Sales invoices, delivery tickets or monthly statements showing name

and address of dealer, name and address of claimant, date of purchase

To qualify for a refund on this form you must be one of the following:

(month, day and year), number of gallons purchased and the fact that the

- U.S. Department of Transportation Certificated Operator;

tax was included in the purchase price are required. After the claim has

- New York State Department of Transportation Certificated Operator;

been paid, the evidence of purchase will be returned if a self-addressed

- District School Contractor; or

stamped envelope is forwarded to this office.

- Carrier operating pursuant to a contract, franchise or consent with

A claim for refund or reimbursement of tax paid on diesel motor fuel should

New York City or any agency thereof.

be based on records (including the original records of all purchases of

To claimants for refunds of New York State diesel motor fuel tax of three

diesel motor fuel by the claimant and a record of the manner in which

cents per gallon as provided by New York State Law, Article 12-A, section

all diesel motor fuel was used). These records must be kept for three

289-c, effective September 1, 1988 (one cent per gallon for purchases on or

years and be produced at any time for audit by the department.

after January 1, 1996, if the diesel motor fuel tax paid is eight cents per gallon):

Privacy Notification

Omnibus carrier means every person engaged in operating an omnibus

line subject to the supervision of the state Department of Public Service

The right of the Commissioner of Taxation and Finance and the Department of

Taxation and Finance to collect and maintain personal information, including

under Article 3-a of the Public Service Law, including every person

mandatory disclosure of social security numbers in the manner required by tax

operating omnibuses used for the transportation of school children under a

regulations, instructions, and forms, is found in Articles 8, 12-A, 13-A, 21, and 21-A of

contract made pursuant to the provisions of the Education Law.

the Tax Law and 42 USC 405(c)(2)(C)(i).

An omnibus carrier who operates in local transit service pursuant to a

The Tax Department will use this information primarily to determine and administer

the gas and diesel motor fuel, petroleum, highway use, and fuel use taxes under

Certificate of Convenience and Necessity issued by the U.S. or New York

Articles 12-A, 13-A, 21, and 21-A of the Tax Law, and for any other purpose

State Department of Transportation, or pursuant to a contract, franchise or

authorized by law.

consent of the city of New York or one of its agencies may claim a refund

Failure to provide the required information may result in civil or criminal penalties, or

of tax paid on the diesel fuel consumed in this state by an omnibus

both, under the Tax Law. In some cases, failure to provide the required information

engaged in local transit service. No refund is allowable under this provision

may result in denial, cancellation, or suspension of a registration as a distributor of

for charter or other contract operations with any party other than the city of

motor fuel or of a license as a terminal operator or importing/exporting transporter.

New York.

This information will be maintained by the Director of the Registration and Data

Services Bureau, NYS Tax Department, Building 8 Room 924, W A Harriman

An omnibus in local transit service is an omnibus that carries passengers

Campus, Albany NY 12227; telephone 1 800 225-5829. From areas outside the U.S.

between two points in this state and that either:

and outside Canada, call (518) 485-6800.

(a) regularly picks up or discharges the passengers at their convenience or

at bus stops on the street or highways, as distinguished from buildings

Need Help?

or facilities used for bus terminals or stations; or

Telephone Assistance is available from 8:30 a.m. to 4:25 p.m. (eastern time),

(b) picks up and discharges passengers at bus terminals or stations that

Monday through Friday. For business tax information and forms, call the Business

are not more than seventy-five miles apart when measured along the

Tax Information Center at 1 800 972-1233. For general information, call toll free

route traveled by the bus.

1 800 225-5829. To order forms and publications, call toll free 1 800 462-8100.

From areas outside the U.S. and outside Canada, call (518) 485-6800.

Any omnibus carrier that qualifies as being engaged in local transit service

Fax-on-Demand Forms Ordering System - Most forms are available by fax 24 hours

as defined in paragraph (a) above must keep a daily record of its

a day, 7 days a week. Call toll free from the U.S. and Canada 1 800 748-3676. You

operations in the form of a vehicular trip record for each bus, listing

must use a Touch Tone phone to order by fax. A fax code is used to identify each

vehicular number, gallons of diesel motor fuel consumed and the monthly

form.

total of gallons consumed. A carrier claiming a credit or refund under

Internet Access -

paragraph (b) must keep a daily record of its operations in the form of a

Access our website for forms, publications, and information.

vehicular trip record for each bus, including the following information:

Hotline for the Hearing and Speech Impaired - If you have access to a

telecommunications device for the deaf (TDD), you can get answers to your New York

1 vehicular number;

State tax questions by calling toll free from the U.S. and Canada 1 800 634-2110.

2 date of each trip;

Assistance is available from 8:30 a.m. to 4:15 p.m. (eastern time), Monday through

3 origin and destination of each trip;

Friday. If you do not own a TDD, check with independent living centers or community

action programs to find out where machines are available for public use.

4 points between which refund is claimed

5 total miles traveled;

Persons with Disabilities - In compliance with the Americans with Disabilities Act,

we will ensure that our lobbies, offices, meeting rooms, and other facilities are

6 refund miles claimed;

accessible to persons with disabilities. If you have questions about special

7 gallons of diesel motor fuel consumed; and

accommodations for persons with disabilities, please call the information numbers

8 refund claimed.

listed above.

Items 6, 7 and 8 must be totaled at the end of each month for each bus.

Mailing Address - If you need to write, address your letter to: NYS Tax Department,

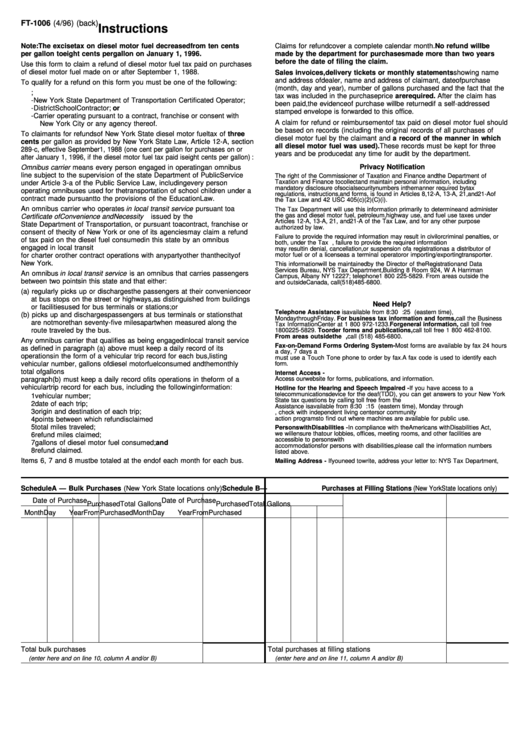

Schedule A — Bulk Purchases (New York State locations only)

Schedule B — Purchases at Filling Stations (New York State locations only)

Date of Purchase

Date of Purchase

Purchased

Total Gallons

Purchased

Total Gallons

Month

Day

Year

From

Purchased

Month

Day

Year

From

Purchased

Total bulk purchases

Total purchases at filling stations

. . . . . . . . . . . .

. . . . . . . . . . . .

(enter here and on line 10, column A and/or B)

(enter here and on line 11, column A and/or B)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1