Instructions For Form Ft-1000-A

ADVERTISEMENT

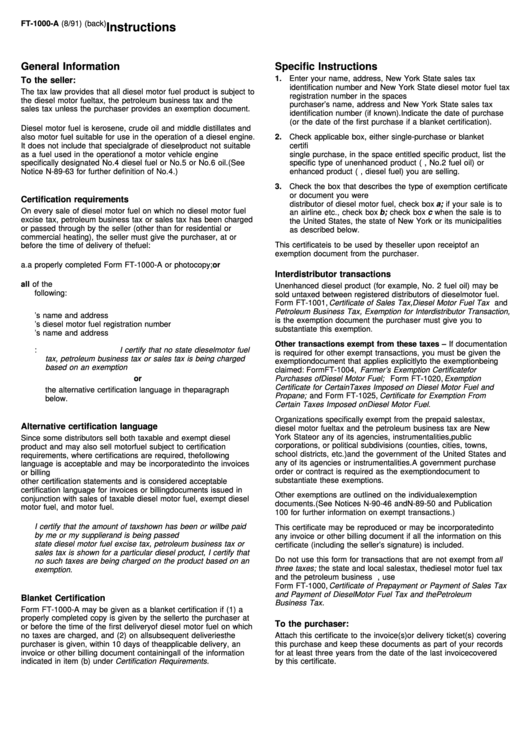

FT-1000-A (8/91) (back)

Instructions

General Information

Specific Instructions

1. Enter your name, address, New York State sales tax

To the seller:

identification number and New York State diesel motor fuel tax

The tax law provides that all diesel motor fuel product is subject to

registration number in the spaces provided. Also enter the

the diesel motor fuel tax, the petroleum business tax and the

purchaser’s name, address and New York State sales tax

sales tax unless the purchaser provides an exemption document.

identification number (if known). Indicate the date of purchase

(or the date of the first purchase if a blanket certification).

Diesel motor fuel is kerosene, crude oil and middle distillates and

also motor fuel suitable for use in the operation of a diesel engine.

2. Check applicable box, either single-purchase or blanket

It does not include that special grade of diesel product not suitable

certification. If the certificate is to be used as certification of a

as a fuel used in the operation of a motor vehicle engine

single purchase, in the space entitled specific product, list the

specifically designated No. 4 diesel fuel or No. 5 or No. 6 oil. (See

specific type of unenhanced product (e.g., No. 2 fuel oil) or

Notice N-89-63 for further definition of No. 4.)

enhanced product (e.g., diesel fuel) you are selling.

3. Check the box that describes the type of exemption certificate

or document you were given. If your sale is to a registered

Certification requirements

distributor of diesel motor fuel, check box a; if your sale is to

On every sale of diesel motor fuel on which no diesel motor fuel

an airline etc., check box b; check box c when the sale is to

excise tax, petroleum business tax or sales tax has been charged

the United States, the state of New York or its municipalities

or passed through by the seller (other than for residential or

as described below.

commercial heating), the seller must give the purchaser, at or

This certificate is to be used by the seller upon receipt of an

before the time of delivery of the fuel:

exemption document from the purchaser.

a. a properly completed Form FT-1000-A or photocopy; or

Interdistributor transactions

b. an invoice or other billing document containing all of the

Unenhanced diesel product (for example, No. 2 fuel oil) may be

following:

sold untaxed between registered distributors of diesel motor fuel.

Form FT-1001, Certificate of Sales Tax, Diesel Motor Fuel Tax and

1. date of sale

Petroleum Business Tax, Exemption for Interdistributor Transaction,

2. seller’s name and address

is the exemption document the purchaser must give you to

3. seller’s diesel motor fuel registration number

substantiate this exemption.

4. purchaser’s name and address

5. type of diesel product

Other transactions exempt from these taxes – If documentation

6. either the statement: I certify that no state diesel motor fuel

is required for other exempt transactions, you must be given the

tax, petroleum business tax or sales tax is being charged

exemption document that applies explicitly to the exemption being

based on an exemption

claimed: Form FT-1004, Farmer’s Exemption Certificate for

or

Purchases of Diesel Motor Fuel; Form FT-1020, Exemption

Certificate for Certain Taxes Imposed on Diesel Motor Fuel and

the alternative certification language in the paragraph

Propane; and Form FT-1025, Certificate for Exemption From

below.

Certain Taxes Imposed on Diesel Motor Fuel.

Organizations specifically exempt from the prepaid sales tax,

Alternative certification language

diesel motor fuel tax and the petroleum business tax are New

York State or any of its agencies, instrumentalities, public

Since some distributors sell both taxable and exempt diesel

corporations, or political subdivisions (counties, cities, towns,

product and may also sell motor fuel subject to certification

school districts, etc.) and the government of the United States and

requirements, where certifications are required, the following

any of its agencies or instrumentalities. A government purchase

language is acceptable and may be incorporated into the invoices

order or contract is required as the exemption document to

or billing documents. This language may be used in lieu of any

substantiate these exemptions.

other certification statements and is considered acceptable

certification language for invoices or billing documents issued in

Other exemptions are outlined on the individual exemption

conjunction with sales of taxable diesel motor fuel, exempt diesel

documents. (See Notices N-90-46 and N-89-50 and Publication

motor fuel, and motor fuel.

100 for further information on exempt transactions.)

I certify that the amount of tax shown has been or will be paid

This certificate may be reproduced or may be incorporated into

by me or my supplier and is being passed through. Where no

any invoice or other billing document if all the information on this

state diesel motor fuel excise tax, petroleum business tax or

certificate (including the seller’s signature) is included.

sales tax is shown for a particular diesel product, I certify that

Do not use this form for transactions that are not exempt from all

no such taxes are being charged on the product based on an

three taxes; the state and local sales tax, the diesel motor fuel tax

exemption.

and the petroleum business tax. For those transactions, use

Form FT-1000, Certificate of Prepayment or Payment of Sales Tax

and Payment of Diesel Motor Fuel Tax and the Petroleum

Blanket Certification

Business Tax.

Form FT-1000-A may be given as a blanket certification if (1) a

properly completed copy is given by the seller to the purchaser at

To the purchaser:

or before the time of the first delivery of diesel motor fuel on which

no taxes are charged, and (2) on all subsequent deliveries the

Attach this certificate to the invoice(s) or delivery ticket(s) covering

purchaser is given, within 10 days of the applicable delivery, an

this purchase and keep these documents as part of your records

invoice or other billing document containing all of the information

for at least three years from the date of the last invoice covered

indicated in item (b) under Certification Requirements.

by this certificate.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1