Instructions For Form Op-281

ADVERTISEMENT

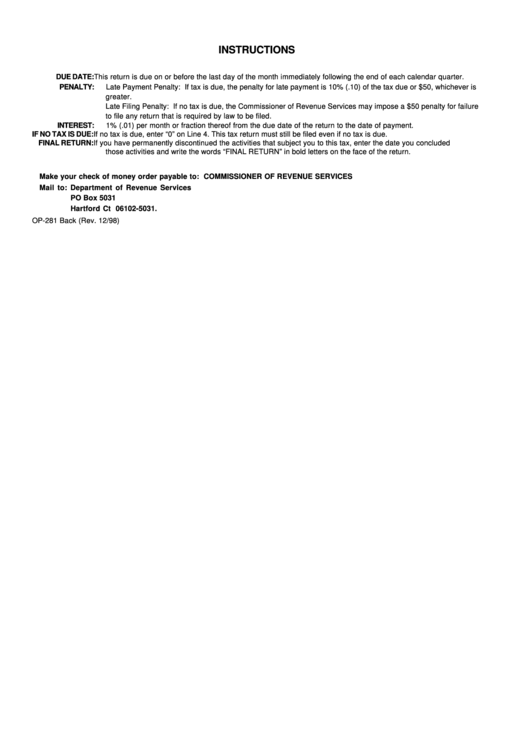

INSTRUCTIONS

DUE DATE:

This return is due on or before the last day of the month immediately following the end of each calendar quarter.

PENALTY:

Late Payment Penalty: If tax is due, the penalty for late payment is 10% (.10) of the tax due or $50, whichever is

greater.

Late Filing Penalty: If no tax is due, the Commissioner of Revenue Services may impose a $50 penalty for failure

to file any return that is required by law to be filed.

INTEREST:

1% (.01) per month or fraction thereof from the due date of the return to the date of payment.

IF NO TAX IS DUE:

If no tax is due, enter “0” on Line 4. This tax return must still be filed even if no tax is due.

FINAL RETURN:

If you have permanently discontinued the activities that subject you to this tax, enter the date you concluded

those activities and write the words “FINAL RETURN” in bold letters on the face of the return.

Make your check of money order payable to: COMMISSIONER OF REVENUE SERVICES

Mail to: Department of Revenue Services

PO Box 5031

Hartford Ct 06102-5031.

OP-281 Back (Rev. 12/98)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1