Instructions For Form Ftb 3534 - California

ADVERTISEMENT

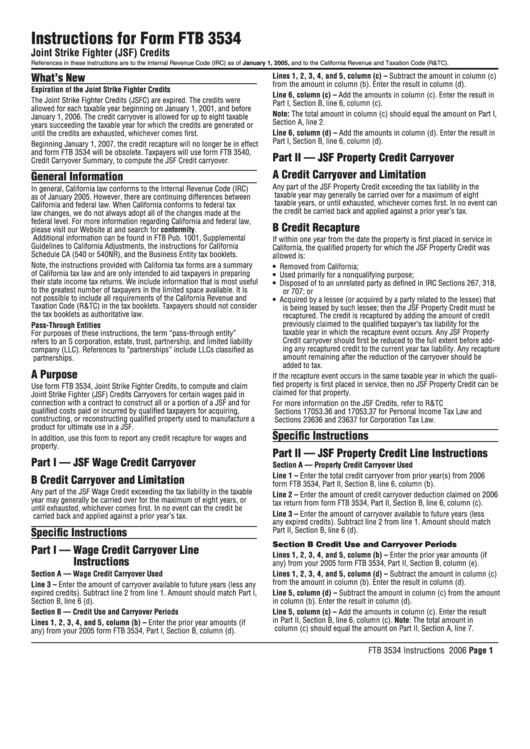

Instructions for Form FTB 3534

Joint Strike Fighter (JSF) Credits

References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 2005, and to the California Revenue and Taxation Code (R&TC).

What’s New

Lines , 2, 3, 4, and 5, column (c) – Subtract the amount in column (c)

from the amount in column (b). Enter the result in column (d).

Expiration of the Joint Strike Fighter Credits

Line 6, column (c) – Add the amounts in column (c). Enter the result in

The Joint Strike Fighter Credits (JSFC) are expired. The credits were

Part I, Section B, line 6, column (c).

allowed for each taxable year beginning on January 1, 2001, and before

Note: The total amount in column (c) should equal the amount on Part I,

January 1, 2006. The credit carryover is allowed for up to eight taxable

Section A, line 2.

years succeeding the taxable year for which the credits are generated or

Line 6, column (d) – Add the amounts in column (d). Enter the result in

until the credits are exhausted, whichever comes first.

Part I, Section B, line 6, column (d).

Beginning January 1, 2007, the credit recapture will no longer be in effect

and form FTB 3534 will be obsolete. Taxpayers will use form FTB 3540,

Part II — JSF Property Credit Carryover

Credit Carryover Summary, to compute the JSF Credit carryover.

A Credit Carryover and Limitation

General Information

Any part of the JSF Property Credit exceeding the tax liability in the

In general, California law conforms to the Internal Revenue Code (IRC)

taxable year may generally be carried over for a maximum of eight

as of January 2005. However, there are continuing differences between

taxable years, or until exhausted, whichever comes first. In no event can

California and federal law. When California conforms to federal tax

the credit be carried back and applied against a prior year’s tax.

law changes, we do not always adopt all of the changes made at the

federal level. For more information regarding California and federal law,

B Credit Recapture

please visit our Website at and search for conformity.

Additional information can be found in FTB Pub. 1001, Supplemental

If within one year from the date the property is first placed in service in

Guidelines to California Adjustments, the instructions for California

California, the qualified property for which the JSF Property Credit was

Schedule CA (540 or 540NR), and the Business Entity tax booklets.

allowed is:

Note, the instructions provided with California tax forms are a summary

• Removed from California;

of California tax law and are only intended to aid taxpayers in preparing

• Used primarily for a nonqualifying purpose;

their state income tax returns. We include information that is most useful

• Disposed of to an unrelated party as defined in IRC Sections 267, 318,

to the greatest number of taxpayers in the limited space available. It is

or 707; or

not possible to include all requirements of the California Revenue and

• Acquired by a lessee (or acquired by a party related to the lessee) that

Taxation Code (R&TC) in the tax booklets. Taxpayers should not consider

is being leased by such lessee; then the JSF Property Credit must be

the tax booklets as authoritative law.

recaptured. The credit is recaptured by adding the amount of credit

previously claimed to the qualified taxpayer’s tax liability for the

Pass-Through Entities

taxable year in which the recapture event occurs. Any JSF Property

For purposes of these instructions, the term “pass-through entity”

Credit carryover should first be reduced to the full extent before add-

refers to an S corporation, estate, trust, partnership, and limited liability

ing any recaptured credit to the current year tax liability. Any recapture

company (LLC). References to “partnerships” include LLCs classified as

amount remaining after the reduction of the carryover should be

partnerships.

added to tax.

A Purpose

If the recapture event occurs in the same taxable year in which the quali-

fied property is first placed in service, then no JSF Property Credit can be

Use form FTB 3534, Joint Strike Fighter Credits, to compute and claim

claimed for that property.

Joint Strike Fighter (JSF) Credits Carryovers for certain wages paid in

connection with a contract to construct all or a portion of a JSF and for

For more information on the JSF Credits, refer to R&TC

qualified costs paid or incurred by qualified taxpayers for acquiring,

Sections 17053.36 and 17053.37 for Personal Income Tax Law and

constructing, or reconstructing qualified property used to manufacture a

Sections 23636 and 23637 for Corporation Tax Law.

product for ultimate use in a JSF.

Specific Instructions

In addition, use this form to report any credit recapture for wages and

property.

Part II — JSF Property Credit Line Instructions

Part I — JSF Wage Credit Carryover

Section A — Property Credit Carryover Used

Line – Enter the total credit carryover from prior year(s) from 2006

B Credit Carryover and Limitation

form FTB 3534, Part II, Section B, line 6, column (b).

Any part of the JSF Wage Credit exceeding the tax liability in the taxable

Line 2 – Enter the amount of credit carryover deduction claimed on 2006

year may generally be carried over for the maximum of eight years, or

tax return from form FTB 3534, Part II, Section B, line 6, column (c).

until exhausted, whichever comes first. In no event can the credit be

Line 3 – Enter the amount of carryover available to future years (less

carried back and applied against a prior year’s tax.

any expired credits). Subtract line 2 from line 1. Amount should match

Specific Instructions

Part II, Section B, line 6 (d).

Section B Credit Use and Carryover Periods

Part I — Wage Credit Carryover Line

Lines , 2, 3, 4, and 5, column (b) – Enter the prior year amounts (if

Instructions

any) from your 2005 form FTB 3534, Part II, Section B, column (e).

Section A — Wage Credit Carryover Used

Lines , 2, 3, 4, and 5, column (d) – Subtract the amount in column (c)

from the amount in column (b). Enter the result in column (d).

Line 3 – Enter the amount of carryover available to future years (less any

expired credits). Subtract line 2 from line 1. Amount should match Part I,

Line 5, column (d) – Subtract the amount in column (c) from the amount

Section B, line 6 (d).

in column (b). Enter the result in column (d).

Section B — Credit Use and Carryover Periods

Line 5, column (c) – Add the amounts in column (c). Enter the result

in Part II, Section B, line 6, column (c). Note: The total amount in

Lines , 2, 3, 4, and 5, column (b) – Enter the prior year amounts (if

column (c) should equal the amount on Part II, Section A, line 7.

any) from your 2005 form FTB 3534, Part I, Section B, column (d).

FTB 3534 Instructions 2006 Page

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2