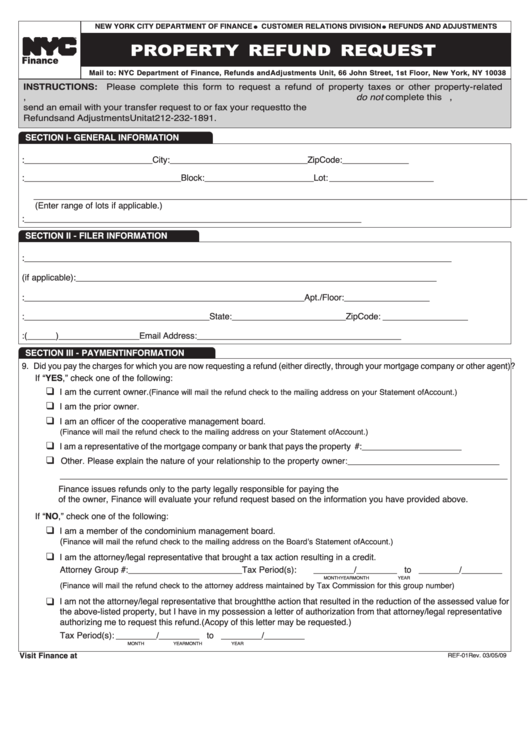

Form Ref-01 - Property Refund Request - 2009

ADVERTISEMENT

NEW YORK CITY DEPARTMENT OF FINANCE

CUSTOMER RELATIONS DIVISION

REFUNDS AND ADJUSTMENTS

G

G

PROPERTY REFUND REQUEST

TM

Finance

Mail to: NYC Department of Finance, Refunds and Adjustments Unit, 66 John Street, 1st Floor, New York, NY 10038

INSTRUCTIONS: Please complete this form to request a refund of property taxes or other property-related

charges. If you would like to transfer credits to another property that you own, do not complete this form. Instead,

send an email with your transfer request to refundsandadjustments@finance.nyc.gov or fax your request to the

Refunds and Adjustments Unit at 212-232-1891.

SECTION I - GENERAL INFORMATION

1. Property Address: ___________________________ City: _____________________________ Zip Code: ______________

2. Borough: _________________________________ Block: _______________________ Lot: ______________________

________________________________________________________________________________________________________

(Enter range of lots if applicable.)

3. Make Refund Check Payable to: _______________________________________________________________________

SECTION II - FILER INFORMATION

4. Your Name: __________________________________________________________________________________________

5. Firm Name (if applicable): ____________________________________________________________________________

6. Street Address: ___________________________________________________________ Apt./Floor:__________________

7. City:_______________________________________ State: ________________________ Zip Code: __________________

8. Telephone Number: (______)_________________ Email Address: ___________________________________________

SECTION III - PAYMENT INFORMATION

9. Did you pay the charges for which you are now requesting a refund (either directly, through your mortgage company or other agent)?

If “YES,” check one of the following:

I am the current owner.

(Finance will mail the refund check to the mailing address on your Statement of Account.)

K

I am the prior owner.

K

I am an officer of the cooperative management board.

K

(Finance will mail the refund check to the mailing address on your Statement of Account.)

I am a representative of the mortgage company or bank that pays the property taxes. Mortgage #:_____________________

K

Other. Please explain the nature of your relationship to the property owner: ________________________________

K

__________________________________________________________________________________

Finance issues refunds only to the party legally responsible for paying the charges. If you paid the charges on behalf

of the owner, Finance will evaluate your refund request based on the information you have provided above.

If “NO,” check one of the following:

I am a member of the condominium management board.

K

(

Finance will mail the refund check to the mailing address on the Boardʼs Statement of Account.)

I am the attorney/legal representative that brought a tax action resulting in a credit.

K

Attorney Group #: ________________________

Tax Period(s): _________/_________ to _________/_________

MONTH

YEAR

MONTH

YEAR

(Finance will mail the refund check to the attorney address maintained by Tax Commission for this group number)

I am not the attorney/legal representative that brought the action that resulted in the reduction of the assessed value for

K

the above-listed property, but I have in my possession a letter of authorization from that attorney/legal representative

authorizing me to request this refund. (A copy of this letter may be requested.)

Tax Period(s): _________/_________ to _________/_________

MONTH

YEAR

MONTH

YEAR

Visit Finance at nyc.gov/finance

REF-01 Rev. 03/05/09

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2