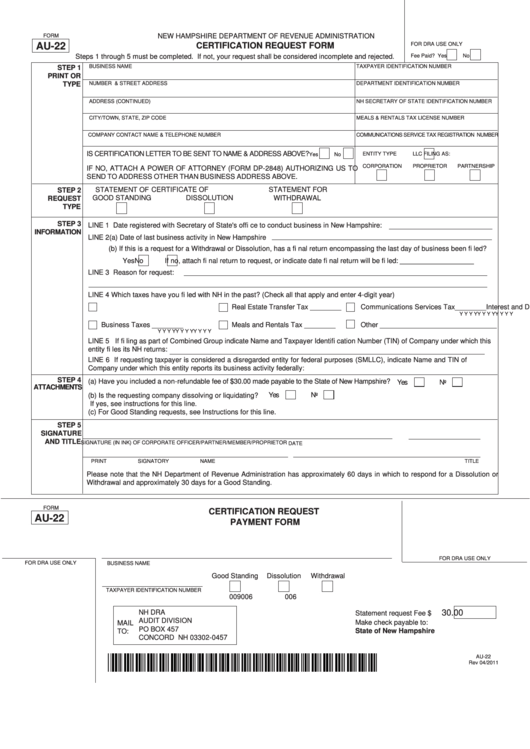

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

FORM

AU-22

FOR DRA USE ONLY

CERTIFICATION REQUEST FORM

Steps 1 through 5 must be completed. If not, your request shall be considered incomplete and rejected.

Fee Paid? Yes

No

BUSINESS NAME

TAXPAYER IDENTIFICATION NUMBER

STEP 1

PRINT OR

NUMBER & STREET ADDRESS

DEPARTMENT IDENTIFICATION NUMBER

TYPE

ADDRESS (CONTINUED)

NH SECRETARY OF STATE IDENTIFICATION NUMBER

CITY/TOWN, STATE, ZIP CODE

MEALS & RENTALS TAX LICENSE NUMBER

COMPANY CONTACT NAME & TELEPHONE NUMBER

COMMUNICATIONS SERVICE TAX REGISTRATION NUMBER

IS CERTIFICATION LETTER TO BE SENT TO NAME & ADDRESS ABOVE?

ENTITY TYPE

LLC FILING AS:

Yes

No

CORPORATION

PROPRIETOR

PARTNERSHIP

IF NO, ATTACH A POWER OF ATTORNEY (FORM DP-2848) AUTHORIZING US TO

SEND TO ADDRESS OTHER THAN BUSINESS ADDRESS ABOVE.

STATEMENT OF

CERTIFICATE OF

STATEMENT FOR

STEP 2

GOOD STANDING

DISSOLUTION

WITHDRAWAL

REQUEST

TYPE

STEP 3

LINE 1

Date registered with Secretary of State's offi ce to conduct business in New Hampshire:

INFORMATION

LINE 2(a) Date of last business activity in New Hampshire

(b) If this is a request for a Withdrawal or Dissolution, has a fi nal return encompassing the last day of business been fi led?

Yes

No

If no, attach fi nal return to request, or indicate date fi nal return will be fi led: ___________________

LINE 3

Reason for request:

LINE 4 Which taxes have you fi led with NH in the past? (Check all that apply and enter 4-digit year)

Interest and Dividends Tax ________

Real Estate Transfer Tax ________

Communications Services Tax________

Y Y Y Y

Y Y Y Y

Y Y Y Y

Business Taxes ________

Meals and Rentals Tax ________

Other ______________________________

Y Y Y Y

Y Y Y Y

Y Y Y Y

LINE 5 If fi ling as part of Combined Group indicate Name and Taxpayer Identifi cation Number (TIN) of Company under which this

entity fi les its NH returns:

LINE 6 If requesting taxpayer is considered a disregarded entity for federal purposes (SMLLC), indicate Name and TIN of

Company under which this entity reports its business activity federally:

STEP 4

(a) Have you included a non-refundable fee of $30.00 made payable to the State of New Hampshire?

Yes

No

ATTACHMENTS

Yes

No

(b) Is the requesting company dissolving or liquidating?

If yes, see instructions for this line.

(c)

For Good Standing requests, see Instructions for this line.

STEP 5

SIGNATURE

AND TITLE

SIGNATURE (IN INK) OF CORPORATE OFFICER/PARTNER/MEMBER/PROPRIETOR

DATE

PRINT SIGNATORY NAME

TITLE

Please note that the NH Department of Revenue Administration has approximately 60 days in which to respond for a Dissolution or

Withdrawal and approximately 30 days for a Good Standing.

FORM

CERTIFICATION REQUEST

AU-22

PAYMENT FORM

FOR DRA USE ONLY

FOR DRA USE ONLY

BUSINESS NAME

Good Standing

Dissolution

Withdrawal

TAXPAYER IDENTIFICATION NUMBER

009

006

006

30.00

NH DRA

Statement request Fee

$

AUDIT DIVISION

Make check payable to:

MAIL

PO BOX 457

State of New Hampshire

TO:

CONCORD NH 03302-0457

AU-22

Rev 04/2011

1

1