Instructions And Definitions For Filing Final Return For Local Earned Income Tax & Net Profit Tax

ADVERTISEMENT

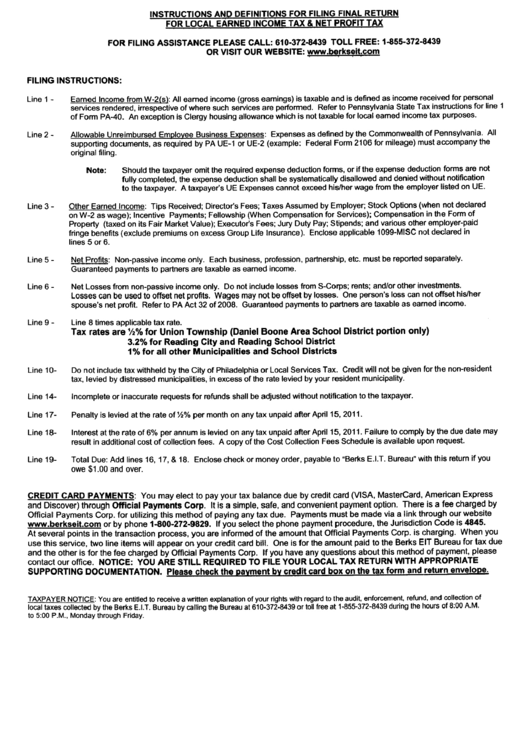

INSTRUCTIONS AND DEFINITIONS FOR FILING FINAL RETURN

FOR LOCAL EARNED INCOME TAX & NET PROFIT TAX

FOR FILING ASSISTANCE PLEASE CALL: 610-372-8439 TOLL FREE: 1-855-372-8439

OR VISIT OUR WEBSITE:

FILING INSTRUCTIONS:

Line 2-

Eamed Income from W-2(s): All eamed income (gross eamings) is taxable and is defined as income ri~ceived for personal

services rendered, irrespective of where such services are performed. Refer to Pennsylvania State Tax instructions for line 1

of Form PA-40. An exception is Clergy housing allowance which is not taxable for local eamed income tax purposes.

Allowable Unreimbursed Employee Business Expenses: Expenses as defined by the Commonwealth of Pennsylvania. All

supporting documents, as required by PA UE-1 or UE-2 (example: Federal Form 2106 for mileage) must accompany the

original filing.

Note: Should the taxpayer omit the required expense deduction forms, or if the expense deduction forms are not

fully completed, the expense deduction shall be systematically disallowed and denied without notification

to the taxpayer. A taxpayer's UE Expenses cannot exceed his/her wage from the employer listed on UE.

Line 1 -

Line 3 - Other Earned Income: Tips Received; Director's Fees; Taxes Assumed by Employer; Stock Options (when not declared

on W-2 as wage); Incentive Payments; Fellowship (When Compensation for Services); Compensation in the Form of

Property (taxed on its Fair Market Value); Executor's Fees; Jury Duty Pay; Stipends; and various other employer-paid

fringe benefits (exclude premiums on excess Group Life Insurance). Enclose applicable 1099-MISC not declared in

lines 5 or 6.

Line 5 - Net Profis: Non-passive income only. Each business, profession, partnership, etc. must be reported separately.

Guaranteed payments to partners are taxable as earned income.

Line 6 - Net losses from non-passive income only. Do not include losses from S-Corps; rents; and/or other investments.

losses can be used to offset net profits. Wages may not be offset by losses. One person's loss can not offet his/her

spouse's net profit. Refer to PA Act 32 of 2008. Guaranteed payments to partners are taxable as earned income.

Line 9 - Line 8 times applicable tax rate.

Tax rates are %% for Union Township (Daniel Boone Area School District portion only)

3.2% for Reading City and Reading School District

1 % for all other Municipalities and School Districts

Line 10- Do not include tax withheld by the City of Philadelphia or local Services Tax. Credit wil not be given for the non-resident

tax. levied by distressed municipalities, in excess of the rate levied by your resident municipality.

Line 14- Incomplete or inaccurate requests for refunds shall be adjusted without notification to the taxpayer.

Line 17- Penalty is levied at the rate of Y2% per month on any tax unpaid after April

15, 2011.

Line 18- Interest at the rate of 6% per annum is levied on any tax unpaid after April 15, 2011. Failure to comply by the due date may

result in additional cost of collection fees. A copy of the Cost Collection Fees Schedule is available upon request.

Line 19- Total Due: Add lines 16, 17, & 18. Enclose check or money order, payable to "Berks E.I.T. Bureau" with this return if

you

owe $1.00 and over.

CREDIT CARD PAYMENTS: You may elect to pay your tax balance due by credit card (VISA, MasterCard, American Express

and Discover) through Offcial Payments Corp. It is a simple, safe, and convenient payment option. There is a fee charged by

Offcial Payments Corp. for utilizing this method of paying any tax due. Payments must be made via a link through our website

or by phone 1-800-272-9829. If you select the phone payment procedure, the Jurisdiction Code is 4845.

At several points in the transaction process, you are informed of the amount that Offcial Payments Corp. is Gharging. When you

use this service, two line items wil appear on your credit card bil. One is for the amount paid to the Berks EIT Bureau for tax due

and the other is for the fee charged by Offcial Payments Corp. If you have any questions about this method of payment, please

contact our offce. NOTICE: YOU ARE STILL REQUIRED TO FILE YOUR LOCAL TAX RETURN WITH APPROPRIATE

SUPPORTING DOCUMENTATION. Please check the payment by credit card box on the tax form and return envelope.

TAXPAYER NOTICE: You are entitled to receive a wrtten explanation of your nghts with regard to the audit. enforcement. refund. and collection of

local taxes collected by the Berks E.I.T. Bureau by callng the Bureau at 610-372-8439 or toll free at 1-855-372-8439 during the hours of 8:00 A.M.

to 5:00 P.M., Monday through Friday.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2