Instructions And Definitions For Filing Final Return For Local Earned Income Tax & Net Profits Tax - 2011

ADVERTISEMENT

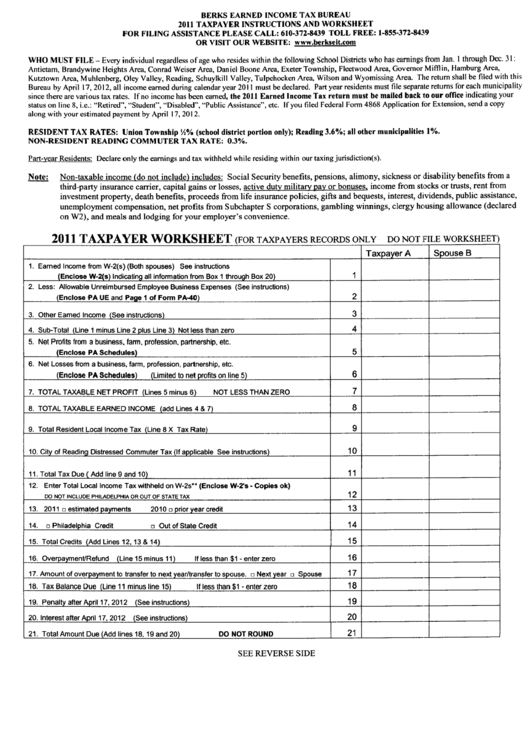

BERKS EARNED INCOME TAX BUREAU

2011 TAXPAYER INSTRUCTIONS AND WORKSHEET

FOR FILING ASSISTANCE PLEASE CALL: 610-372-8439 TOLL FREE: 1-855-372-8439

OR VISIT OUR WEBSITE:

WHO MUST FILE - Every individual regardless of age who resides within the following School Districts who has earnings frorn Jan. I through Dec. 3 I:

Antietarn, Brandywine Heights Area, Conrad Weiser Area, Daniel Boone Area, Exeter Township, Fleetwood Area, Governor Miffin, Harnburg Area,

Kutztown Area, Muhlenberg, Oley Valley, Reading, Schuylkill Valley, Tulpehocken Area, Wilson and Wyomissing Area. The return shall be fied with this

Bureau by April 17,2012, all income earned during calendar year 201 i must be declared. Part year residents must fie separate returns for each municipality

since there are various tax rates. Ifno income has been earned, the 2011 Earned Income Tax return must be mailed back to our offce indicating your

status on line 8, i.e.: "Retired", "Student", "Disabled", "Public Assistance", etc. If

you fied Federal Fonn 4868 Application for Extension, send a copy

along with your estirnated payrnent by April 17,2012.

RESIDENT TAX RATES: Union Township Yi% (school district portion only); Reading 3.6%; all other municipalities 1 %.

NON-RESIDENT READING COMMUTER TAX RATE: 0.3%.

Part-year Residents: Declare only the earnings and tax withheld while residing within our taxingjurisdiction(s).

Note: Non-taxable income (do not include) includes: Social Security benefits, pensions, alimony, sickness or disability benefits from a

third-party insurance carrier, capital gains or losses, active duty military payor bonuses, income from stocks or trusts, rent from

investment property, death benefits, proceeds from life insurance policies, gifts and bequests, interest, dividends, public assistance,

unemployment compensation, net profits from Subchapter S corporations, gambling winnings, clergy housing allowance (declared

on W2), and meals and lodging for your employer's convenience.

2011 TAXPAYER WORKSHEET (FOR TAXPAYERS

RECORDS

ONLY DO

NOT

fiLE

WORKSHEET)

Taxpayer A

Spouse B

1.

Earned Income from W-2(s) (Both spouses) See instructions

(Enclose W-2(s) Indicatino all information from Box 1 throuoh Box 20)

1

2. Less: Allowable Unreimbursed Employee Business Expenses (See instructions)

(Enclose PA UE and Page 1 of Form PA-40)

2

3. Other Earned Income (See instructions)

3

4.

Sub-Total (Line 1 minus Line 2 olus Line 3) Not less than zero

4

5. Net Profits from a business, farm, profession, partnership, etc.

(Enclose PA Schedules)

5

6. Net Losses from a business, farm, profession, partnership, etc.

(Enclose PA Schedules)

(Limited to net profis on line 5)

6

7. TOTAL TAXBLE NET PROFIT (Lines 5 minus 6)

NOT LESS THAN ZERO

7

8. TOTAL TAXBLE EARNED INCOME (add Lines 4 & 7)

8

9. Total Resident Local

Income Tax (Line 8 X Tax Rate)

9

10. City of Readino Distressed Commuter Tax (If applicable See instructions)

10

11. Total Tax Due ( Add line 9 and 10)

11

12. Enter Total Local Income Tax withheld on W-2s.. (Enclose W-2's - Copies ok)

DO NOT INCLUDE PHILADELPHIA OR OUT OF STATE TAX

12

13.

2011 0 estimated payments

20100 orior year credit

13

14.

o Philadelohia Credit

o Out of State Credit

14

15. Total Credits (Add Lines 12, 13 & 14)

15

16. Overpayment/Refund (Line 15 minus 11)

If less than $1 - enter zero

16

17. Amount of overpayment to transfer to next year/transfer to soouse. 0 Next year 0 Soouse

17

18. Tax Balance Due (Line 11 minus line 15)

If less than $1 - enter zero

18

19. Penalty after April

17, 2012 (See instructions)

19

20. Interest after April

17, 2012 (See instructions)

20

21. Total Amount Due (Add lines 18,19 and 20)

DO

NOT

ROUND

21

SEE REVERSE SIDE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2