Instructions For Form 37a

ADVERTISEMENT

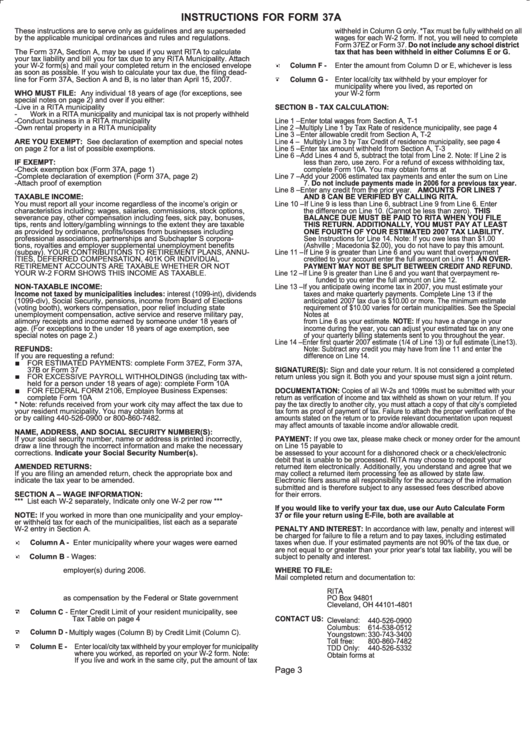

INSTRUCTIONS FOR FORM 37A

These instructions are to serve only as guidelines and are superseded

withheld in Column G only. *Tax must be fully withheld on all

by the applicable municipal ordinances and rules and regulations.

wages for each W-2 form. If not, you will need to complete

Form 37EZ or Form 37. Do not include any school district

The Form 37A, Section A, may be used if you want RITA to calculate

tax that has been withheld in either Columns E or G.

your tax liability and bill you for tax due to any RITA Municipality. Attach

your W-2 form(s) and mail your completed return in the enclosed envelope

o

Column F -

Enter the amount from Column D or E, whichever is less

as soon as possible. If you wish to calculate your tax due, the filing dead-

line for Form 37A, Section A and B, is no later than April 15, 2007.

o

Column G - Enter local/city tax withheld by your employer for

municipality where you lived, as reported on

WHO MUST FILE: Any individual 18 years of age (for exceptions, see

your W-2 form

special notes on page 2) and over if you either:

-

Live in a RITA municipality

SECTION B - TAX CALCULATION:

-

Work in a RITA municipality and municipal tax is not properly withheld

-

Conduct business in a RITA municipality

Line 1 – Enter total wages from Section A, T-1

-

Own rental property in a RITA municipality

Line 2 – Multiply Line 1 by Tax Rate of residence municipality, see page 4

Line 3 – Enter allowable credit from Section A, T-2

ARE YOU EXEMPT: See declaration of exemption and special notes

Line 4 – Multiply Line 3 by Tax Credit of residence municipality, see page 4

on page 2 for a list of possible exemptions.

Line 5 – Enter tax amount withheld from Section A, T-3

Line 6 – Add Lines 4 and 5, subtract the total from Line 2. Note: If Line 2 is

IF EXEMPT:

less than zero, use zero. For a refund of excess withholding tax,

-

Check exemption box (Form 37A, page 1)

complete Form 10A. You may obtain forms at

-

Complete declaration of exemption (Form 37A, page 2)

Line 7 – Add your 2006 estimated tax payments and enter the sum on Line

-

Attach proof of exemption

7. Do not include payments made in 2006 for a previous tax year.

Line 8 – Enter any credit from the prior year. AMOUNTS FOR LINES 7

TAXABLE INCOME:

AND 8 CAN BE VERIFIED BY CALLING RITA.

You must report all your income regardless of the income’s origin or

Line 10 – If Line 9 is less than Line 6, subtract Line 9 from Line 6. Enter

characteristics including: wages, salaries, commissions, stock options,

the difference on Line 10. (Cannot be less than zero). THIS

severance pay, other compensation including fees, sick pay, bonuses,

BALANCE DUE MUST BE PAID TO RITA WHEN YOU FILE

tips, rents and lottery/gambling winnings to the extent they are taxable

THIS RETURN. ADDITIONALLY, YOU MUST PAY AT LEAST

as provided by ordinance, profits/losses from businesses including

ONE FOURTH OF YOUR ESTIMATED 2007 TAX LIABILITY.

professional associations, partnerships and Subchapter S corpora-

See Instructions for Line 14. Note: If you owe less than $1.00

tions, royalties and employer supplemental unemployment benefits

(Ashville ; Macedonia $2.00), you do not have to pay this amount.

(subpay). YOUR CONTRIBUTIONS TO RETIREMENT PLANS, ANNU-

Line 11 –If Line 9 is greater than Line 6 and you want that overpayment

ITIES, DEFERRED COMPENSATION, 401K OR INDIVIDUAL

credited to your account enter the full amount on Line 11. AN OVER-

RETIREMENT ACCOUNTS ARE TAXABLE WHETHER OR NOT

PAYMENT MAY NOT BE SPLIT BETWEEN CREDIT AND REFUND.

YOUR W-2 FORM SHOWS THIS INCOME AS TAXABLE.

Line 12 –If Line 9 is greater than Line 6 and you want that overpayment re-

funded to you enter the full amount on Line 12.

NON-TAXABLE INCOME:

Line 13 –If you anticipate owing income tax in 2007, you must estimate your

Income not taxed by municipalities includes: interest (1099-int), dividends

taxes and make quarterly payments. Complete Line 13 if the

(1099-div), Social Security, pensions, income from Board of Elections

anticipated 2007 tax due is $10.00 or more. The minimum estimate

(voting booth), workers compensation, poor relief including state

requirement of $10.00 varies for certain municipalities. See the Special

unemployment compensation, active service and reserve military pay,

Notes at for exceptions. You may use the amount

alimony receipts and income earned by someone under 18 years of

from Line 6 as your estimate. NOTE: If you have a change in your

age. (For exceptions to the under 18 years of age exemption, see

income during the year, you can adjust your estimated tax on any one

special notes on page 2.)

of your quarterly billing statements sent to you throughout the year.

Line 14 – Enter first quarter 2007 estimate (1/4 of Line 13) or full estimate (Line13).

REFUNDS:

Note: Subtract any credit you may have from line 11 and enter the

If you are requesting a refund:

difference on Line 14.

FOR ESTIMATED PAYMENTS: complete Form 37EZ, Form 37A,

37B or Form 37

SIGNATURE(S): Sign and date your return. It is not considered a completed

FOR EXCESSIVE PAYROLL WITHHOLDINGS (including tax with-

return unless you sign it. Both you and your spouse must sign a joint return.

held for a person under 18 years of age): complete Form 10A

FOR FEDERAL FORM 2106, Employee Business Expenses:

DOCUMENTATION: Copies of all W-2s and 1099s must be submitted with your

complete Form 10A

return as verification of income and tax withheld as shown on your return. If you

* Note: refunds received from your work city may affect the tax due to

pay the tax directly to another city, you must attach a copy of that city’s completed

your resident municipality. You may obtain forms at

tax form as proof of payment of tax. Failure to attach the proper verification of the

or by calling 440-526-0900 or 800-860-7482.

amounts stated on the return or to provide relevant documentation upon request

may affect amounts of taxable income and/or allowable credit.

NAME, ADDRESS, AND SOCIAL SECURITY NUMBER(S):

If your social security number, name or address is printed incorrectly,

PAYMENT: If you owe tax, please make check or money order for the amount

draw a line through the incorrect information and make the necessary

on Line 15 payable to R.I.T.A. and attach to the front of your return. A fee will

corrections. Indicate your Social Security Number(s).

be assessed to your account for a dishonored check or a check/electronic

debit that is unable to be processed. RITA may choose to redeposit your

AMENDED RETURNS:

returned item electronically. Additionally, you understand and agree that we

If you are filing an amended return, check the appropriate box and

may collect a returned item processing fee as allowed by state law.

indicate the tax year to be amended.

Electronic filers assume all responsibility for the accuracy of the information

submitted and is therefore subject to any assessed fees described above

SECTION A – WAGE INFORMATION:

for their errors.

*** List each W-2 separately, Indicate only one W-2 per row ***

If you would like to verify your tax due, use our Auto Calculate Form

NOTE: If you worked in more than one municipality and your employ-

37 or file your return using E-File, both are available at

er withheld tax for each of the municipalities, list each as a separate

W-2 entry in Section A.

PENALTY AND INTEREST: In accordance with law, penalty and interest will

be charged for failure to file a return and to pay taxes, including estimated

o

Column A - Enter municipality where your wages were earned

taxes when due. If your estimated payments are not 90% of the tax due, or

are not equal to or greater than your prior year’s total tax liability, you will be

o

Column B - Wages:

subject to penalty and interest.

A.

All employee compensations paid to you by your

employer(s) during 2006.

WHERE TO FILE:

B.

Tips not reported by your employer

Mail completed return and documentation to:

C.

Wages you received not included on a W-2 form

D.

Employee contributions to retirement plans excludable

RITA

as compensation by the Federal or State government

PO Box 94801

Cleveland, OH 44101-4801

o

Column C - Enter Credit Limit of your resident municipality, see

Tax Table on page 4

CONTACT US:

Cleveland:

440-526-0900

Columbus:

614-538-0512

o

Column D - Multiply wages (Column B) by Credit Limit (Column C).

Youngstown:

330-743-3400

Toll free:

800-860-7482

o

Column E - Enter local/city tax withheld by your employer for municipality

TDD Only:

440-526-5332

where you worked, as reported on your W-2 form. Note:

Obtain forms at

If you live and work in the same city, put the amount of tax

Page 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2