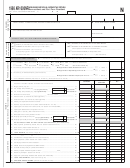

FORM 740-NP (2006)

Page 2

REFUND/TAX

PAYMENT

SUMMARY

29 Enter amount from page 1, line 28.

00

This is your Total Tax Liability ......................................................................................................................................................................................... 29

30 (a) Enter Kentucky income tax withheld as shown on attached

•

00

2006 Form W-2(s) and other supporting statements ................................................................ 30(a)

•

00

(b) Enter 2006 Kentucky estimated tax payments ........................................................................... 30(b)

(c) Enter refundable Kentucky corporation tax credit (KRS 141.420(3)(c))

•

00

as shown on attached Kentucky Schedule(s) K-1 or Form(s) 725 ................................. 30(c)

00

31 Add lines 30(a) through 30(c) ............................................................................................................................................................................................... 31

00

32 If line 31 is larger than line 29, enter AMOUNT OVERPAID (see instructions) .................................................................................................. 32

See instructions for a detailed description of funds.

(Enter amount(s) checked)

•

00

33 Nature and Wildlife Fund Contribution

$2

$5

$10

Other

... 33

•

00

34

$2

$4

Other

.................... 34

Child Victims' Trust Fund Contribution

•

00

35 Veterans' Program Trust Fund Contribution .................................................................................................................. 35

•

00

36 Breast Cancer Research and Education Trust Fund Contribution ........................................................................ 36

00

37 Add lines 33 through 36 ......................................................................................................................................................................................................... 37

•

00

38 Amount of line 32 to be CREDITED TO YOUR 2007 ESTIMATED TAX ............................................................................................................... 38

•

00

39 Subtract lines 37 and 38 from line 32. Amount to be REFUNDED TO YOU ................................................................

REFUND

39

•

00

40 If line 29 is larger than line 31, enter ADDITIONAL TAX DUE ................................................................................................................................ 40

41 (a) Estimated tax penalty

(c) Late payment penalty

Check if Form 2210-K attached

(d) Late filing penalty

•

00

(b) Interest

(e) Add lines 41(a) through 41(d). Enter here .................................. 41(e)

00

42 Add lines 40 and 41(e) and enter here. This is the AMOUNT YOU OWE ...................................................................................

OWE

42

Make check payable to Kentucky State Treasurer. Write your Social Security number and "KY Income Tax-2006" on the check.

SECTION A-BUSINESS INCENTIVE AND OTHER TAX CREDITS

00

1 Enter nonrefundable Kentucky corporation tax credit (KRS 141.420(3)) (attach Kentucky Schedule(s) K-1 or Form(s) 725) .................. 1

00

2 Enter skills training investment credit (attach copy(ies) of certification) ................................................................................................................. 2

3 Enter historic preservation restoration credit .................................................................................................................................................................... 3

00

4 Enter credit for tax paid to another state (attach copy of other state's return(s)) .......................................................................................... 4

00

5 Enter unemployment credit (attach Schedule UTC) ....................................................................................................................................................... 5

00

00

6 Enter recycling and/or composting equipment credit (attach Schedule RC) ........................................................................................................ 6

00

7 Enter Kentucky Investment Fund credit (attach copy(ies) of certification) ............................................................................................................ 7

8 Enter credit for purchases of Kentucky coal used for generating electricity ......................................................................................................... 8

00

00

9 Enter qualified research facility credit (attach Schedule QR) ....................................................................................................................................... 9

00

10 Enter GED incentive credit (attach Form DAEL-31) ......................................................................................................................................................... 10

00

11 Enter voluntary environmental remediation credit (Brownfield) .............................................................................................................................. 11

00

12 Enter biodiesel credit.................................................................................................................................................................................................................. 12

00

13 Enter environmental stewardship credit ............................................................................................................................................................................ 13

00

14 Enter clean coal incentive credit ............................................................................................................................................................................................ 14

00

15 Add lines 1 through 14. Enter here and on page 1, line 15 ........................................................................................................................................ 15

1 Enter number of

SECTION B-PERSONAL TAX CREDITS

Check Regular

Check both if 65 or over

Check both if blind

boxes checked

1 (a) Credits for yourself:

on line 1 ........................

2 Enter number of

(b) Credits for spouse:

dependents who:

2 Dependents:

Dependent's

Check if qualifying

• lived with you ............

Dependent's

relationship

child for family

First name

Last name

Social Security number

to you

size tax credit

• did not live with you

(see instructions) ......

• other dependents ......

•

3 Add lines 1 and 2 and enter total here ..................................................................................................................................................................................................... 3

x $20

4 Multiply credits on line 3 by $20. Enter here and on page 1, line 17 .......................................................................................................................................... 4

SECTION C-FAMILY SIZE TAX CREDIT (List the name and Social Security number of qualifying children that are not claimed as dependents in Section B.)

First name

Last name

Social Security number

First name

Last name

Social Security number

Official Use Only

R

Mail to: Kentucky Department of Revenue, Frankfort, KY 40618-0006.

EFUNDS

EST

CF

NT

P B F

R

P

Mail to: Kentucky Department of Revenue, Frankfort, KY 40619-0008.

AYMENTS

1

1 2

2 3

3