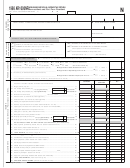

FORM 740-NP (2006)

Page 3

SECTION D

A. Total from

Attached

B. Kentucky

Federal Return

INCOME

1 Enter all wages, salaries, tips, etc. (attach wage

00

00

and tax statements) Do not include moving expense reimbursements .......................................

1

00

00

2 Moving expense reimbursement (attach Schedule ME)..........................................................................

2

00

00

3 Interest ......................................................................................................................................................................

3

00

00

4 Dividends .................................................................................................................................................................

4

00

00

5 Taxable refunds, credits or offsets of state and local income taxes ...................................................

5

00

00

6 Alimony received ..................................................................................................................................................

6

00

00

7 Business income or loss (attach federal Schedule C or C-EZ)................................................................

7

00

00

8 Capital gain or loss

............................................................................................

(attach federal Schedule D)

8

00

00

9 Other gains or losses (attach federal Form 4797)......................................................................................

9

00

00

10 (a) Federally taxable IRA distributions, pensions and annuities ........................................................... 10(a)

(

00)

(b) Pension income exclusion (attach Schedule P if more than $41,110)....................................... 10(b)

00

00

11 Rents, royalties, partnerships, estates, trusts, etc. (attach federal Schedule E)...................................... 11

00

00

12 Farm income or loss (attach federal Schedule F).............................................................................................. 12

00

00

.................................................................................................................................. 13

13 Unemployment compensation

00

14 Taxable Social Security benefits ............................................................................................................................. 14

00

15 Gambling winnings ..................................................................................................................................................... 15

00

16 Other income (list type and amount)

00

00

16

00

00

17 Combine lines 1 through 16. This is your Total Income ......................................... 17

ADJUSTMENTS TO INCOME

00

00

18 Archer medical savings account (MSA) deduction ....................................................................................... 18

19 Certain business expenses of reservists, performing artists and

00

00

fee-basis government officials (attach federal Form 2106 or 2106-EZ)............................................... 19

00

00

20 Health savings account deduction (attach federal Form 8889)............................................................... 20

00

00

21 Moving expenses (attach Schedule ME)........................................................................................................... 21

00

00

22 Deduction for one-half of self-employment tax ........................................................................................... 22

00

00

23 Self-employed SEP, SIMPLE, and qualified plans deduction .................................................................... 23

00

24 Self-employed health insurance deduction ................................................................................................... 24

25 Penalty on early withdrawal of savings ............................................................................................................ 25

00

00

26 Alimony paid (enter recipient's name and Social Security number)

00

00

26

00

00

27 IRA deduction ........................................................................................................................................................... 27

00

00

deduction ........................................................................................................................... 28

28 Student loan interest

00

00

29 Jury duty pay you gave to your employer ...................................................................................................... 29

30 Domestic production activities deduction ..................................................................................................... 30

00

00

31 Long-term care insurance premiums (see instructions) ............................................................................ 31

00

00

32 Health insurance premiums (see instructions).............................................................................................. 32

00

00

Total adjustments to income ............................................................................ 33

33 Add lines 18 through 32.

00

00

34 Subtract line 33 from line 17. This is your Adjusted Gross Income .................................................... 34

35 Divide line 34, Column B, by line 34, Column A. If amount is equal to or

.

greater than 100%, enter 100%. This is your Percentage of Kentucky

%

Adjusted Gross Income to Federal Adjusted Gross Income ......................................................... 35

SECTION E-COMPUTATION OF MODIFIED GROSS INCOME FOR FAMILY SIZE TAX CREDIT

If federal adjusted gross income is $26,600 or less, you may qualify for the Family Size Tax Credit. See instructions.

(a) .....

00

Enter your federal adjusted gross income from line 34, Column A. If zero or less, enter zero .................................................

(a)

(b)

Enter your spouse's federal adjusted gross income if married filing separate returns and

00

living in the same household. If zero or less, enter zero..........................................................................................................................

(b)

00

(c)

Enter tax-exempt interest from municipal bonds (non-Kentucky) .........................................................................................................

(c)

(d)

Enter amount of lump-sum distributions not included in federal adjusted gross income

00

(federal Form 4972) .................................................................................................................................................................................................

(d)

(e)

Enter total of lines (a), (b), (c) and (d). This is your Modified Gross Income. Use this amount to

00

determine if you qualify for the Family Size Tax Credit .............................................................................................................................

(e)

1

1 2

2 3

3