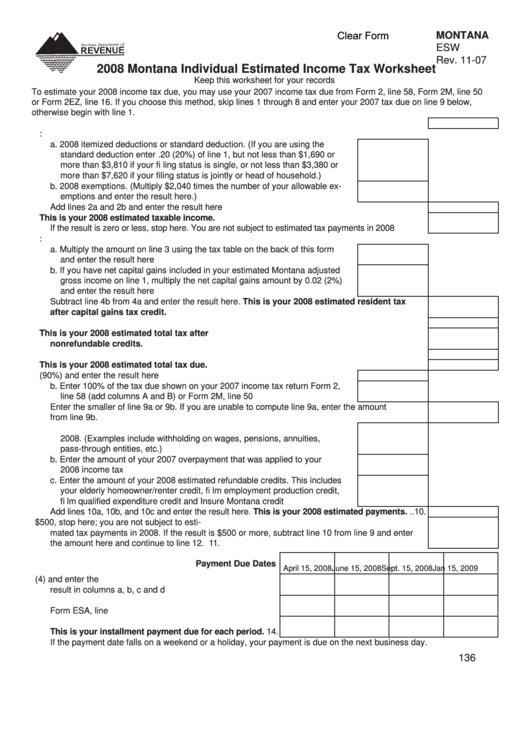

Form Esw - Individual Estimated Income Tax Worksheet - 2008

ADVERTISEMENT

Clear Form

MONTANA

ESW

Rev. 11-07

2008 Montana Individual Estimated Income Tax Worksheet

Keep this worksheet for your records

To estimate your 2008 income tax due, you may use your 2007 income tax due from Form 2, line 58, Form 2M, line 50

or Form 2EZ, line 16. If you choose this method, skip lines 1 through 8 and enter your 2007 tax due on line 9 below,

otherwise begin with line 1.

1. Enter your 2008 estimated Montana adjusted gross income here .................................................. 1.

2. Enter the estimated amount of your:

a. 2008 itemized deductions or standard deduction. (If you are using the

standard deduction enter .20 (20%) of line 1, but not less than $1,690 or

more than $3,810 if your fi ling status is single, or not less than $3,380 or

more than $7,620 if your fi ling status is jointly or head of household.) ........ 2a.

b. 2008 exemptions. (Multiply $2,040 times the number of your allowable ex-

emptions and enter the result here.) ........................................................... 2b.

Add lines 2a and 2b and enter the result here ................................................................................ 2.

3. Subtract line 2 from line 1 and enter the result here. This is your 2008 estimated taxable income.

If the result is zero or less, stop here. You are not subject to estimated tax payments in 2008 ..........3.

4. Calculate your estimated 2008 income tax:

a. Multiply the amount on line 3 using the tax table on the back of this form

and enter the result here .............................................................................. 4a.

b. If you have net capital gains included in your estimated Montana adjusted

gross income on line 1, multiply the net capital gains amount by 0.02 (2%)

and enter the result here .............................................................................. 4b.

Subtract line 4b from 4a and enter the result here. This is your 2008 estimated resident tax

after capital gains tax credit. ........................................................................................................ 4.

5. Enter your 2008 estimated nonrefundable single-year credits and carryover credits here ............. 5.

6. Subtract line 5 from line 4 and enter the result here. This is your 2008 estimated total tax after

nonrefundable credits. .................................................................................................................. 6.

7. Enter your estimated 2008 recapture taxes here ............................................................................ 7.

8. Add lines 6 and 7 and enter the result here. This is your 2008 estimated total tax due. ............ 8.

9. a. Multiply line 8 by .90 (90%) and enter the result here .................................. 9a.

b. Enter 100% of the tax due shown on your 2007 income tax return Form 2,

line 58 (add columns A and B) or Form 2M, line 50 ..................................... 9b.

Enter the smaller of line 9a or 9b. If you are unable to compute line 9a, enter the amount

from line 9b. ..................................................................................................................................... 9.

10. a. Enter the amount of your estimated Montana income tax withheld in

2008. (Examples include withholding on wages, pensions, annuities,

pass-through entities, etc.) ........................................................................ 10a.

b. Enter the amount of your 2007 overpayment that was applied to your

2008 income tax ......................................................................................... 10b.

c. Enter the amount of your 2008 estimated refundable credits. This includes

your elderly homeowner/renter credit, fi lm employment production credit,

fi lm qualifi ed expenditure credit and Insure Montana credit ....................... 10c.

Add lines 10a, 10b, and 10c and enter the result here. This is your 2008 estimated payments. ..10.

11. Subtract line 10 from line 8. If the result is less than $500, stop here; you are not subject to esti-

mated tax payments in 2008. If the result is $500 or more, subtract line 10 from line 9 and enter

the amount here and continue to line 12. ...................................................................................... 11.

a.

b.

c.

d.

Payment Due Dates

April 15, 2008 June 15, 2008 Sept. 15, 2008 Jan 15, 2009

12. Divide the amount on line 11 by four (4) and enter the

result in columns a, b, c and d ..........................................12.

13. Enter your annualized income installment amount from

Form ESA, line 25c...........................................................13.

14. Enter the amount from line 12 or line 13 whichever applies.

This is your installment payment due for each period. 14.

If the payment date falls on a weekend or a holiday, your payment is due on the next business day.

136

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2