Instructions For Form Ifta-101 - Ifta Quarterly Fuel Use Tax Schedule

ADVERTISEMENT

HOW TO USE THE IFTA FORM

BASIC INFORMATION

Entering IFTA Identification Number:

KY is already entered. The IFTA Identification number is your social security number or Federal ID

number followed by your fleet number. Fleet number is usually 01. Example: (KY12345678901)

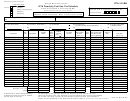

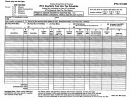

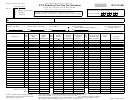

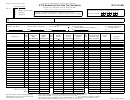

At the bottom of your screen you will see sheet tabs labled; IFTA-100-MN, Diesel, Diesel-

Continuation, Motor_Fuel_Gasoline, etc. Single click on these tabs to move from one page or fuel

type to another. Fuel types must be entered separately. On IFTA-101 forms, columns A through D

must be entered first.

Only enter information in cells that are blank or have blue text.

DO NOT enter amounts in columns that are X'd out. Make no entries on surcharge lines.

The red dots you will see on the screen are called note cells. The note cell contains information to

help you complete information in that cell or section. You view this note cell by selecting the cell

with your mouse pointer. If you do not see the red dots, you will need to go into your Tools/Options

menu and turn on 'Note Indicator'.

If you are using the number pad to enter numbers, be sure the number lock is on. If number lock is

not on, the 2,4,6, and 8 key will act like arrow keys.

There is also a custom menu at the top. Use these items to view and or print.

Error messages will appear at the bottom of the screen if any information is left blank or does not

balance. You can also check the accuracy of your report by looking at the ERROR report. It will tell

you if any information has been possibly left off or if the form is not balanced.

If certain functions seem to be "disabled" you may have made an entry in a cell and did not hit

ENTER. As a result the cell is still "active". Hit ENTER and try again.

USING EXCEL

1.

Entering Data---The best way to move around in this spreadsheet is using the tab key.

The tab key will skip all protected cells and take you to your next allowable cell.

Enter the data by typing whatever is needed and pressing either ENTER on the

keyboard or clicking the CHECK button on the screen.

2.

Editing Data--- To edit the data in a particular cell, position the pointer over the text on

the edit line and click the left mouse button. You can click the left mouse button

again or select the F2 edit key. The edit line is the row directly

below the tool bar. Now you can edit the text of the cell. When you finish, click

either the CHECK button or press ENTER on the keyboard.

3.

Correct a mistake--- Should you make an entry or delete an item you did not intend to

do, simply stop immediately, select Edit on the menu bar and then Undo.

4.

Printing---

You can print using the print macros already setup with the IFTA Tax

Form by clicking on the PRINT REPORT button on IFTA-101, or by using the

drop down menu at the top.

If you have difficulty printing, possibly a "Run-time error", try these steps

first. Check your paper tray and/or selection. It could also be a memory error.

Try lowering your print settings as low as they will go.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11