Instructions For Form Ifta-101 - Ifta Quarterly Fuel Use Tax Schedule Page 3

ADVERTISEMENT

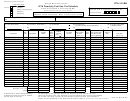

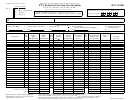

Instructions for Form IFTA-101

Instructions for Form IFTA-101

IFTA Quarterly Fuel use Tax Schedule

IFTA Quarterly Fuel use Tax Schedule

A separate Form IFTA-101 must be used for each fuel

A separate Form IFTA-101 must be used for each fuel

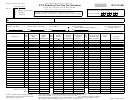

Column J – The computer automatically puts this amount in from

Column J – The computer automatically puts this amount in from

type. If you used fuel type(s) other than the type(s)

type. If you used fuel type(s) other than the type(s)

item (E) above.

item (E) above.

available in this form you must obtain a blank schedule by

available in this form you must obtain a blank schedule by

calling (502) 564-4150.

calling (502) 564-4150.

Column K – This column is automatically calculated by the

Column K – This column is automatically calculated by the

computer. This amount is figured by dividing the amount in column

computer. This amount is figured by dividing the amount in column

Jurisdictions that have a surcharge are listed twice on Form IFTA-

Jurisdictions that have a surcharge are listed twice on Form IFTA-

I by the amount in column J to determine the total taxable gallons

I by the amount in column J to determine the total taxable gallons

101 (column F). If you enter any jurisdiction(s) with a surcharge,

101 (column F). If you enter any jurisdiction(s) with a surcharge,

of fuel consumed in each IFTA jurisdiction. For surcharge taxable

of fuel consumed in each IFTA jurisdiction. For surcharge taxable

the computer will automatically add a surcharge line and the

the computer will automatically add a surcharge line and the

gallons, the computer automatically places the amount from the

gallons, the computer automatically places the amount from the

amounts for you. Do not enter amounts in columns that are X’d

amounts for you. Do not enter amounts in columns that are X’d

above line.

above line.

out. Make no entries on surcharge lines.

out. Make no entries on surcharge lines.

Column L – Enter the total tax-paid gallons of fuel purchased and

Column L – Enter the total tax-paid gallons of fuel purchased and

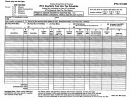

(A) Total IFTA Miles – Enter the total miles traveled in IFTA

(A) Total IFTA Miles – Enter the total miles traveled in IFTA

placed in the propulsion tank of a qualified motor vehicle in each

placed in the propulsion tank of a qualified motor vehicle in each

jurisdictions by all qualified motor vehicles in your fleet using

jurisdictions by all qualified motor vehicles in your fleet using

IFTA jurisdiction. Keep your records for each purchase claimed.

IFTA jurisdiction. Keep your records for each purchase claimed.

the fuel type indicated on each form/schedule (total from

the fuel type indicated on each form/schedule (total from

When using bulk storage, report only tax-paid gallons removed for

When using bulk storage, report only tax-paid gallons removed for

column H). Report all miles traveled whether the miles are

column H). Report all miles traveled whether the miles are

use in your qualified motor vehicles. Fuel remaining in storage

use in your qualified motor vehicles. Fuel remaining in storage

taxable or nontaxable. The computer will round mileage to

taxable or nontaxable. The computer will round mileage to

cannot be claimed until it is used. Make no entry on surcharge line.

cannot be claimed until it is used. Make no entry on surcharge line.

the nearest whole mile (e.g., 1234.5 = 1235).

the nearest whole mile (e.g., 1234.5 = 1235).

The computer will round gallons to the nearest whole gallon

The computer will round gallons to the nearest whole gallon

(e.g., 123.4 = 123).

(e.g., 123.4 = 123).

(B) Total NON-IFTA Miles – Enter the total miles traveled in non-

(B) Total NON-IFTA Miles – Enter the total miles traveled in non-

IFTA jurisdictions by all qualified motor vehicles in your fleet

IFTA jurisdictions by all qualified motor vehicles in your fleet

Column M – This column is computed by the computer. Amounts

Column M – This column is computed by the computer. Amounts

using the fuel type indicated on each form/schedule. Report

using the fuel type indicated on each form/schedule. Report

in column L are subtracted from column K. Make no entry on

in column L are subtracted from column K. Make no entry on

all miles traveled whether the miles are taxable or nontaxable.

all miles traveled whether the miles are taxable or nontaxable.

surcharge line for the column.

surcharge line for the column.

The computer will round mileage to the nearest whole mile

The computer will round mileage to the nearest whole mile

(e.g., 1234.5 = 1235). NON-IFTA Jurisdictions: Alaska - AK,

(e.g., 1234.5 = 1235). NON-IFTA Jurisdictions: Alaska - AK,

Column N – The tax rate will automatically appear in this column if

Column N – The tax rate will automatically appear in this column if

Dist. of Columbia - DC, Mexico - MX, Yukon Territory - YT, and

Dist. of Columbia - DC, Mexico - MX, Yukon Territory - YT, and

column F has been entered correctly.

column F has been entered correctly.

Northwest Territory - NW.

Northwest Territory - NW.

Column O – This column is automatically computed by the

Column O – This column is automatically computed by the

(C) Total Miles – This field is automatically calculated by the

(C) Total Miles – This field is automatically calculated by the

computer. This amount is calculated by multiplying the amount in

computer. This amount is calculated by multiplying the amount in

computer.

computer.

column M by the tax rate for that jurisdiction in column N to

column M by the tax rate for that jurisdiction in column N to

determine the tax or credit. Credit amounts will be displayed in

determine the tax or credit. Credit amounts will be displayed in

(D) Total Gallons – Enter the total gallons of fuel placed in the

(D) Total Gallons – Enter the total gallons of fuel placed in the

brackets. Where a surcharge is applicable, amounts will be

brackets. Where a surcharge is applicable, amounts will be

propulsion tank in both IFTA and non-IFTA jurisdictions for all

propulsion tank in both IFTA and non-IFTA jurisdictions for all

calculated by multiplying the gallons in column K by the surcharge

calculated by multiplying the gallons in column K by the surcharge

qualified motor vehicles in your fleet using the fuel type

qualified motor vehicles in your fleet using the fuel type

tax rate in column N.

tax rate in column N.

indicated. The computer will round gallons to the nearest

indicated. The computer will round gallons to the nearest

whole gallon (e g 123 4 = 123)

whole gallon (e.g., 123.4 = 123).

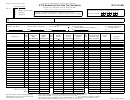

Column P – If you file late the computer will calculate interest on

Column P – If you file late, the computer will calculate interest on

any tax due for each jurisdiction for each fuel type indicated on

(E) Average Fleet MPG – This field is automatically calculated by

each form/schedule. Interest is computed on tax due from the due

the computer.

date of the report until the date payment is received. Interest is

computed at 1% per month or part of a month, to a maximum of

Column F – Enter all IFTA jurisdictions you have operated in

12% per year. Reports must be postmarked no later than the last

during that quarter. Enter the states abbreviation. The states

day of the month following the end of the quarter to be timely.

name will appear to the side if entered correctly. There is a View

State Abbreviations button at the top of the column for a listing of all

Column Q – This column is automatically computed by the

jurisdictions and their abbreviations.

computer. This amount is calculated by adding the amounts in

column O and column P. Credit amounts will be displayed in

Column G – The rate code will automatically appear in this column

brackets.

if column F has been entered correctly.

Subtotals – Automatically computed by the computer.

Column H – Enter the total miles traveled (taxable and nontaxable)

in each IFTA jurisdiction for this fuel type only. Make no entry on

Total – Automatically computed by the computer. Totals are

surcharge line for this column. The computer will round mileage

automatically carried over to the appropriate line on IFTA-100.

to the nearest whole mile (e.g. , 1234.5 = 1235).

Column I – By default the computer will place the amount in

column H in column I. If different, enter the actual IFTA taxable

miles for each IFTA jurisdiction. Do not include fuel use trip permit

miles. Make no entry on surcharge line for this column. The

computer will round mileage to the nearest whole mile (e.g.,

1234.5 = 1235).

Jurisdictions with surcharge: Indiana, Kentucky, and Virginia.

Make a copy of this report for your records.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11