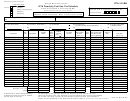

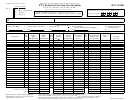

Instructions For Form Ifta-101 - Ifta Quarterly Fuel Use Tax Schedule Page 2

ADVERTISEMENT

GENERAL INFORMATION

GENERAL INFORMATION

Who Must File – Anyone holding a license under the International Fuel Tax Agreement (IFTA) is required to file, on

Who Must File – Anyone holding a license under the International Fuel Tax Agreement (IFTA) is required to file, on

a quarterly basis Form IFTA-100, IFTA Quarterly Fuel Use Tax Schedule for each fuel type.

a quarterly basis Form IFTA-100, IFTA Quarterly Fuel Use Tax Schedule for each fuel type.

Form IFTA-100 summarizes the amount of tax due or the amount to be credited for the various fuel types computed

Form IFTA-100 summarizes the amount of tax due or the amount to be credited for the various fuel types computed

on each Form IFTA-101 and is used to determine the total amount due/credit, including any appropriate penalty and

on each Form IFTA-101 and is used to determine the total amount due/credit, including any appropriate penalty and

interest.

interest.

INSTRUCTIONS

INSTRUCTIONS

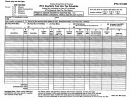

Please enter your IFTA number, name and address on your report.

Please enter your IFTA number, name and address on your report.

No Operation – Mark X in this box if you did not operate a qualified motor vehicle(s) in any jurisdiction including

No Operation – Mark X in this box if you did not operate a qualified motor vehicle(s) in any jurisdiction including

your base jurisdiction during the quarter. Sign this report and mail to the address indicated on the report.

your base jurisdiction during the quarter. Sign this report and mail to the address indicated on the report.

Cancel License – Mark X in this box if you are filing a final report and requesting your license be canceled.

Cancel License – Mark X in this box if you are filing a final report and requesting your license be canceled.

Complete this report for your operations during the quarter and return your IFTA license and any unused decals to

Complete this report for your operations during the quarter and return your IFTA license and any unused decals to

the address on your license. Destroy any used decals.

the address on your license. Destroy any used decals.

Amended Report – Mark X in this box if this report corrects a previous report. Indicate the quarter and year of the

Amended Report – Mark X in this box if this report corrects a previous report. Indicate the quarter and year of the

report you are correcting. The amended report should show the correct figures for that quarter – not the difference.

report you are correcting. The amended report should show the correct figures for that quarter – not the difference.

An explanation of the changes must accompany the amended report.

An explanation of the changes must accompany the amended report.

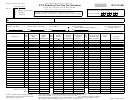

Line Instructions

Line Instructions

Lines 1 through 6, 8 and 10 will be computed automatically by the computer.

Lines 1 through 6, 8 and 10 will be computed automatically by the computer.

Line 9 – Enter credit amount on this line as a positive.

Line 9 – Enter credit amount on this line as a positive.

Line 11 – By default, the computer will enter the credit amount on line 10. If you do not wish a refund, enter 0 on

Line 11 – By default, the computer will enter the credit amount on line 10. If you do not wish a refund, enter 0 on

this line. If you do not request a refund of the total credit, the credit balance will be available for your next quarterly

this line. If you do not request a refund of the total credit, the credit balance will be available for your next quarterly

report. Caution: Credit balances can not be carried forward for more than eight quarters (two years) from the

report. Caution: Credit balances can not be carried forward for more than eight quarters (two years) from the

quarter earned.

quarter earned.

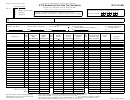

Signature – The report must be signed and dated by the owner (if an individual business), a partner (if a partnership

Signature – The report must be signed and dated by the owner (if an individual business), a partner (if a partnership

or a limited liability partnership), a member (if a limited liability company), or (if a corporation) by the president,

treasurer, chief accounting officer, or any other person specifically authorized to act on behalf of a corporation. The

fact that an individual’s name is signed on the certification shall be prima facie evidence that the individual is

authorized to sign and certify the report on behalf of the business.

Additionally, if anyone other than an employee, owner, partner, officer or member of the business is paid to prepare

the report he or she is required to sign and date the report and provide his or her EIN/social security number,

mailing address and telephone number.

MAILING INSTRUCTIONS

1. Attach a check or money order payable to KENTUCKY STATE TREASURER.

2. Include on your check or money order your identification number, Form IFTA-100 and the period covered by this

return.

3. Mail to the address below.

DIVISION OF MOTOR CARRIERS

PO BOX 22105

ALBANY NY 12201-2105

4.

If you are filing late OR AMENDED returns, please mail to the address below.

TRANSPORTATION CABINET

DIVISION OF MOTOR CARRIERS

200 MERO STREET

PO BOX 2007

FRANKFORT KY 40602

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11