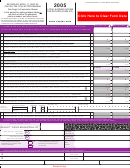

Form 531 - Local Earned Income Tax Return Page 2

ADVERTISEMENT

Examples of “net profits” (without intending in any way to limit the provisions of the Resolutions/Ordinances to these example s) are: The

net profits of a business or profession or of farm operations conducted by an individual or by a husband and wife, as computed according

to the laws, regulations and procedure for computing PA Personal Income Tax “net profits” or “net farm profits” as required to be reported

on PA Personal Income Tax portion thereof resulting from things not taxed by the Resolutions/Ordinances, (such as capital gains or

interest): income from the operation of hotels, motels, trailer camps, tourist homes, boarding houses and other similar businesses; income

from the business of renting of personal property; all other net profits of an enterprise, venture, or other activity, whether such activities

are conducted within or outside the Taxing District. PLEASE NOTE - The net profit and loss of each business must be SEPARATELY

stated and the net profit or net loss is to be determined SEPARATELY for each business enterprise. Persons engaged in more than one

business activity during the tax year may offset a loss in one activity against the gain in another.

WHAT IS NOT SUBJECT TO THE TAX

The following are not considered to be earned income and are not subject to the tax: 3

rd

party sick pay, disability or retirement benefits

paid (except regular wages); payments made under any public assistance or unemployment compensation legislation; compensation

bonuses paid by a State or the United States for active military service in the Armed Forces, except National Guard and 1-W pay; death

benefit payments to an employee’s beneficiary or estate, whether payable in a lump sum or otherwise; proceeds of Life Insurance

policies; cash or property received as a gift, by Will or statutes of descent or distribution; interest and dividends; value of meals and

lodging furnished to domestics or other employees by the employer for the latter’s convenience; capital gains; social security benefits

damages for personal injuries; scholarships; profits from limited partnerships engaged in real estate, oil, gas, mining leases or other

similar investments.

UNREIMBURSED BUSINESS EXPENSES

The fact that an expense is deductible for Federal tax purposes does NOT mean that it is an allowable business expense for Earned

Income Tax purposes. The Pennsylvania Personal Income Tax law allows a deduction of "allowable employee business expenses" for

which the taxpayer was not reimbursed. In order to be claimed as an expense, the item must be ordinary, necessary, reasonable, actually

incurred in performing the duties of the job, and directly related to present employment. NOTE: Employee business expenses can NOT

exceed W-2 wage.

The PA Schedule UE does not cover these expenses: Deductions not allowable as business expenses; Personal, living, or family

expenses; Capital expenditures normally are not an allowable business expense except through depreciation. Certain depreciation

expense exclusions may be taken. Federal depreciation or cost-recovery deductions are acceptable for Pennsylvania purposes as an

administrative convenience to compute allowable business expense deductions; Dues to professional or fraternal societies, Chambers of

Commerce, or recreational club memberships; Subscriptions to publications; Campaign or political contributions; Charitable contributions;

Commuting expenses; Cost of meals while working late except while traveling away from home overnight; Occupational privilege taxes;

Child care and elderly care expenses; Life, disability income, and health service insurance premiums; Malpractice insurance premiums

except where required by law or employer; Pension contributions; Fines, penalties, legal fees (except to recover back wages), and bad

debts; Bribes, kickbacks, or other illegal payments; Eligible job hunting expenses and pre-employment expenses; Residential phone

service (however, specific charges for telephone calls required to be made for business purposes may be deducted).

IMPORTANT -

The accompanying tax return must be filed with this office by the indicated due date even if no tax is due or if all has

been withheld by your employer. Failure to file your return may subject you to a fine of up to $500.00. A HUSBAND AND WIFE MAY

BOTH FILE ON THIS FORM. HOWEVER, TAX CALCULATIONS MUST BE REPORTED SEPARATELY. JOINT FILING (I.E.

COMBINING INCOME, ETC.) IS NOT PERMITTED. Failure to receive a Local Earned Income Tax Return is no excuse for a taxpayer not

to file a return.

WHO MUST FILE A FINAL RETURN: All residents of the municipalities and school districts listed below who are employed or self-

employed and all non-residents who work or are self-employed within the municipalities and school districts listed on the table below. If

you received a tax form but did NOT work, you must still return the form and indicate the reason that no income is shown (full time

student, homemaker, disabled, retired, unemployed, etc.)

West Shore Tax Bureau collects the earned income/ compensation tax and the net profits tax for the following school districts

and municipalities. If you were a resident of any of the listed municipalities and school districts for all or any portion of the tax

year, you are required to file a return with this bureau.

TAX TABLE: TOTAL TAX RATE IS INDICATED BELOW FOR EACH OF THE MEMBER SCHOOL DISTRICTS

CUMBERLAND COUNTY TAXING AUTHORITIES:

CUMBERLAND COUNTY AND YORK COUNTY:

Camp Hill School District

2%

Camp Hill Borough

West Shore School District

1.45%

Fairview Township; Goldsboro

Borough; Lemoyne Borough; Lower

Cumberland Valley School District

1.6%

Hampden Township; Middlesex Township;

Monroe Township; Silver Spring Township

Allen Township; Newberry Township ;

New Cumberland Borough;

East Pennsboro School District

1.6%

East Pennsboro Township

Wor mleysburg Borough

Mechanicsburg School District

1.7%

Mechanicsburg Borough; Shiremanstown

Borough; Shiremansto wn Annex; Upper Allen

YORK COUNTY:

Township;

Northeastern School District

1%

Newberry Township II

Northern York County School District

1.25%

Carroll Township; Dillsburg

*Maryland Residents will receive credit upon application by the taxpayer.

Borough; Franklin Township;

Franklintown Borough; Monaghan

Township; Warrington Township;

Wellsville Borough

IF YOU MOVED DURING THE TAX YEAR PLEASE BE SURE TO COMPLETE THE MOVING INFORMATION ON THE FRONT SIDE OF THE EARNED

INCOME TAX RETURN. IF YOU NEED ADDITIONAL SPACE PLEASE USE A COPY OR ATTACH A SEPARATE PAGE. PRORATE INCOME AND TAX

WITHHELD BY THE NUMBER OF MONTHS IN EACH MUNICIPALITY USING THE EMPLOYMENT/OTHER INCOME WORKSHEET ON THE BACK

SIDE OF THE WEST SHORE TAX BUREAU ANNUAL EARNED INCOME TAX RETURN.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4