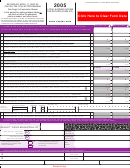

Form 531 - Local Earned Income Tax Return Page 4

ADVERTISEMENT

INSTRUCTIONS FOR COMPLETING THE LOCAL EARNED INCOME TAX RETURN FORM 531

THESE INSTRUCTIONS ARE ONLY A SUMMARY OF THE TAX BUREAU’S RULES AND REGULATIONS. COPIES OF THE RULES AND REGULATIONS

ARE AVAILABLE, FREE OF CHARGE, ALONG WITH SPECIFIC INSTRUCTIONS AND WORKSHEETS FOR OUT OF STATE TAX CREDIT/PHILADELPHIA

TAX CREDITS AND FOR TAXPAYERS WHO MOVED DURING THE YEAR CAN BE FOUND AT OUR WEBSITE

( )

OR AT THE TAX

BUREAU.

Line 1. List GROSS earnings (wages, salaries, commissions, etc.) regardless where received. Attach a copy of the withholding

statements (W-2) from each employer. If you had no earnings, indicate the reason why (homemaker, disabled, unemployed etc.)

Line 2. Business expenses for which an employee has NOT been reimbursed are allowed as a deduction from W-2 earnings, provided

such expenses are required by the employer in order for the taxpayer to keep his present job. (Refer to section on Unreimbursed

Business Expenses) Expenses must be taken with regard to each employer SEPARATELY as a deduction from the business

income thereof and CANNOT be consolidated in any form. Attach appropriate PA schedules (and Federal schedules if required

as support to PA schedules). PLEASE NOTE: Business Expenses claimed without proper supporting documentation will be

denied without notification to the taxpayer. Submit separate expense forms for each employer. NOTE: Employee Business

Expenses can NOT be deducted from Non-Employee compensation reported on 1099MISC.

Line 3. Enter income received that was not reported to you on a form W-2. If you received a form 1099MISC for income that you did

NOT report as part of the gross income of a sole proprietorship, partnership, LLC or other business entity, please report the

income on Line 3. Please be sure to attach a copy of your form 1099MISC, 1099R (exclude 1099R Codes 3, 4 & 7), 1099C or

other proof of income to your WSTB Annual Earned Income Tax Return. If you did not receive a form 1099MISC, 1099R, 1099C

or other proof of income please provide a brief description of the income on the WSTB Annual Earned Income Tax Return. DO

NOT REPORT INTEREST, DIVIDENDS, or UNEMPLOYMENT COMPENSATION on the WSTB Annual Earned Income Tax

Return.

Line 4. Line 1 minus Line 2 plus Line 3. IF LESS THAN ZERO. ENTER ZERO. (CAN NOT BE LESS THAN ZERO)

Line 5. This Line is to be used by SELF-EMPLOYED persons. Refer to section on Net Profits. (Loss info should be all on Line 6

description). The Net Profit and Loss of each business must be SEPARATELY stated and Net Profit or Net Loss is to be

determined SEPARATELY for each business enterprise. Attach the appropriate PA Schedule(s) C, F, RK-1 and/or NRK-1.

Line 6. Enter amount of business loss. Attach the appropriate PA Schedule(s) C, F, RK-1 and/or NRK-1. If appropriate documentation is

not attached, Loss from business will not be allowed.

Line 7. Subtotal Subtract Line 6 from Line 5. IF LESS THAN ZERO, ENTER ZERO.

Line 8. Total Earned Income Line 4 plus Line 7. DO NOT ROUND PAST THIS POINT.

Line 9. TAX LIABILITY (Line 8 multiplied by resident tax rate) Find your school district and municipality on the list given in these

instructions and use the corresponding tax rate to calculate your total tax liability.

Line 10. Complete Line 10 if you had the PA local income tax withheld by your employer. (Generally, Box 19 of W-2). CREDIT for

withholding WILL NOT be given, if W-2 is NOT Provided.

Line 11. Complete Line 11 if you have made Quarterly payments, or if refund from previous tax year was credited to this tax year.

Line 12. Complete Line 12 if you had any prior year credit, Out-Of-State or Philadelphia Tax credits as calculated on the NON

RECIPROCAL STATE/PHILADELPHIA CREDIT WORKSHEET. Please note that this credit cannot exceed your local income tax

liability on the income taxed by the other state or Philadelphia. Copies of the other state’s non-resident tax return along with

a PA 40 and PA Schedule G must be attached or the Out of State credit will be denied.

Line 13. TOTAL TAX CREDIT (Add Lines 10 + 11 + 12)

Line 14. REFUND/CREDIT (If Line 13 is greater than Line 9, subtract Line 9 from Line 13). Refunds or credits of $10.00 or more must be

reported by us to the Internal Revenue Service. No refunds or credits under $1.00.

w

w

Line 15. (

SPOUSE

NEXT YEAR) If appropriate box is not checked, any overpayment will be refunded to the taxpayer.

Line 16. TAX DUE (If Line 9 is greater than Line 13, subtract Line 13 from Line 9). Payment must be RECEIVED in this office, or mailed

and POSTMARKED, ON or BEFORE APRIL 15

th

. There will be a $20.00 fee for returned checks.

Line 17. PENALTY: Payable at a rate of ½% (.005) per month or any portion of a month that the earned income tax remains unpaid after

the April 15 due date. (Example: $ tax due x .005 x # of months = penalty).

Line 18. INTEREST: Payable at a rate of 6% (.06) per annum of the unpaid tax after the due date. (Example: .000167 x # of days after

4/15/10)

Line 19. TOTAL AMOUNT DUE (Add Line 16 plus Line 17 plus Line 18) Make check payable to WEST SHORE TAX BUREAU.

NON RECIPROCAL STATE/PHILADELPHIA CREDIT WORKSHEET

ACTUAL INCOME taxed by other state as shown on other state's return or for Philadelphia credit as shown on W-2 or as reported to the

(1)

City of Philadelphia. Do not use business privilege tax.

Required: attach copy of out-of-state filing & PA Sch G

X

%

Local Tax Rate as specified in the table below

Local Tax Liability

(2)

(3)

Tax Liability paid to other state or Philadelphia (PHILADELPHIA CREDIT: Lesser Amount should be entered on Line 12)

(4)

Continue for OUT-OF-STATE CREDIT:

PA Income Tax (Line 1 x PA Income Tax Rate)

(5)

LOCAL TAX CREDIT (Line 3 minus Line 4) If Line 4 is more than Line 3 enter ZERO, Enter lesser amount from Line 2 or 5 on Line 12

(REVISED 12/10)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4