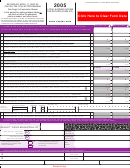

Form 531 - Local Earned Income Tax Return Page 3

ADVERTISEMENT

WEST SHORE TAX BUREAU

717-761-4900

WEB SITE:

FORM 531 INSTRUCTION SHEET

ONLINE FILING NOW AVAILABLE

West Shore Tax Bureau taxpayers may now file their local earned income tax

returns online.

To file your return or view eligibility requirements visit

WEST SHORE TAX BUREAU ANNUAL EARNED INCOME TAX RETURN (FORM 531):

Moving Information. The local income tax is based on your residence or DOMICILE. If you and/or your spouse have moved

during the tax year please complete the MOVING INFORMATION section of the tax return. If you and/or your spouse have

moved from one WSTB Member Municipality to another WSTB Member Municipality during the tax year you do not need to file a

second local tax return as long as the MOVING INFORMATION worksheet is completed. PLEASE NOTE: If yo u have moved

from a non-member municipality/school district or moved to a non-member municipality/school district during the year, YOU ARE

REQUIRED TO FILE LOCAL TAX RETURNS WITH THE WEST SHORE TAX BUREAU AND THE NON-MEMBER

MUNICIPALITY/SCHOOL DISTRICT.

Other Income (Line 3) Please record income reported on forms 1099-MISC, 1099-R (exclude 1099 R Codes 3, 4 & 7) or 1099-C

or other miscellaneous income that has NOT been included as gross income of your sole proprietorship (PA Schedule C),

partnership, LLC (PA RK-1) or other business entity. DO NOT list income reported to you on Form 1099 DIV / INT.

Unemployment Compensation should NOT be reported on your WSTB Earned Income Tax Return.

Transfer of one spouse’s overpayment to the other spouse’s balance due (Line 15) WSTB will allow the offsetting of one

spouse’s balance due by the transfer of his or her spouse’s current year overpayment provided both spouses are filed on the

same form. Please note, if the first spouse’s requested overpayment amount is reduced or denied, the second spouse’s tax

liability will be affected by the reduced or denied credit and a balance of tax due may result. Interest and penalties will be

th

assessed on tax not received on or before the April 15

due date of the WSTB Annual Earned Income Tax Return. NOTE: If the

‘transfer to spouse box’ is not checked no transfer will be made.

Loss can be deducted from profit only - NOT W2 wages.

MAILING ADDRESSES

PAYMENT DUE

NO PAYMENT

REFUND DUE

West Shore Tax Bureau

West Shore Tax Bureau

West Shore Tax Bureau

PO Box 899

PO Box 960

PO Box 1256

Camp Hill PA 17001

Camp Hill PA 17001

Camp Hill PA 17001

WHAT IS INCLUDED IN EARNED INCOME

Act 166 of 2002 and Act 24 of 2004 changed the definitions of “earned income” and “net profits” for purposes of the earned income tax

imposed under the Local Tax Enabling Act, Act 511 of 1965, 53 P.S. §6901 et seq., to adopt, with certain exceptions, the definitions of

“compensation” and “net profits” as set forth by the state for personal income tax purposes. The changes to the definitions of earned

income and net profits are not optional. They apply for tax years beginning on and after January 1, 2003.

The definitions of “earned income” and “net profits” in the Local Tax Enabling Act, now reference the definitions of “compensation” and

“net profits” that are used for the personal income tax in state law and regulations. Local taxpayers are permitted to deduct from

compensation the same employee business expenses that are deductible from compensation for state income tax purposes. Interest and

dividends, which are taxable under the state personal income tax, are still not taxable at the local level.

Taxable compensation at the local level is almost identical to taxable compensation at the state level, except that housing allowances

provided to a member of clergy and active-duty military pay are not taxable at the local level.

Examples of earned income/compensation (without intending in any way to limit the provisions of the Resolutions/Ordinances to these

examples) are salaries, wages; commissions, bonuses; drawing accounts (if amounts received as a drawing account exceed the salary or

commissions earned, the tax is payable on the amounts received. If the employee subsequently repays to the employer any amounts not

in fact earned, the tax shall be adjusted accordingly); incentive payments; tips; fees; benefits accruing from employment, including, but not

limited to annual leave, vacation, holiday, sickness and separation payments; National Guard pay (except active duty), 1-W classification

pay; stipends paid to graduate assistants;

all other forms of compensation for an employee’s services. Neither the kind nor rate of

payment, nor the manner of employment exempts an employee from the tax. Compensation received in the form of property shall be

taxed at its fair market value at the time of receipt. Premature distributions from IRA’s, Roth IRA’s, 401K’s, and other Qualified and Non-

Qualified Retirement Plans are taxable. Please use the “PA Cost Recovery Method” to determine the taxable amount of compensation

that must be reported from premature distributions from IRA’s, Roth IRA’s , 401K’s,and other Qualified and Non-Qualified Retirement

Plans. Report “Other Income” on Line 3 and file a copy of 1099R, MISC, or an explanation with tax return.

WHAT IS INCLUDED IN NET PROFITS

Act 166 of 2002 and Act 24 of 2004 changed the definitions of “earned income” and “net profits” for purposes of the earned income tax

imposed under the Local Tax Enabling Act, Act 511 of 1965, 53 P.S. §6901 et seq., to adopt, with certain exceptions, the definitions of

“compensation” and “net profits” as set forth by the state for personal income tax purposes. The changes to the definitions of earned

income and net profits are not optional. They apply for tax years beginning on and after January 1, 2003. While the definition of “net

profits” in the Local Tax Enabling Act includes net income from the operation of a business, profession or other activity, it does not include

income from corporations. In addition, net profits do not include income that is “not paid for services provided” or that is in the nature of

earnings from an investment. Most distributions passed through to a taxpayer by an S Corporation are considered investment income and

not subject to the earned income tax, unless the distributions are based on services provided by the taxpayer.

(Cont’d on back)

(REVISED 12/10)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4