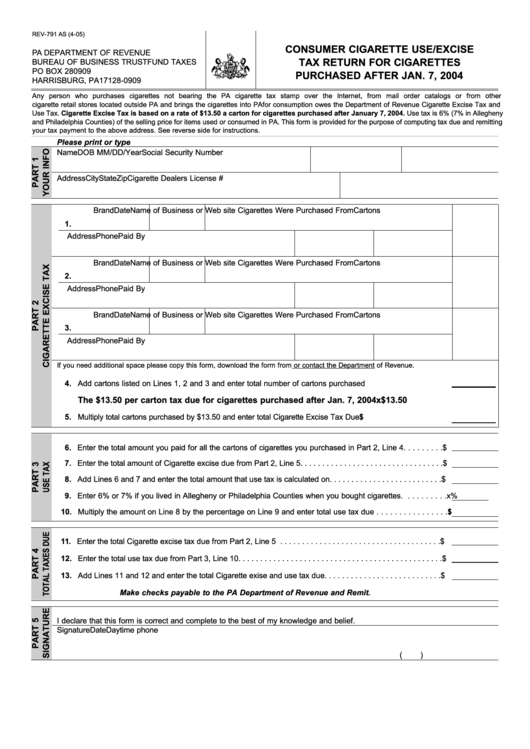

Form Rev-791 As - Consumer Cigarette Use/excise Tax Return For Cigarettes Purchased After Jan. 7, 2004

ADVERTISEMENT

REV-791 AS (4-05)

CONSUMER CIGARETTE USE/EXCISE

PA DEPARTMENT OF REVENUE

BUREAU OF BUSINESS TRUST FUND TAXES

TAX RETURN FOR CIGARETTES

PO BOX 280909

PURCHASED AFTER JAN. 7, 2004

HARRISBURG, PA 17128-0909

Any person who purchases cigarettes not bearing the PA cigarette tax stamp over the Internet, from mail order catalogs or from other

cigarette retail stores located outside PA and brings the cigarettes into PA for consumption owes the Department of Revenue Cigarette Excise Tax and

Use Tax. Cigarette Excise Tax is based on a rate of $13.50 a carton for cigarettes purchased after January 7, 2004. Use tax is 6% (7% in Allegheny

and Philadelphia Counties) of the selling price for items used or consumed in PA. This form is provided for the purpose of computing tax due and remitting

your tax payment to the above address. See reverse side for instructions.

Please print or type

Name

DOB MM/DD/Year

Social Security Number

Address

City

State

Zip

Cigarette Dealers License #

Brand

Date

Name of Business or Web site Cigarettes Were Purchased From

Cartons

1.

Address

Phone

Paid By

Brand

Date

Name of Business or Web site Cigarettes Were Purchased From

Cartons

2.

Address

Phone

Paid By

Brand

Date

Name of Business or Web site Cigarettes Were Purchased From

Cartons

3.

Address

Phone

Paid By

If you need additional space please copy this form, download the form from or contact the Department of Revenue.

4. Add cartons listed on Lines 1, 2 and 3 and enter total number of cartons purchased

The $13.50 per carton tax due for cigarettes purchased after Jan. 7, 2004

x

$13.50

5. Multiply total cartons purchased by $13.50 and enter total Cigarette Excise Tax Due

$

6. Enter the total amount you paid for all the cartons of cigarettes you purchased in Part 2, Line 4. . . . . . . . .$

7. Enter the total amount of Cigarette excise due from Part 2, Line 5. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$

8. Add Lines 6 and 7 and enter the total amount that use tax is calculated on. . . . . . . . . . . . . . . . . . . . . . . . . .$

9. Enter 6% or 7% if you lived in Allegheny or Philadelphia Counties when you bought cigarettes. . . . . . . . . .x

%

10. Multiply the amount on Line 8 by the percentage on Line 9 and enter total use tax due . . . . . . . . . . . . . . . .$

11. Enter the total Cigarette excise tax due from Part 2, Line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$

12. Enter the total use tax due from Part 3, Line 10. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$

13. Add Lines 11 and 12 and enter the total Cigarette exise and use tax due. . . . . . . . . . . . . . . . . . . . . . . . . . .$

Make checks payable to the PA Department of Revenue and Remit.

I declare that this form is correct and complete to the best of my knowledge and belief.

Signature

Date

Daytime phone

(

)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2