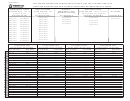

Form Rev-791 As - Consumer Cigarette Use/excise Tax Return For Cigarettes Purchased After Jan. 7, 2004 Page 2

ADVERTISEMENT

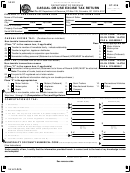

INFORMATION AND INSTRUCTIONS

Who must file a Commonwealth of Pennsylvania

Filing Instructions:

Consumer Cigarette Excise Tax Return, Form REV-791?

Part 1:

Any person who purchases cigarettes not bearing the PA cigarette

Print or type your name, Date of Birth (Month, Day and Year)

tax stamp over the Internet, via mail order catalogs, or from other

Social Security Number, Address, City, State and Zip Code.

cigarette retail stores located outside PA and brings the cigarettes

into PA for consumption owes the Department of Revenue

Part 2:

Cigarette Excise Tax and Use Tax. PA Law permits you to possess

Lines 1., 2. & 3.

one carton of unstamped cigarettes at a time. Possessing more

Brand: List the full brand name of cigarettes purchased. Do not

than one carton is a violation and may result in prosecution.

break down into subcategories, such as regular, menthol, light, etc.

Purchased From: List the name of business the cigarettes were

What is the deadline for filing this form?

purchased from, address, phone number (if available), and Web

Form REV-791 must be completed and returned along with one

site. Paid by Credit Card, Check, Money Order, Cash or other.

check for payment of both Cigarette Excise Tax and Use Tax at

# of cartons: List the number of cartons purchased.

the end of the month following the month of purchase. For

example: If you purchase a carton of cigarettes March 28th, you

Line 4.

must remit to the Department Cigarette Excise Tax and Use Tax

Enter the total number of cartons purchased.

by April 30th.

Line 5.

Multiply the total cartons by the cigarette tax rate and enter the

What if I fail to file this return and pay the tax I owe?

amount. The rate is $13.50 per carton for purchases made after

Any person who willfully evades the payment of PA cigarette tax

Jan. 7, 2004.

and possesses any pack of cigarettes which does not have

affixed thereto the proper amount of genuine PA cigarette tax

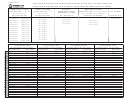

Part 3:

Line 6.

stamps shall be guilty of a felony, and upon conviction thereof,

shall be sentenced to pay a fine of not more than five thousand

Enter the total amount you paid for all the cartons of cigarettes

you purchased in Part 2, Line 4.

dollars ($5,000) and imprisonment of up to five years.

Line 7.

How do I get forms, Commonly Asked Questions and help

Enter the amount of Cigarette Excise Tax due from Part 2, Line 5.

completing the form?

Line 8.

(This form may be photocopied.)

Add Lines 6 and 7 and enter the total amount that Use tax is

calculated on.

To request additional copies of the REV-791 and a copy of

commonly asked questions:

Line 9.

Enter tax percentage. Enter 6% (.06) or 7% (.07) if you live in

Allegheny or Philadelphia Counties.

●

visit our home page at www. revenue. state. pa. us

Line 10.

and download the form;

Multiply Line 8 by Line 9. Enter that total here. This is the total

amount of Use Tax.

●

call 717-783-9364 (TT# 1-800-447-3020 Services

Part 4:

for Taxpayers with Special Hearing and/or Speaking needs

Line 11.

only); or

Enter the amount of Cigarette Excise Tax due from Part 2, Line 5.

Line 12.

●

Write to:

Enter the amount from Part 3, Line 10 (total Use Tax) here.

PA DEPARTMENT OF REVENUE

Line 13.

BUREAU OF BUSINESS TRUST FUND TAXES

Add Lines 11 & 12, this is the combined total of Cigarette Excise

PO BOX 280909

and Use Tax due to the Department of Revenue.

HARRISBURG, PA 17128-0909

Make checks payable to: PA Department of Revenue

Mail the completed REV-791 form and check to:

PA DEPARTMENT OF REVENUE, BUREAU OF BUSINESS

●

You may also call our toll-free 24-hour a day answering

TRUST FUND TAXES, PO BOX 280909, HARRISBURG, PA

s e r v i c e n u m b e r f o r o r d e r i n g f o r m s o n l y a t

17128-0909

1-800-362-2050; or visit one of our local Revenue district

offices. (See blue pages of your telephone directory for

Part 5:

office locations.)

Please sign and date the form. Include a telephone number

where you can be reached should we have any questions

Help:

concerning your return.

For help completing the form, call 717-783-9364 between the

hours of 8:00 am and 4:00 pm weekdays.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2