Nc-480 - Application For Tax Credit For A Development Zone Project - North Carolina Department Of Revenue - 2004

ADVERTISEMENT

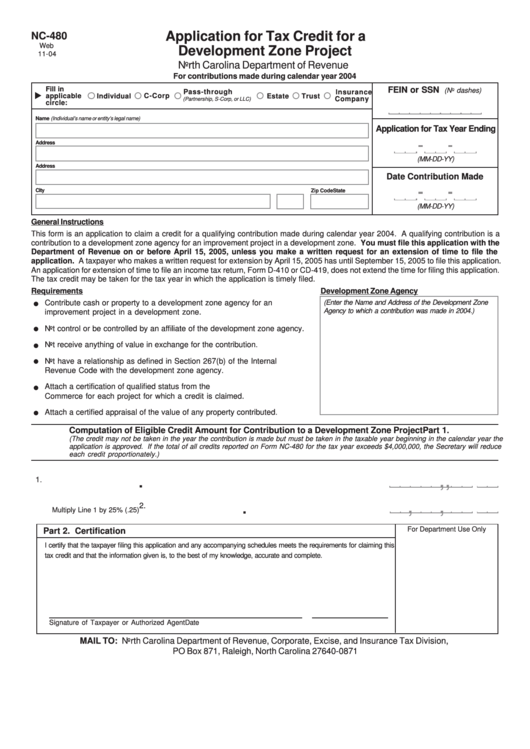

Application for Tax Credit for a

NC-480

Web

Development Zone Project

11-04

North Carolina Department of Revenue

For contributions made during calendar year 2004

Fill in

FEIN or SSN

(No dashes)

Pass-through

Insurance

applicable

Individual

C-Corp

Estate

Trust

Company

(Partnership, S-Corp, or LLC)

circle:

Name (Individual’s name or entity’s legal name)

Application for Tax Year Ending

Address

(MM-DD-YY)

Address

Date Contribution Made

City

State

Zip Code

(MM-DD-YY)

General Instructions

This form is an application to claim a credit for a qualifying contribution made during calendar year 2004. A qualifying contribution is a

contribution to a development zone agency for an improvement project in a development zone. You must file this application with the

Department of Revenue on or before April 15, 2005, unless you make a written request for an extension of time to file the

application. A taxpayer who makes a written request for extension by April 15, 2005 has until September 15, 2005 to file this application.

An application for extension of time to file an income tax return, Form D-410 or CD-419, does not extend the time for filing this application.

The tax credit may be taken for the tax year in which the application is timely filed.

Requirements

Development Zone Agency

Contribute cash or property to a development zone agency for an

(Enter the Name and Address of the Development Zone

Agency to which a contribution was made in 2004.)

improvement project in a development zone.

Not control or be controlled by an affiliate of the development zone agency.

Not receive anything of value in exchange for the contribution.

Not have a relationship as defined in Section 267(b) of the Internal

Revenue Code with the development zone agency.

Attach a certification of qualified status from the N.C. Secretary of

Commerce for each project for which a credit is claimed.

Attach a certified appraisal of the value of any property contributed.

Part 1.

Computation of Eligible Credit Amount for Contribution to a Development Zone Project

(The credit may not be taken in the year the contribution is made but must be taken in the taxable year beginning in the calendar year the

application is approved. If the total of all credits reported on Form NC-480 for the tax year exceeds $4,000,000, the Secretary will reduce

each credit proportionately.)

,

,

.

1.

Amount contributed to a development zone agency

1.

2.

Eligible credit amount for contributing to a development zone project in 2004

,

,

.

2.

Multiply Line 1 by 25% (.25)

For Department Use Only

Part 2. Certification

I certify that the taxpayer filing this application and any accompanying schedules meets the requirements for claiming this

tax credit and that the information given is, to the best of my knowledge, accurate and complete.

Signature of Taxpayer or Authorized Agent

Date

MAIL TO: North Carolina Department of Revenue, Corporate, Excise, and Insurance Tax Division,

PO Box 871, Raleigh, North Carolina 27640-0871

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2