Instructions For Form Hp-941/501/form Hpw-3 - Highland Park Income Tax Withheld/ Annual Reconciliation Income Tax Withheld

ADVERTISEMENT

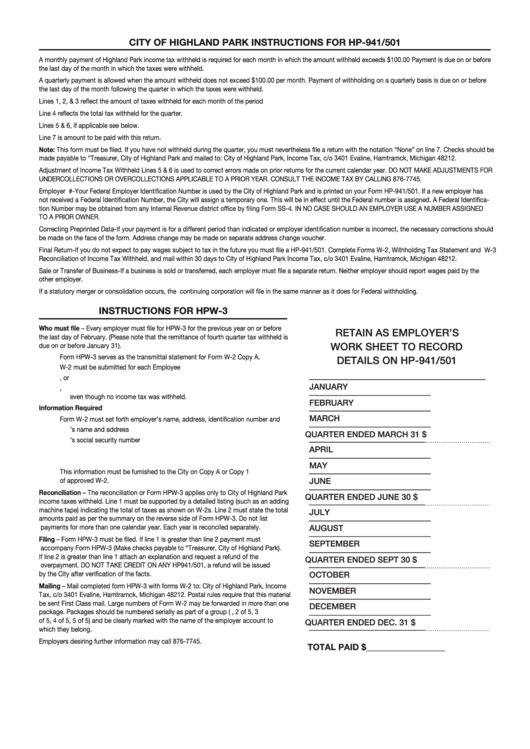

CITY OF HIGHLAND PARK INSTRUCTIONS FOR HP-941/501

A monthly payment of Highland Park income tax withheld is required for each month in which the amount withheld exceeds $100.00 Payment is due on or before

the last day of the month in which the taxes were withheld.

A quarterly payment is allowed when the amount withheld does not exceed $100.00 per month. Payment of withholding on a quarterly basis is due on or before

the last day of the month following the quarter in which the taxes were withheld.

Lines 1, 2, & 3 reflect the amount of taxes withheld for each month of the period

Line 4 reflects the total tax withheld for the quarter.

Lines 5 & 6, if applicable see below.

Line 7 is amount to be paid with this return.

Note: This form must be filed. If you have not withheld during the quarter, you must nevertheless file a return with the notation “None” on line 7. Checks should be

made payable to “Treasurer, City of Highland Park and mailed to: City of Highland Park, Income Tax, c/o 3401 Evaline, Hamtramck, Michigan 48212.

Adjustment of Income Tax Withheld Lines 5 & 6 is used to correct errors made on prior returns for the current calendar year. DO NOT MAKE ADJUSTMENTS FOR

UNDERCOLLECTIONS OR OVERCOLLECTIONS APPLICABLE TO A PRIOR YEAR. CONSULT THE INCOME TAX BY CALLING 876-7745.

Employer I.D. #-Your Federal Employer Identification Number is used by the City of Highland Park and is printed on your Form HP-941/501. If a new employer has

not received a Federal Identification Number, the City will assign a temporary one. This will be in effect until the Federal number is assigned. A Federal Identifica-

tion Number may be obtained from any Internal Revenue district office by filing Form SS-4. IN NO CASE SHOULD AN EMPLOYER USE A NUMBER ASSIGNED

TO A PRIOR OWNER.

Correcting Preprinted Data-If your payment is for a different period than indicated or employer identification number is incorrect, the necessary corrections should

be made on the face of the form. Address change may be made on separate address change voucher.

Final Return-If you do not expect to pay wages subject to tax in the future you must file a HP-941/501. Complete Forms W-2, Withholding Tax Statement and W-3

Reconciliation of Income Tax Withheld, and mail within 30 days to City of Highland Park Income Tax, c/o 3401 Evaline, Hamtramck, Michigan 48212.

Sale or Transfer of Business-If a business is sold or transferred, each employer must file a separate return. Neither employer should report wages paid by the

other employer.

If a statutory merger or consolidation occurs, the continuing corporation will file in the same manner as it does for Federal withholding.

INSTRUCTIONS FOR HPW-3

Who must file – Every employer must file for HPW-3 for the previous year on or before

RETAIN AS EMPLOYER’S

the last day of February. (Please note that the remittance of fourth quarter tax withheld is

WORK SHEET TO RECORD

due on or before January 31).

Form HPW-3 serves as the transmittal statement for Form W-2 Copy A.

DETAILS ON HP-941/501

W-2 must be submitted for each Employee

_____________________________

a. From whom Highland Park tax has been withheld during the year, or

JANUARY

b. Who earned wages in Highland Park or lived in Highland Park during the year,

____________________

even though no income tax was withheld.

FEBRUARY

____________________

Information Required

MARCH

Form W-2 must set forth employer’s name, address, identification number and

____________________

1. Employee’s name and address

QUARTER ENDED MARCH 31 $

___________________

2. Employee’s social security number

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

APRIL

3. Total compensation paid during the year

____________________

4. Amount of Highland Park Income Tax withheld.

MAY

____________________

This information must be furnished to the City on Copy A or Copy 1

of approved W-2.

JUNE

____________________

Reconciliation – The reconciliation or Form HPW-3 applies only to City of Highland Park

QUARTER ENDED JUNE 30

$

___________________

income taxes withheld. Line 1 must be supported by a detailed listing (such as an adding

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

machine tape) indicating the total of taxes as shown on W-2s. Line 2 must state the total

JULY

____________________

amounts paid as per the summary on the reverse side of Form HPW-3. Do not list

payments for more than one calendar year. Each year is reconciled separately.

AUGUST

____________________

Filing – Form HPW-3 must be filed. If line 1 is greater than line 2 payment must

SEPTEMBER

____________________

accompany Form HPW-3 (Make checks payable to “Treasurer, City of Highland Park).

If line 2 is greater than line 1 attach an explanation and request a refund of the

QUARTER ENDED SEPT 30

$

___________________

overpayment. DO NOT TAKE CREDIT ON ANY HP941/501, a refund will be issued

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

by the City after verification of the facts.

OCTOBER

____________________

Mailing – Mail completed form HPW-3 with forms W-2 to: City of Highland Park, Income

NOVEMBER

____________________

Tax, c/o 3401 Evaline, Hamtramck, Michigan 48212. Postal rules require that this material

be sent First Class mail. Large numbers of Form W-2 may be forwarded in more than one

DECEMBER

____________________

package. Packages should be numbered serially as part of a group (E.G. 1 of 5, 2 of 5, 3

of 5, 4 of 5, 5 of 5) and be clearly marked with the name of the employer account to

QUARTER ENDED DEC. 31

$

___________________

which they belong.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Employers desiring further information may call 876-7745.

TOTAL PAID $ __________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1