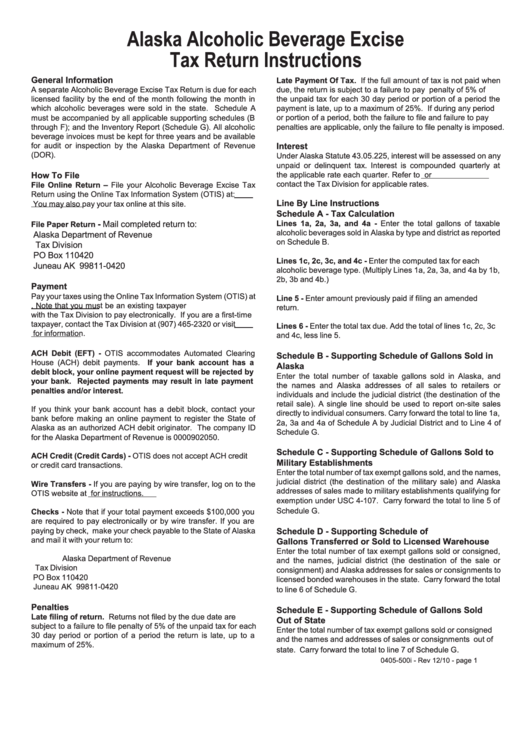

Alaska Alcoholic Beverage Excise Tax Return Instructions

ADVERTISEMENT

Alaska Alcoholic Beverage Excise

Tax Return Instructions

General Information

Late Payment Of Tax. If the full amount of tax is not paid when

A separate Alcoholic Beverage Excise Tax Return is due for each

due, the return is subject to a failure to pay penalty of 5% of

licensed facility by the end of the month following the month in

the unpaid tax for each 30 day period or portion of a period the

which alcoholic beverages were sold in the state. Schedule A

payment is late, up to a maximum of 25%. If during any period

or portion of a period, both the failure to file and failure to pay

must be accompanied by all applicable supporting schedules (B

through F); and the Inventory Report (Schedule G). All alcoholic

penalties are applicable, only the failure to file penalty is imposed.

beverage invoices must be kept for three years and be available

for audit or inspection by the Alaska Department of Revenue

Interest

(DOR).

Under Alaska Statute 43.05.225, interest will be assessed on any

unpaid or delinquent tax. Interest is compounded quarterly at

the applicable rate each quarter. Refer to or

How To File

contact the Tax Division for applicable rates.

File Online Return – File your Alcoholic Beverage Excise Tax

Return using the Online Tax Information System (OTIS) at: www.

Line By Line Instructions

tax.alaska.gov. You may also pay your tax online at this site.

Schedule A - Tax Calculation

Lines 1a, 2a, 3a, and 4a - Enter the total gallons of taxable

- Mail completed return to:

File Paper Return

alcoholic beverages sold in Alaska by type and district as reported

Alaska Department of Revenue

on Schedule B.

Tax Division

PO Box 110420

Lines 1c, 2c, 3c, and 4c - Enter the computed tax for each

Juneau AK 99811-0420

alcoholic beverage type. (Multiply Lines 1a, 2a, 3a, and 4a by 1b,

2b, 3b and 4b.)

Payment

Pay your taxes using the Online Tax Information System (OTIS) at

Line 5 - Enter amount previously paid if filing an amended

. Note that you must be an existing taxpayer

return.

with the Tax Division to pay electronically. If you are a first-time

taxpayer, contact the Tax Division at (907) 465-2320 or visit www.

Lines 6 - Enter the total tax due. Add the total of lines 1c, 2c, 3c

tax.alaska.gov for information.

and 4c, less line 5.

ACH Debit (EFT) - OTIS accommodates Automated Clearing

Schedule B - Supporting Schedule of Gallons Sold in

House (ACH) debit payments. If your bank account has a

Alaska

debit block, your online payment request will be rejected by

Enter the total number of taxable gallons sold in Alaska, and

your bank. Rejected payments may result in late payment

the names and Alaska addresses of all sales to retailers or

penalties and/or interest.

individuals and include the judicial district (the destination of the

retail sale). A single line should be used to report on-site sales

If you think your bank account has a debit block, contact your

directly to individual consumers. Carry forward the total to line 1a,

bank before making an online payment to register the State of

2a, 3a and 4a of Schedule A by Judicial District and to Line 4 of

Alaska as an authorized ACH debit originator. The company ID

Schedule G.

for the Alaska Department of Revenue is 0000902050.

Schedule C - Supporting Schedule of Gallons Sold to

ACH Credit (Credit Cards) - OTIS does not accept ACH credit

Military Establishments

or credit card transactions.

Enter the total number of tax exempt gallons sold, and the names,

judicial district (the destination of the military sale) and Alaska

Wire Transfers - If you are paying by wire transfer, log on to the

addresses of sales made to military establishments qualifying for

OTIS website at for instructions.

exemption under USC 4-107. Carry forward the total to line 5 of

Schedule G.

Checks - Note that if your total payment exceeds $100,000 you

are required to pay electronically or by wire transfer. If you are

paying by check, make your check payable to the State of Alaska

Schedule D - Supporting Schedule of

and mail it with your return to:

Gallons Transferred or Sold to Licensed Warehouse

Enter the total number of tax exempt gallons sold or consigned,

Alaska Department of Revenue

and the names, judicial district (the destination of the sale or

Tax Division

consignment) and Alaska addresses for sales or consignments to

PO Box 110420

licensed bonded warehouses in the state. Carry forward the total

Juneau AK 99811-0420

to line 6 of Schedule G.

Penalties

Schedule E - Supporting Schedule of Gallons Sold

Late filing of return. Returns not filed by the due date are

Out of State

subject to a failure to file penalty of 5% of the unpaid tax for each

Enter the total number of tax exempt gallons sold or consigned

30 day period or portion of a period the return is late, up to a

and the names and addresses of sales or consignments out of

maximum of 25%.

.

state. Carry forward the total to line 7 of Schedule G

0405-500i - Rev 12/10 - page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2