Unincorporated Dade Utility Excise Tax Return Instructions

ADVERTISEMENT

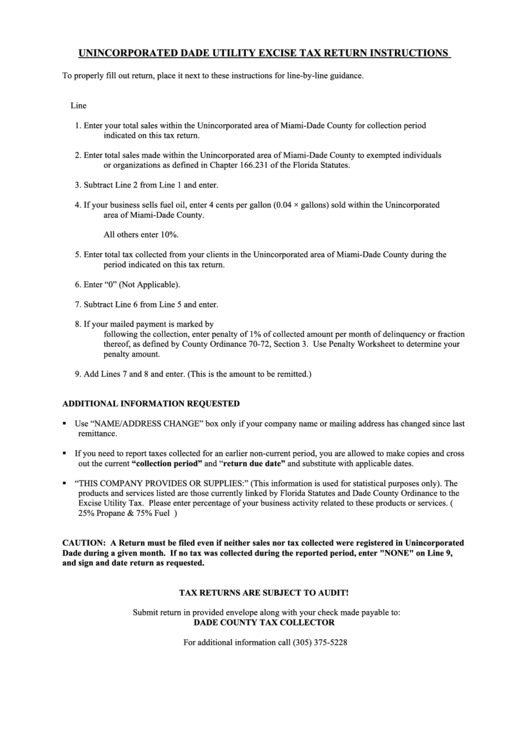

UNINCORPORATED DADE UTILITY EXCISE TAX RETURN INSTRUCTIONS

To properly fill out return, place it next to these instructions for line-by-line guidance.

Line

1.

Enter your total sales within the Unincorporated area of Miami-Dade County for collection period

indicated on this tax return.

2.

Enter total sales made within the Unincorporated area of Miami-Dade County to exempted individuals

or organizations as defined in Chapter 166.231 of the Florida Statutes.

3.

Subtract Line 2 from Line 1 and enter.

4.

If your business sells fuel oil, enter 4 cents per gallon (0.04 × gallons) sold within the Unincorporated

area of Miami-Dade County.

All others enter 10%.

5.

Enter total tax collected from your clients in the Unincorporated area of Miami-Dade County during the

period indicated on this tax return.

6.

Enter “0” (Not Applicable).

7.

Subtract Line 6 from Line 5 and enter.

8.

If your mailed payment is marked by U.S. Post Office as received on or after the 21st day of the month

following the collection, enter penalty of 1% of collected amount per month of delinquency or fraction

thereof, as defined by County Ordinance 70-72, Section 3. Use Penalty Worksheet to determine your

penalty amount.

9.

Add Lines 7 and 8 and enter. (This is the amount to be remitted.)

ADDITIONAL INFORMATION REQUESTED

Use “NAME/ADDRESS CHANGE” box only if your company name or mailing address has changed since last

remittance.

If you need to report taxes collected for an earlier non-current period, you are allowed to make copies and cross

out the current “collection period” and “return due date” and substitute with applicable dates.

“THIS COMPANY PROVIDES OR SUPPLIES:” (This information is used for statistical purposes only). The

products and services listed are those currently linked by Florida Statutes and Dade County Ordinance to the

Excise Utility Tax. Please enter percentage of your business activity related to these products or services. (i.e.

25% Propane & 75% Fuel Oil... Etc.)

CAUTION: A Return must be filed even if neither sales nor tax collected were registered in Unincorporated

Dade during a given month. If no tax was collected during the reported period, enter "NONE" on Line 9,

and sign and date return as requested.

TAX RETURNS ARE SUBJECT TO AUDIT!

Submit return in provided envelope along with your check made payable to:

DADE COUNTY TAX COLLECTOR

For additional information call (305) 375-5228

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1