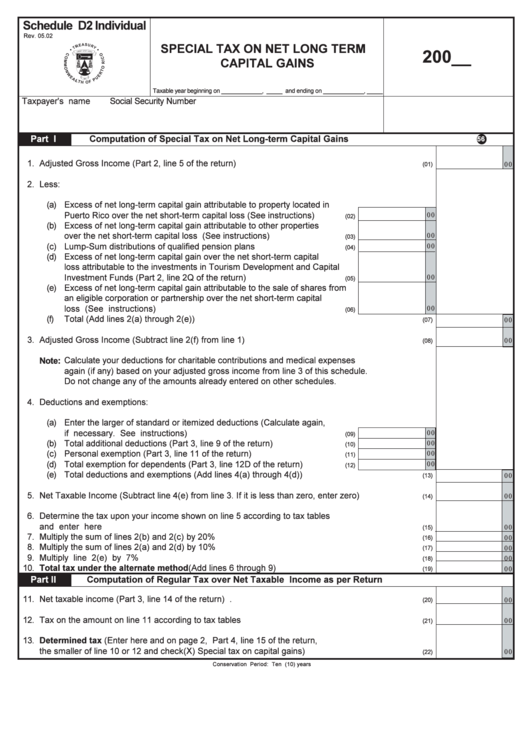

Schedule D2 Individual - Special Tax On Net Long Term Capital Gains

ADVERTISEMENT

Schedule D2 Individual

Rev. 05.02

SPECIAL TAX ON NET LONG TERM

200__

CAPITAL GAINS

Taxable year beginning on _____________, _____ and ending on _____________, _____

Taxpayer's name

Social Security Number

Part I

Computation of Special Tax on Net Long-term Capital Gains

56

NO INCLUYA CENTAVOS

1.

Adjusted Gross Income (Part 2, line 5 of the return) .........................................................................

0 0

(01)

2.

Less:

(a)

Excess of net long-term capital gain attributable to property located in

Puerto Rico over the net short-term capital loss (See instructions) ............

0 0

(02)

(b)

Excess of net long-term capital gain attributable to other properties

over the net short-term capital loss (See instructions) .............................

0 0

(03)

(c)

Lump-Sum distributions of qualified pension plans ...................................

0 0

(04)

(d)

Excess of net long-term capital gain over the net short-term capital

loss attributable to the investments in Tourism Development and Capital

Investment Funds (Part 2, line 2Q of the return) .......................................

0 0

(05)

(e)

Excess of net long-term capital gain attributable to the sale of shares from

an eligible corporation or partnership over the net short-term capital

loss (See instructions) ..........................................................................

0 0

(06)

(f)

Total (Add lines 2(a) through 2(e)).........................................................................................

0 0

(07)

3.

Adjusted Gross Income (Subtract line 2(f) from line 1) .....................................................................

0 0

(08)

Note:

Calculate your deductions for charitable contributions and medical expenses

again (if any) based on your adjusted gross income from line 3 of this schedule.

Do not change any of the amounts already entered on other schedules.

4.

Deductions and exemptions:

(a)

Enter the larger of standard or itemized deductions (Calculate again,

if necessary. See instructions) ..............................................................

0 0

(09)

(b)

Total additional deductions (Part 3, line 9 of the return) ............................

0 0

(10)

(c)

Personal exemption (Part 3, line 11 of the return) ....................................

0 0

(11)

(d)

Total exemption for dependents (Part 3, line 12D of the return) .................

0 0

(12)

(e)

Total deductions and exemptions (Add lines 4(a) through 4(d)) ................................................

0 0

(13)

5.

Net Taxable Income (Subtract line 4(e) from line 3. If it is less than zero, enter zero) ..............................

0 0

(14)

6.

Determine the tax upon your income shown on line 5 according to tax tables

and enter here ..............................................................................................................................

0 0

(15)

7.

Multiply the sum of lines 2(b) and 2(c) by 20% ................................................................................

0 0

(16)

8.

Multiply the sum of lines 2(a) and 2(d) by 10% ................................................................................

0 0

(17)

9.

Multiply line 2(e) by 7% ..................................................................................................................

0 0

(18)

10.

Total tax under the alternate method (Add lines 6 through 9) ........................................................

0 0

(19)

Part II

Computation of Regular Tax over Net Taxable Income as per Return

11.

Net taxable income (Part 3, line 14 of the return) .............................................................................

0 0

(20)

12.

Tax on the amount on line 11 according to tax tables ......................................................................

0 0

(21)

13.

Determined tax (Enter here and on page 2, Part 4, line 15 of the return,

the smaller of line 10 or 12 and check(X) Special tax on capital gains) ................................................

0 0

(22)

Conservation Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1