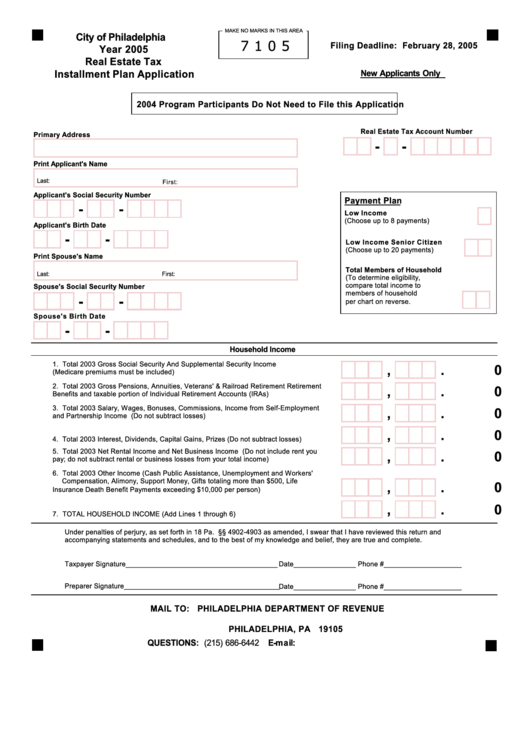

Real Estate Tax Installment Plan Application - City Of Philadelphia - 2005

ADVERTISEMENT

MAKE NO MARKS IN THIS AREA

City of Philadelphia

7 1 0 5

Filing Deadline: February 28, 2005

Year 2005

Real Estate Tax

Installment Plan Application

New Applicants Only

2004 Program Participants Do Not Need to File this Application

Re al Es tate Tax Account Number

Pr imary Address

-

-

Pr int Applicant's Name

Last:

First:

Applicant's Social Security Number

Payment Plan

-

-

Low Income

(Choose up to 8 payments)

Applicant's Birth Date

-

-

Low Income Senior Citizen

(Choose up to 20 payments)

Pr int Spouse's Name

Total Members of Household

Last:

First:

(To determine eligibility,

compare total income to

Spouse's Social Se curity Number

members of household

-

-

per chart on reverse.

Spouse's Birth Date

-

-

Household Income

1. Total 2003 Gross Social Security A nd Supplemental S ecurity Income

,

. 0 0

(Medicare premiums must be included)....................... ............... ............... ............... .......1.

2. Total 2003 Gross Pensions, A nnuities, Veterans' & Railroad Retirement Retirement

,

. 0 0

Benef its and taxable portion of Individual Retirement A ccounts (IRA s)....................... .....2.

3. Total 2003 Salary, Wages, Bonuses, Comm issions, Income f rom Self -Em ployment

,

. 0 0

and Partnership Income (Do not subtract losses)..................... .............................. ........3.

,

. 0 0

4. Total 2003 Interest, Dividends, Capital Gains, Prizes (Do not subtract losses)................4.

5. Total 2003 Net Rental Income and Net Business Income (Do not include rent you

,

. 0 0

pay; do not subtract rental or business losses from your total income)............... .............5.

6. Total 2003 Other Income (Cash Public A ssistance, Unemployment and Workers'

Compensation, Alimony, Support Money, Gif ts totaling more than $500, Life

,

. 0 0

Insurance Death Benef it Payments exceeding $10,000 per person)................ ............... .6.

,

. 0 0

7. TOTA L HOUSEHOLD INCOME (Add Lines 1 through 6) ..................... ............... ...........7.

Under penalties of perjury, as set forth in 18 Pa. C.S . §§ 4902-4903 as amended, I swear that I have reviewed this return and

accompanying statements and schedules, and to the best of my knowledge and belief , they are true and complete.

Taxpayer Signature_______________________________________

Date________________ Phone #____________________

Preparer Signature________________________________________ Date________________ Phone #____________________

MAIL TO: PHILADELPHIA DEPARTMENT OF REVENUE

P.O. BOX 53190

PHILADELPHIA, PA 19105

QUESTIONS: (215) 686-6442

E-mail: revenue@phila.gov

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2