Form K-96t - Kansas Magnetic Media Transmittal Required W-2 And 1099 Information

ADVERTISEMENT

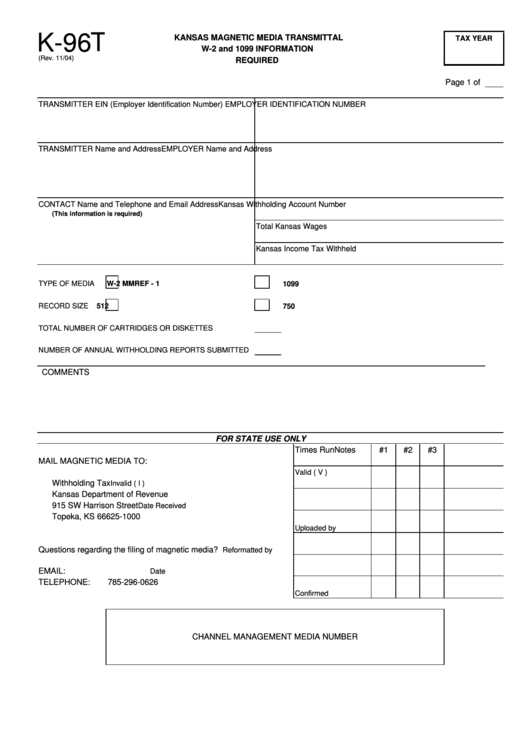

K-96T

KANSAS MAGNETIC MEDIA TRANSMITTAL

TAX YEAR

W-2 and 1099 INFORMATION

(Rev. 11/04)

REQUIRED

Page 1 of

TRANSMITTER EIN (Employer Identification Number)

EMPLOYER IDENTIFICATION NUMBER

TRANSMITTER Name and Address

EMPLOYER Name and Address

CONTACT Name and Telephone and Email Address

Kansas Withholding Account Number

(This information is required)

Total Kansas Wages

Kansas Income Tax Withheld

TYPE OF MEDIA

W-2 MMREF - 1

1099

RECORD SIZE

512

750

TOTAL NUMBER OF CARTRIDGES OR DISKETTES

NUMBER OF ANNUAL WITHHOLDING REPORTS SUBMITTED

COMMENTS

FOR STATE USE ONLY

Times Run

#1

#2

#3

Notes

MAIL MAGNETIC MEDIA TO:

Valid ( V )

Withholding Tax

Invalid ( I )

Kansas Department of Revenue

915 SW Harrison Street

Date Received

Topeka, KS 66625-1000

Uploaded by

Questions regarding the filing of magnetic media?

Reformatted by

EMAIL:

Audit_DiscoveryTeam@kdor.state.ks.us

Date

TELEPHONE:

785-296-0626

Confirmed

CHANNEL MANAGEMENT MEDIA NUMBER

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2