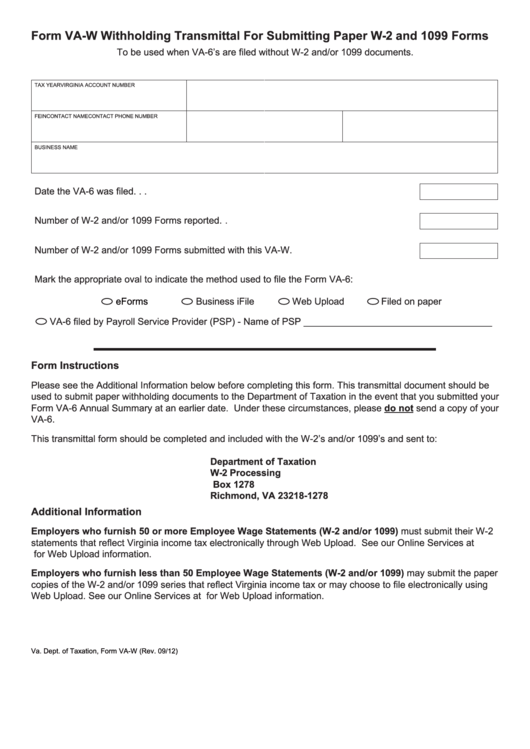

Form VA-W Withholding Transmittal For Submitting Paper W-2 and 1099 Forms

To be used when VA-6’s are filed without W-2 and/or 1099 documents.

TAX YEAR

VIRGINIA ACCOUNT NUMBER

FEIN

CONTACT NAME

CONTACT PHONE NUMBER

BUSINESS NAME

Date the VA-6 was filed. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Number of W-2 and/or 1099 Forms reported. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Number of W-2 and/or 1099 Forms submitted with this VA-W. . . . . . . . . . . . . . . . . . . . . . .

Mark the appropriate oval to indicate the method used to file the Form VA-6:

eForms

Business iFile

Web Upload

Filed on paper

VA-6 filed by Payroll Service Provider (PSP) - Name of PSP ____________________________________

Form Instructions

Please see the Additional Information below before completing this form. This transmittal document should be

used to submit paper withholding documents to the Department of Taxation in the event that you submitted your

Form VA-6 Annual Summary at an earlier date. Under these circumstances, please do not send a copy of your

VA-6.

This transmittal form should be completed and included with the W-2’s and/or 1099’s and sent to:

Department of Taxation

W-2 Processing

P.O. Box 1278

Richmond, VA 23218-1278

Additional Information

Employers who furnish 50 or more Employee Wage Statements (W-2 and/or 1099) must submit their W-2

statements that reflect Virginia income tax electronically through Web Upload. See our Online Services at

for Web Upload information.

Employers who furnish less than 50 Employee Wage Statements (W-2 and/or 1099) may submit the paper

copies of the W-2 and/or 1099 series that reflect Virginia income tax or may choose to file electronically using

Web Upload. See our Online Services at for Web Upload information.

Va. Dept. of Taxation, Form VA-W (Rev. 09/12)

1

1