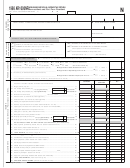

FORM 740-NP (2010)

Page 2 of 4

*1000030005*

REFUND/TAX PAYMENT SUMMARY

•

00

31 Enter amount from page 1, line 30. This is your Total Tax Liability ..........................................................................

31

32 (a) Enter Kentucky income tax withheld as shown on attached

•

00

2010 Form W-2(s) and other supporting statements ........................................

32(a)

•

00

(b) Enter 2010 Kentucky estimated tax payments ..................................................

32(b)

•

00

(c) Enter 2010 refundable certifi ed rehabilitation credit (KRS 141.382(1)(b)) .......

32(c)

•

00

(d) Enter 2010 fi lm industry tax credit (KRS 141.383) .............................................

32(d)

•

00

(e) Enter Nonresident Withholding from Form PTE-WH, line 9 (KRS 141.206(4)(b)(1))

32(e)

•

00

33 Add lines 32(a) through 32(e) ......................................................................................................................................

33

00

34 If line 33 is larger than line 31, enter AMOUNT OVERPAID (see instructions) ........................................................

34

➤ (Enter amount(s) checked)

Fund Contributions; See instructions.

•

00

35 Nature and Wildlife Fund .............................................

$10

$25

$50

Other

35

•

36 Child Victims’ Trust Fund .............................................

$10

$25

$50

Other

36

00

•

37 Veterans’ Program Trust Fund .....................................

$10

$25

$50

Other

37

00

•

38 Breast Cancer Research/Education Trust Fund .........

$10

$25

$50

Other

38

00

00

39 Add lines 35 through 38 ...............................................................................................................................................

39

•

00

40 Amount of line 34 to be CREDITED TO YOUR 2011 ESTIMATED TAX .......................................................................

40

REFUND

•

00

41 Subtract lines 39 and 40 from line 34. Amount to be REFUNDED TO YOU ..................................

41

•

00

42 If line 31 is larger than line 33, enter ADDITIONAL TAX DUE ...................................................................................

42

00

•

43 (a) Estimated tax penalty and/or interest.

Check if Form 2210-K attached....

43(a)

00

•

(b) Interest .................................................................................................................

43(b)

00

•

(c) Late payment penalty .........................................................................................

43(c)

00

•

(d) Late fi ling penalty ................................................................................................

43(d)

•

00

44 Add lines 43(a) through 43(d). Enter here ...................................................................................................................

44

00

OWE

45 Add lines 42 and 44 and enter here. This is the AMOUNT YOU OWE ..................................................

45

OFFICIAL USE ONLY

●

Make check payable to Kentucky State Treasurer or visit for more options.

PWR

●

Write your Social Security number and “KY Income Tax—2010” on the check.

SECTION A—BUSINESS INCENTIVE AND OTHER TAX CREDITS

1 Enter nonrefundable limited liability entity credit (KRS 141.0401(2))

00

(attach Kentucky Schedule(s) K-1 or Form(s) 725) ....................................................................................................

1

00

2 Enter skills training investment credit (attach copy(ies) of certifi cation)..................................................................

2

00

3 Enter nonrefundable certifi ed rehabilitation credit (KRS 171.397(1)(a)) ...................................................................

3

00

4 Enter credit for tax paid to another state (attach copy of other state’s return(s)) ...................................................

4

00

5 Enter unemployment credit (attach Schedule UTC) ...................................................................................................

5

00

6 Enter recycling and/or composting equipment credit (attach Schedule RC) ...........................................................

6

00

7 Enter Kentucky Investment Fund credit (attach copy(ies) of certifi cation) ...............................................................

7

00

8 Enter coal incentive credit ............................................................................................................................................

8

00

9 Enter qualifi ed research facility credit (attach Schedule QR) .....................................................................................

9

00

10 Enter GED incentive credit (attach Form DAEL-31) .....................................................................................................

10

00

11 Enter voluntary environmental remediation credit (attach Schedule VERB) ............................................................

11

00

12 Enter biodiesel and renewable diesel credit ...............................................................................................................

12

00

13 Enter environmental stewardship credit .....................................................................................................................

13

00

14 Enter clean coal incentive credit ..................................................................................................................................

14

00

15 Enter ethanol credit (attach Schedule ETH) ................................................................................................................

15

00

16 Enter cellulosic ethanol credit (attach Schedule CELL) ..............................................................................................

16

00

17 Enter energy effi ciency products credit (attach Form 5695-K) ..................................................................................

17

00

18 Enter railroad maintenance and improvement credit (attach Schedule RR-I) ..........................................................

18

00

19 Add lines 1 through 18. Enter here and on page 1, line 15 .....................................................................................

19

1

1 2

2 3

3 4

4