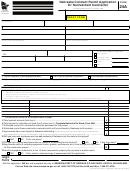

INSTRUCTIONS

Computation of bond amount:

WHO MUST FILE. Each nonresident contractor/

10% of $100,000 $10,000

subcontractor must register each contract and provide

5% of $54,300

2,715

a project bond or other acceptable security for each

$12,715

(Round up to nearest 1,000)

contract in an amount as determined below before

Amount of contract bond

$13,000

commencing work within this state.

If the department determines at any time that the

WHEN AND WHERE TO FILE. This bond or other

required bond will not cover the tax liabilities involved,

acceptable security must be attached to the Nebraska

it may require the bond to be increased.

Contract Permit Application for Nonresident Con-

A multiple project bond may be issued for all contracts

tractor, Form 24A, for every permit application. The

to be performed if the requirement that a bond be

bond and application must be mailed together to the

supplied for each project has been waived by written

Nebraska Department of Revenue, P.O. Box 98903,

approval of the Nebraska Department of Revenue.

Lincoln, Nebraska 68509-8903. If the bond or ap-

A written request for approval to submit a multiple

plication is received separately, it will be returned

project bond must be submitted to the department.

to the applicant.

A multiple project bond is computed by totaling all

DETERMINATION OF BOND AMOUNT. The

construction projects to be simultaneously performed

required bond amount is ten percent of the contract

in this state during a specific period of time. For

price up to the first $100,000, plus five percent of the

additional information, please refer to the Nebraska

contract price in excess of $100,000, rounded to the

Nonresident Contractor Information Guide.

nearest multiple of $1,000. A bond is not required for

Certificates of deposit, share accounts and investment

contracts less than $2,500.

certificates from a Nebraska banking institution are

acceptable forms of security in lieu of a bond. Prior

Computation Example:

approval from the Nebraska Department of Revenue

Total contract price

$200,000

is required before any other type of security will be

Amount awarded to resident subcontractor $20,000

accepted for the purpose of meeting this requirement.

Amount awarded to properly registered

Security other than a security bond may be retained for

and bonded nonresident subcontractor

15,000

up to three years after the project is complete.

Total of contracts less than $2,500

(5 contracts)

10,700

SIGNATURES. This bond must be signed by the

principal, attorney-in-fact or authorized surety officer,

45,700

and the agent for the surety.

Amount subject to bonding

$154,300

1

1 2

2